Richard Beddard: the UK’s Amazon is already in the FTSE 100

Profitable, adaptable and often compared to Ocado and Amazon. Our analyst thinks this stock will prosper.

14th May 2021 15:00

by Richard Beddard from interactive investor

Profitable, adaptable and often compared to Ocado and Amazon. Our analyst thinks this stock will prosper.

This time last year, Next (LSE:NXT)’s shops had been shuttered for two months and its online operation had also closed while the company made warehouses safe for workers.

Although it did not necessarily seem like it would then, even to Lord Wolfson the company’s indefatigable chief executive, Next is emerging from the pandemic in a good position financially and strategically.

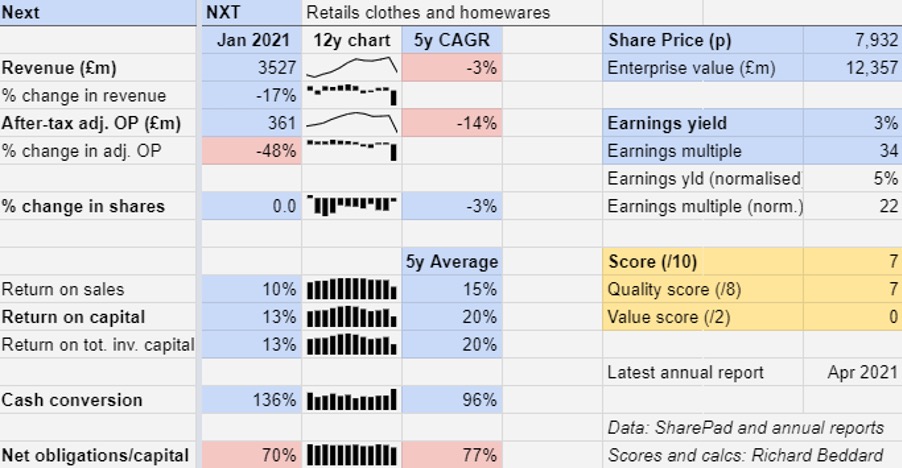

Revenue fell nearly 17% in the full year to January 2021 compared to the previous year and profit fell 48%, but the stalwart retailer still earned a respectable return on capital of 13%.

Next’s online operation, which already contributed more than half of revenue and profit, grew sufficiently to compensate for some of the decline in store sales due to the various lockdowns.

The variable costs of packaging and delivery on top of the fixed costs of the stores, albeit ameliorated by government support, impacted profit more.

Meanwhile, Next continued to increase capital expenditure, spending almost four times as much on warehousing and almost as much on IT as it did on retail stores.

In the first 13 weeks of the new financial year, the company has experienced revenue only 1.2% below the same period to January 2020 (i.e. before the pandemic) despite 10 weeks in lockdown.

- Next beats forecasts again as shares near record high

- Global funds switch focus from tech to value shares to play recovery

- Check out our award-winning stocks and shares ISA

The online effect helped, and so too did the release of pent-up demand in the last three weeks of the period, when shops opened again.

While Next believes demand will moderate quickly, if there are no more lockdowns it expects to earn levels of revenue and profit in the year to January 2022 not too dissimilar to the last pandemic free year (the year to January 2020).

Prosperity no accident

The fact that Next was, like all companies, unprepared for the specific challenges of a pandemic but is prospering anyway, should not surprise us.

The company has a long history of adaptation, evident in the success of Next Directory, its once mighty mail order division, in the gradual shift of Directory online and overseas, in the management of leases and concessions to keep its store estate profitable, and in its evolution into a channel for other fashion brands.

Next realised early that as retail moved online, many of its traditional advantages like prime high street locations and the brand itself were less relevant. On the internet, where choice is near limitless and so too is competition, it has to offer the widest range possible (currently 1,300 brands) and make it more convenient to buy from Next.

To win, Next realises it must be its partners’ most profitable route to market, which it can achieve by pooling costs and sharing the benefit of its long experience in logistics. After it takes its 15% profit margin, Next gives the rest back to partners, baking in mutual benefits.

