Richard Beddard: why this restless innovator could clean up

10th December 2021 15:25

by Richard Beddard from interactive investor

This impressive business understands itself and its opportunities very well, but the share price currently works against it.

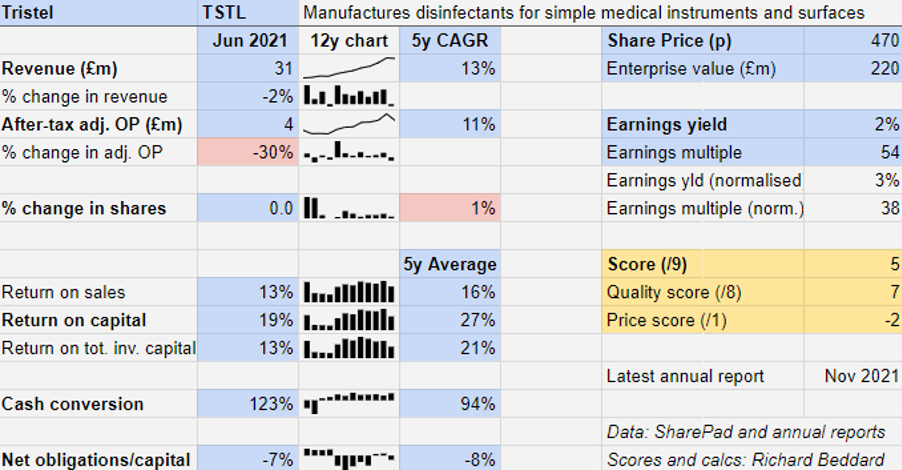

The most surprising revelation in Tristel (LSE:TSTL)’s annual report this year was not the headline item – that revenue and more so profit have fallen, breaking the company’s seven-year growth streak. Tristel had already warned investors that a decline in routine outpatient procedures during the pandemic meant it had sold less disinfectant for the decontamination of medical instruments.

The surprise was that Tristel is discontinuing its non-hospital ranges of disinfectants, a small part of the business that gave it a foothold in alternative markets such as veterinary surgeries. This will lose the company £600,000 of sales in the financial year to June 2022, and £1.1 million the following year (total revenue in 2021 was £31 million).

Tristel says vets are more than happy with low-grade disinfectants, and it has failed to persuade them to buy its more effective product.

Maintaining these ranges was expensive and the company does not expect the impact on profit to be great due to cost savings. Perhaps Tristel’s sharpened focus also indicates confidence in its unique human health products, where efficacy is paramount, and the popularity of these products in still largely untapped markets overseas.

Record run over

Revenue fell 2% in the year to June 2021, and profit fell 30% as the company continued to add staff to support growth.

Tristel could afford to keep investing because it was still highly profitable. Return on Capital was 19%, and the company raked in more cash than it made in profit.

Tristel mostly makes disinfectants for simple medical instruments used in hospital departments, such as endoscopes used by Ear Nose and Throat (ENT) departments, ophthalmic devices and ultrasound probes.

In the UK, clinics closed temporarily during the pandemic to protect medical staff and patients from Covid-19. Revenue declined 10% compared to the previous financial year, when panic-buying in the early days of the pandemic had accelerated the company’s growth. The differential would have been more dramatic, had it not been for stockpiling during the summer of 2020 to prepare for shortages after Brexit.

- Richard Beddard: a good company with the mother of all strategies

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

International sales grew 3%, though, and now represent 63% of total revenue. Other countries did better at keeping hospitals open, and Tristel is growing much more rapidly overseas where it is less well-established. In the UK, it is already the dominant supplier in certain outpatient clinics.

Tristel has yet to crack the market that could be its biggest, however. An application to the US Food and Drug Administration (FDA) has been a long time coming, but it expects to file one for a specific product before the year end in June. The company says the novelty of the product means it has taken longer to prepare an application than expected, and the pandemic has delayed it. But once Tristel has one application approved, others should follow more quickly.

