Richard Beddard: why this is my second favourite stock

28th January 2022 13:22

by Richard Beddard from interactive investor

With more than 100 years of resilience and adaptation to its name, our columnist believes this family business will find ways through pandemic-induced changes.

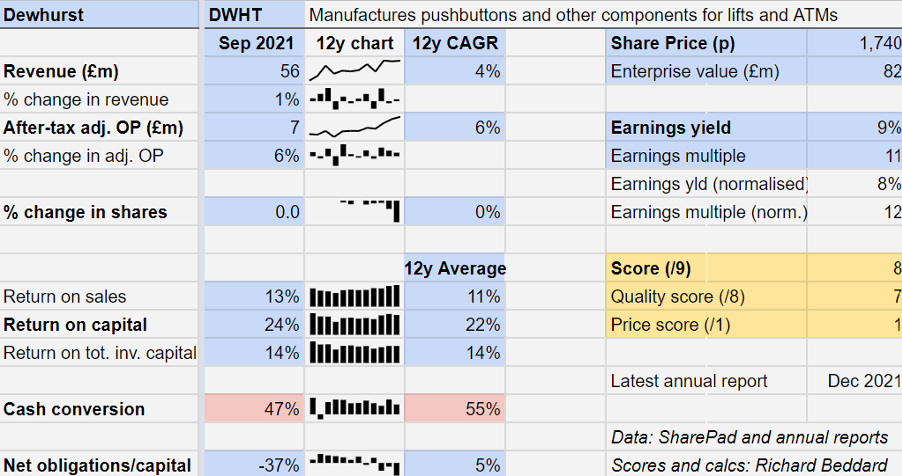

Yikes! Dewhurst (LSE:DWHT)’s annual report this year is a sobering read. The company just earned a record level of revenue and record profit by a greater margin, but it faces challenges.

Under the cosh

The pandemic has accelerated the use of cashless payments, which is helping to stymie an already contracting Dewhurst subsidiary that makes keypads for ATMs.

Sales in the company’s transport division declined in the year to September 2021 due to the completion of trials of delineator products such as street bollards and marker posts at government-funded cycle scheme projects. These products are supplied by TMP, a subsidiary of Dewhurst that also makes traffic bollards and chevron systems. More funding for cycle paths depends on the performance of the trials, and is not expected for at least a year.

Perhaps the 27 train despatch equipment units (TDEUs) being installed at Birmingham New Street station will take up some of the slack in this market, along with orders from another two stations and potentially more.

- Six value share tips for 2022 – and beyond

- Six speculative UK share ideas for 2022

- Our outlook for 2022: key topics and investment ideas for the year ahead

Neither of these two divisions, Transport and Keypad, has a reliable track record of growth. Both are relatively small parts of the business, though: each is about a tenth of the size of Dewhurst’s lift component division by revenue. For many years growth has come from Dewhurst’s lift businesses as it has diversified from manufacturing pushbuttons to being a manufacturer, distributor and installer of a wide range of components, acquiring businesses in the UK, Australia and the USA along the way.

The pandemic has also had an unwelcome effect on this, by far the most important of Dewhurst’s divisions. Lifts are installed late in the construction of a building and in 2021 Dewhurst was still earning revenue from projects commissioned before the pandemic started. That effect may be wearing off.

The company reports that demand is softening in Australia, which along with Asia is its biggest and most profitable market, because of a dearth of new commissions during the pandemic. Australia experienced a harsher lockdown than Dewhurst’s other big markets, so elsewhere the effect may be more muted and diffused over a longer period; but the UK and North America could experience slumps too.

Meanwhile, profit margins may come under pressure from rising material and component prices, which Dewhurst reports it cannot pass on to its customers in full.

Having ushered in remote working, it is also possible the pandemic will leave a permanent legacy. If, as seems likely, an element of remote working is here to stay, it may diminish demand for office space and business travel. That might mean fewer new offices and hotels, and less business for lift component suppliers.