A thriving online business diversifying overseas and into product categories like sportswear and beauty products meant Next was in a better position to manage its way through the pandemic. But the company’s evolution also says something about the culture of Next, which probably enabled it to rapidly and effectively come to terms with the demands and restrictions of operating through a pandemic.

Next stage

The next stage in Next’s evolution may be its boldest yet: Total Platform, a development that is turning Next into a solutions provider for other retailers.

Users of Total Platform can get on with sourcing products and building their brands while Next provides the logistics, the warehousing, call centre facilities, delivery and returns, customer credit, a website, and sales channels using the same resources as the mothership.

Next’s first two partners - Childsplay Clothing and Laura Ashley - are live now and the company has three more in the pipeline: Victoria’s Secret (UK), which is launching imminently, a new and as yet unnamed fashion brand launching in October, and Reiss, the biggest, which is expected to launch in February 2022.

Next has also taken a stake in three of the first five partners, Laura Ashley, Victoria’s Secret and Reiss, which enables Next to profit from its partners’ growth beyond the commissions it makes.

Part-owning partnerships will deliver these benefits without nixing their creativity and entrepreneurialism and allow next to spread its investments more widely.

- Why Warren Buffett just rang the alarm bell on inflation

- Seven ‘buy and forget’ shares for investors with time on their side

- Bill Ackman: I think this could be the Black Swan event of 2021

Initially the numbers are small. Five partners is likely to be the limit in 2022 as Next develops services for these partners and makes them reusable before bringing on more.

But these baby steps could be harbingers of something much bigger. Total Platform has drawn comparisons with Ocado and Amazon, both companies that use technology developed for their own businesses to service others. Reportedly, Next employs over 500 IT professionals at its site near Leicester.

Total Platform also allows Next to launch niche online brands of its own like Little Label, which sells high-end baby clothing.

Scoring Next

There are two aspects of Next that sometimes raise eyebrows. Both involve debt.

Next earns substantial profit from customers through nextpay and next3step. If you take the view that it is too easy for people to get into debt using credit products like these then Next is part of the problem.

But the credit is regulated and the interest rates are similar to credit card rates, so Next is not behaving egregiously by current norms.

Next also has a long record of paying special dividends and buying back shares, which means the company does not keep much cash in reserve. This could come back to haunt it when times are tough.

The company’s performance during the pandemic has assuaged this fear somewhat and chastened by its experience, Next intends to use the cash windfall it received from cancelling the dividend and selling and leasing back warehouses to pay off bonds.

But although its reliance on conventional borrowing has fallen considerably, and Next intends to keep it that way, I am not sure whether its overall dependence on external finance (including leases) will improve beyond the modest reduction it achieved this year.

Mostly I admire Next for its profitability, its adaptability, and because it tells investors what it knows. In the company’s half-year results announcement (September 2020), it explained why, saying: “The more clarity we give about the state of the company’s sales, finances, and prospects, the better we ourselves understand the business. The more precise and coherent we are in explaining our objectives and plans, the more likely it is that we will succeed in implementing them.”

These words inspire trust, but more than that they imply the company is so confident in the capabilities it is building it does not need to keep them a secret. It wants to tell people about them.

Reinventing itself, cannibalising sales of its own brand, for example, by retailing competitor brands, are the kind of changes few businesses are prepared to make. Copying Next, would be very hard for this reason, and because rivals would not be starting with the same capabilities.

The first of the principal risks Next lists in its annual report is “Business strategy development and implementation”. I think the emphasis on this element of running a business is the principal reason Next will prosper.

Does the business make good money? [2]

+ High average return on capital

+ Decent profit margins

+ Strong cash flow

What could stop it growing profitably? [1]

+ Failure to develop and execute strategy

? Strong online competition

? Financial obligations (debt and leases primarily)

How does its strategy address the risks? [2]

+ Seeking to profit from all its capabilities

+ Commitment to profitability of partners

+ Online expansion overseas

Will we all benefit? [2]

+ Extremely experienced board

+ Emphasis on promotion from within

+ Company explains itself well

Is the share price low relative to profit? [0]

? The share price looks high because profits were depressed due to the pandemic. On a normalised basis, the share price looks more reasonable.

A score of 7 out of 9 indicates that Next is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Next.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.