The trailblazer is Duo Ult, for the disinfection of ultrasound probes, which should be submitted by the end of the financial year in June. Applications will follow for the use of the same product in Ophthalmology, ENT, and other product ranges; so by 2026 Tristel should have a fully fledged business in the US and Canada, where it is also seeking approvals. Initially the disinfectant will be manufactured and distributed by Parker Laboratories, a supplier of ultrasound gel.

Restless innovation

One of the other product ranges Tristel is seeking approval for in the US is Cache, its new range of hospital surface disinfectants. Most Cache products use Tristel’s chlorine dioxide chemistry in combination with a component licensed from Byotrol, another infection control company, that produces a residual antimicrobial effect lasting up to eight hours.

Tristel says Cache, which can be used with pretty much any cloth or even paper towels, is more effective than wipes pre-wetted with lower grade disinfectants. Wipes are also bad for the environment because they are made from plastic, which is durable and maintains their integrity during their long shelf lives. Cache is no more expensive than wipes, and is a big growth opportunity. It is emblematic of Tristel’s restless innovation.

Tristel is the only company making chlorine dioxide disinfectant for hospitals, which is safer to handle and more effective than other high-level disinfectants such as peracetic acid and hydrogen peroxide. These are mostly confined to instrument-washing machines, but washing machines are expensive and are no good if the device is being used in the community.

The chlorine dioxide chemistry is proprietary and packaged in patented delivery devices. Although some of its earlier patents are due to expire soon, Tristel is constantly adding to them. The hundreds of certifications and approvals it has achieved with national regulators and medical device manufacturers, to which it is also continuously adding, should be a barrier to new rivals.

The proof of advantage lies in Tristel’s strong returns, its dominance of its home market, and overseas growth.

Scoring Tristel

Tristel explains itself very well. The decision to exit the veterinary market shows it is making tough decisions. It is also largely in control of its own destiny. Tristel manufactures in Newmarket and once it has become established in a territory it often takes control of distribution, either by acquiring its distributor or setting up its own salesforce.

But it is not a perfect investment.

The environmental promise of Cache reveals a contradiction in Tristel’s line-up of disinfectants for simple medical instruments. Its biggest selling product is not Duo, a foaming disinfectant that can be applied with sustainable wipe materials, but Trio, a chemically identical disinfectant applied with pre-wetted wipes.

- Subscribe to the ii YouTube channel for interviews with popular investors

- Read more Richard Beddard articles here

Trio is the source of most of Tristel’s seven years of growth and UK dominance, but because of its superior environmental credentials Tristel will be encouraging hospitals to switch to Duo in future. This is, of course, laudable, but any transition is potentially a source of disruption.

Slightly scarily, Tristel failed a British Standards Institute (BSI) audit recently, and it admits it has a long way to go to be in a position to pass a US Food And Drug Administration (FDA) audit. The directors were refreshingly candid about this when they presented the full-year results, though, and they are beefing up their administrative capabilities.

Tristel also has a competitor in the US ultrasound market, a machine called Trophon which cleans probes in a mist of hydrogen peroxide. It has been adopted quite rapidly since it was approved by the FDA in 2012, but it is less popular in the UK and Europe where Tristel is more established.

While it will be interesting to see how the two products perform once Duo Ult is available in the US, given the fundamental differences between them, it seems likely Tristel will find its market.

Does the business make good money? [2]

+ High Return on Capital

+ Strong profit margin

+ Excellent cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Little competition

? Some of Tristel’s earlier patents expire from the mid 2020s

How does its strategy address the risks? [2]

+ Focus on proprietary, protected, chlorine dioxide chemistry

+ Innovation of new products and IP e.g. Cache

+ International expansion

Will we all benefit? [1]

+ Very experienced management, CEO Paul Sweeney is the founder

+ Good communication with shareholders

− Expensive and convoluted executive incentives

Is the share price low relative to profit? [-2]

− No, a share price of £4.70 values the enterprise at £220 million, about 38 times normalised profit.

A score of 5 out of 9 suggests Tristel may be a good long-term investment, but its attraction is muted by a high share price and convoluted executive compensation.

It is currently ranked 33 out of 41 high quality businesses I have scored in the last year or so.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Tristel.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.