Historic resilience

The annual report is quite a bleak read, but the company should be resilient. Historically, the cyclicality of construction markets has nor severely impacted Dewhurst’s results. Its worst Return on Capital over the last 12 years was 15% achieved in 2013, when revenue fell 15% and adjusted profit fell 25%. In 2021 it achieved its highest Return on Capital (24%). The average is a very respectable 22%.

Dewhurst achieves these steady-ish returns because of the diversity of its customers. It does a considerable amount of refurbishment work and supplies public sector projects; moreover, the commercial construction cycles in its big markets in the UK, North America, and Australia are not perfectly synchronised, so the impact of downturns and upturns in different markets is diffused.

Past performance is not a guide to future performance.

The one red flag in the numbers is cash conversion. Cash flow is weak compared to adjusted profit. The biggest drain on cash in recent years, amounting to between £3 million and £5 million, has been capital expenditure, principally because of the construction of a new factory at Dewhurst’s Canadian subsidiary. The company has not said capital expenditure will abate, but prior to 2018 it was closer to the £1 million mark.

The other big drain on cash is the deficit in Dewhurst’s defined benefit pension fund. The company pays £1.4 million into the fund every year, yet the cost is much lower in the profit and loss account due to the way pension funds are accounted for. The deficit fell to £4.7 million in 2021 from a high of £16.4 million in 2016 though, so the prospect of an end to these payments may be drawing closer.

What we know, versus what we fear

I think the big worry is the potential impact of remote working on the market for lift components. Think of all those technology companies that investors are betting will profit handsomely in future from the trend. This is the opposite of that trade.

It raises the question of whether Dewhurst can flourish in a moribund market, and whether it can find new markets.

The company has pivoted before. In manufacturing it has embraced new technologies and learned how to put together assemblies such as lift operating panels and hall lanterns.

Dewhurst also has a trusted position in its market. In 1971 it designed the US81 pushbutton with a chrome surround and stainless steel pressel, which was subsequently widely adopted and imitated. Since then it has focused on the reliability of its products as well as their attractiveness, which is important because a defective or vandalised component is many times more expensive to fix than a robust one is to install in the first place.

- Watch our latest share tips by subscribing for free to the ii YouTube channel

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Reassuringly, in the summary of its financial performance the company includes two non-financial statistics: Defective parts per million (down significantly over the last five years) and on time delivery (90%, comparable to previous years despite the pandemic).

The company’s commitment to quality is no doubt driven by the controlling shareholders Richard and David Dewhurst, and their family. The brothers have been chairman and chief executive respectively since the 1980s. They will be concerned that the business founded by Melbourne Dewhurst 103 years ago is a legacy for younger Dewhursts working in the business, as well as for other employees and customers.

If I had to pick a company to survive and prosper in a difficult market it would be Dewhurst, which is lucky because that is a plausible scenario.

Scoring Dewhurst

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

? Pension deficit payments drag on cash flow

What could stop it growing profitably? [1]

+ Strong finances, modest impact of construction cycle in past

? Competition? Unable to pass on price increases in full

? More remote working may diminish lift component market

How does its strategy address the risks? [2]

+ Diversification smooths impact of construction cycle

+ Focus on quality and service means Dewhurst is trusted

? Can Dewhurst win in a mature market or find new markets?

Will we all benefit? [2]

+ Long-term stewardship of Dewhurst family

+ Modest executive pay

+ Communicates well with shareholders

Is the share price low relative to profit? [1]

+ Yes.

I thought long and hard about whether to downrate Dewhurst’s strategy, given that I cannot be sure how well it will address an unquantifiable risk, the impact of remote working. Once again, I decided not to. A good business is a collection of good people investing to make profit in future. I think they will work out how to do that.

A score of 8 out of 9 means Dewhurst probably is a good long-term investment, but even if you agree, there is something else to consider before buying the shares. They are thinly traded and can be difficult to buy or sell in quantity.

Dewhurst is ranked 2 out of 40 shares I consider to be good long-term investments.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Dewhurst.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.