Richard Beddard: why I’m in favour of this promiscuous FTSE 100 firm

13th May 2022 15:06

by Richard Beddard from interactive investor

Our companies analyst explains why it’s good that this blue-chip is spreading its wings and making good money from it.

Next (LSE:NXT), the retailer, has navigated the pandemic better than many of its peers because it had already adapted to a world in which most of its sales would be online.

It is emerging from the last two years with profitability intact, having done a whole lot more adapting.

Evolution not Strategy

At a fundamental level, Next’s strategy is the same as it ever has been: to sell more fashion, beauty and homeware products in more places.

What is changing is what it sells, where it sells, and how it sells.

Once a High Street and catalogue seller of its own brand, today Next makes 56% of its revenue and 64% of profit online.

A growing proportion of online sales, just over 50%, is from other brands

An investor looking at Next’s financial performance over the last decade might assume nothing much has changed.

Barring the first year of the pandemic, which pretty much coincided with Next’s financial year to January 2021, return on capital, and cash conversion have been high and stable.

Only growth has stalled, giving Next the financial profile of a mature and rather boring business.

But Next is far from boring. At some point falling retail sales will stabilise and by then Next will have become a completely different business.

The company says its buying side and selling side now work independently.

The buying side designs and sources products to sell through the selling business, Next’s technological and physical infrastructure: its warehouse, logistics, finance, website and online marketing capabilities.

The NEXT brand dominates the buying side, but it also licences other brands like Ted Baker’s childrenswear brand, Baker by Ted Baker, for its own ranges, and it is acquiring the UK franchises of overseas brands like Victoria’s Secret and GAP.

NEXT is also the biggest client of the selling side of the business, which aggregates Next’s brands, its licences and franchises, with hundreds of third party brands.

Only about 36% of this third-party revenue is earned on products Next buys wholesale, the other 64% is commission earned on stock held by Next but owned by partner brands using Next’s online platform.

The next level of partnership, Total Platform, has barely begun, and it earns the company only a tiny proportion of revenue and profit.

Total Platform brands pay a commission to use the selling side of Next’s business so they can focus on their own buying sides. It leaves them free to design products for their brands, without having to worry about finding the capital and expertise to build their own websites, call centres, and warehouses.

Next handles the nuts and bolts of their online business, either as part of its own website or through a partially or completely client-branded customer experience.

Just about any of Next’s capabilities, built up as it adapted its own operations for the Internet, is for hire, from finance to online marketing.

Next’s newfound promiscuity extends to taking equity stakes in Total Platform partners like Reiss, an upmarket fashion brand, and most recently JoJo Maman Bébé which sells maternity and baby clothes. This, it says, creates a common interest in growing them.

Complexity risk

The buying business is high risk and high return because buyers buy the wrong thing and end up with unsold stock, and brands fail.

The selling business is stable because it provides a service to hundreds of brands across proliferating product categories, but it is more capital intensive. Consequently, it earns lower returns.

The company is aiming for a sweet spot, a business that earns decent returns consistently.

By becoming an enabler for fashion, beauty and homeware brands Next expects to profit from limitless competition on the internet instead of succumbing to it.

But the strategy introduces new risks. The lists of partnerships and capabilities required to service them in Next’s annual report is exhausting.

Next has to be good at a lot of things, which challenges the organisation to stay focused.

It is addressing that by keeping things simple. It says the independence of its two businesses, the buying and the selling sides, has given employees a clearer sense of purpose.

Next instructs buyers to seek products that add something different. It works hard on search and navigation to ensure customers can find what they want, and is investing heavily in automation to manage stock levels predictively and pick products in warehouses from its ever-increasing range.

Bounceback

Next experienced a dramatic bounceback in revenue and profit in the year to January 2022, as retail stores that were closed for 10 weeks during the first quarter reopened.

Cash conversion was slightly sub-par mainly due to investment in a new warehouse, but capital expenditure is expected to peak in the current financial year and fall back for a while.

While borrowings including lease obligations are relatively low compared to the past, they remain above my arbitrary comfort level of 50% of operating capital. The company has sustained these levels without getting into trouble for years though.

Next expects a much more modest increase in revenue of 3.5% in the year to January 2023, while acknowledging that it is more than usually uncertain due to inflation, people spending more on leisure activities now they can, likely increases in tax and mortgage rates, and war.

Scoring Next

I like Next despite the fact that it has not grown revenue or profit over the last six years, because I believe it is evolving into a business that will grow again.

I used to worry it appealed to a particular middle of the road demographic of 25-to-45 year olds and that as the customers of youth oriented online retailers like ASOS (LSE:ASC) and Boohoo Group (LSE:BOO) grew up they would not graduate to Next.

But it has found a way to broaden its appeal by enabling brands that complement its own, which shorn of the need for physical stores, can be rolled out on Next’s platform very quickly.

Since it wants to become its partners’ most profitable route to market it must keep commission low, and earn a profit by being more efficient. Next’s commission rate has fallen 3% over the last three years.

More so than any other company I know, Next’s annual report is like a handbook for shareholders and employees. It might also be a handbook for any business overhauling itself and wondering how to carry its people with it.

The annual report says:

“Our business ‘model’ was not conceived in the Boardroom, but is the result of countless ideas conceived at every level of the organisation. It is an important distinction, because businesses that are the sum total of their initiatives and values are those that best harness the creative intelligence and energy of all their people.”

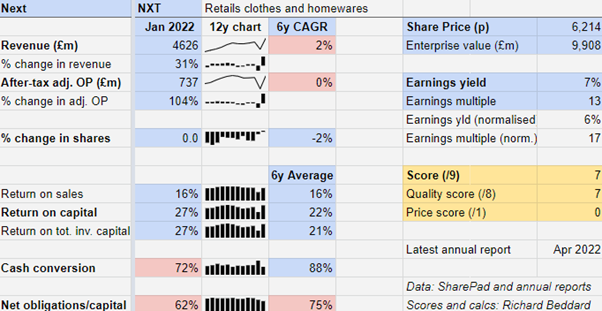

Does the business make good money? [2]

- High returns on capital averaging over 20%

- Good profit margins, averaging over 10%

- Reasonable cash conversion of 75%

What could stop it growing profitably? [1]

- Competition online

- Complexity

- Lease obligations and bank borrowings

How does its strategy address the risks? [2]

- Seeking to profit from all its capabilities

- Bifurcation of two sides of the business

- Debt levels have reduced somewhat

Will we all benefit? [2]

- Chief executive Lord Wolfson, is very experienced

- Business engaged at every level

- Exemplary communication with shareholders

Is the share price low relative to profit? [0]

- Maybe. A share price of £62.14 values the enterprise at about £10 billion, about 17 times normalised profit.

A score of 7 out of 9 means I believe Next is a good long-term investment.

It is ranked 5/40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Next

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.