Richard Beddard: will you strike it rich with this Hollywood stock?

4th February 2022 15:54

by Richard Beddard from interactive investor

This family-focused entertainment enterprise is a well-managed business, but valuing it accurately is a challenge for our columnist.

Through no fault of its own, Hollywood Bowl (LSE:BOWL) has performed poorly by its own pre-pandemic standards, but there is little doubt it is a slick operator.

Kingpin

In total there are 327 UK tenpin bowling alleys, of which Hollywood Bowl owns 64 of the bigger ones – more than any other operator.

Most of them are Hollywood-themed family-friendly bowling alleys located near other attractions. As retailers depart from retail parks, park owners are increasingly looking to restaurants, leisure, and entertainment venues to fill the gaps. Profitable formats like Hollywood Bowl are in a good position to secure the best locations.

Weeks before the pandemic the company also opened the first Puttstars centres, indoor crazy golf centres. Currently there are three.

Only about 50% of bowling revenue comes directly from bowling. The rest comes from food, drink and family-focused amusement arcades.

- Richard Beddard: six value share tips for 2022 – and beyond

- Share Sleuth: what I learned from attending my first AGM since 2019

Puttstars replicates these revenue streams, and also apes the company’s proprietary software systems, which improve efficiency and personalise the customer’s experience, encouraging friendly competition, return trips and bragging on social media.

Growth should come from new centres. The company points out that bowling is pretty thinly distributed across the country and it plans to open at least 10 new Hollywood Bowls by 2024.

Like many bowling centres, crazy golf courses are typically run by small owner-operators, so Hollywood Bowl has the opportunity to bring the slick systems and negotiating power of a chain to a new market. These are very early days, but putters are spending about as much per game as bowlers, and Hollywood Bowl plans to open four new Puttstars by 2024.

Customer focus

I think Hollywood Bowl’s focus on families helps it stand out from other operators, and rivals rarely locate themselves near each other anyway.

A further advantage is that as a chain, the cost of developing efficient systems is defrayed over a large number of centres, resulting in a perhaps surprisingly sophisticated operation.

The company routinely refurbishes centres, introducing improvements such as its new customer data platform, which makes it easy for customers to book games, and tenpins on strings, which reduces interruptions due to equipment failure compared to old-style pin spotters.

Airline-style dynamic pricing maximises revenue and lane utilisation; and Hollywood Bowl even adjusts its menus to nudge customers to snack during busy times, and eat meals when it is quieter.

- 10 shares to give you a £10,000 annual income in 2022

- The First & Last share I bought: Gervais Williams of Premier Miton

Old-style customer service is important too. The company claims to have the best management training programme in the business and promotes about half of its managers from within. The promotion of its talent director of nearly 10 years to the board (as chief people officer) may be a sign of the company’s further intent to keep employees happy as a means of keeping customers happy.

Reviews and customer satisfaction metrics vindicate that strategy. Hollywood Bowl centres typically get thousands of broadly positive reviews on Google and the first few hundred reviews for the three Puttstars sites are higher. The company’s chosen measure of customer satisfaction, the Net Promoter Score (NPS), is very high.

One metric that is not so easy to reconcile with employee satisfaction, though, is the disparity between executive pay and the median UK employee.

In 2021, when the executives received no bonus, chief executive Stephen Burns earned 25 times as much pay as the median UK employee. In future years – when his remuneration could exceed £1 million in cash and share incentives, as it did in 2019 – it could be well above 50 times median pay within the company , which was £16,400 in 2021.

Striking out

The pandemic has not been kind to hospitality businesses, although with the financial help of government, shareholders and landlords Hollywood Bowl remained solvent and profitable in the year to September 2021, as it did the previous year.

Past performance is not a guide to future performance.

Making any kind of profit was an achievement considering Hollywood Bowl was closed for over half the year and only able to operate without restrictions for 10 weeks.

At the end of the financial year last summer, business was extremely brisk – the result of pent-up demand, people staying in the UK for their holidays, and wet weather, which drove people to indoor entertainment.

Most of the red flags in the numbers, the contraction of revenue and profit and reduced return on capital, should recede if, as seems likely, the company is allowed to trade freely for the rest of the current financial year and thereafter.

Its eagerness to resume investing in new and existing centres means it may not reduce its significant financial obligations, however.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Watch our share tips here and subscribe to the ii YouTube channel for free

Scoring Hollywood Bowl

I think Hollywood Bowl is a very well managed business, but I remain befuddled when it comes to value.

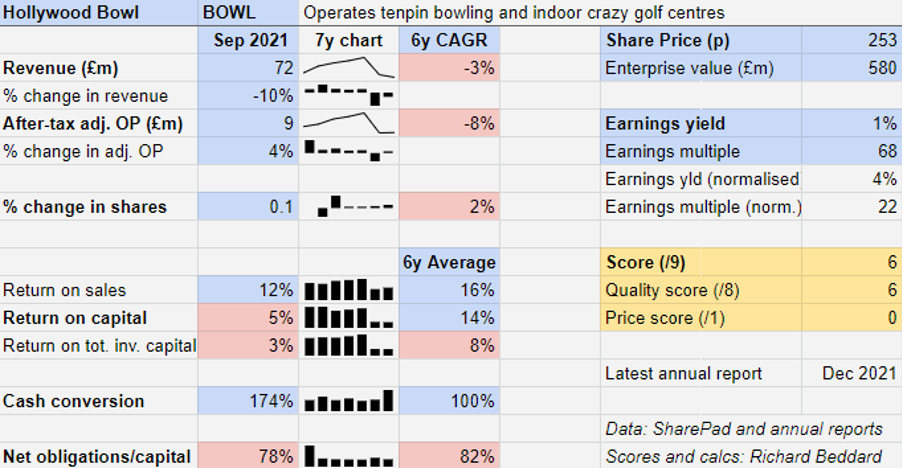

Now that the impact of the pandemic seems to be receding, it is tempting to think things will return to normal. But we do not really know what normal is. The company traded as a listed company for little more than three years before the pandemic. Then its return on capital averaged nearly 20%.

Valuing the company on the basis of the very low returns of 2021 gives us a gigantic multiple of 67 times profit, because it ignores the near certainty that profitability will be higher in future.

Assuming Hollywood Bowl earns its pre-pandemic return on capital of 20% in future, the shares only cost about 15 times normalised profit. That seems a little panglossian.

I have used the 14% average return on capital earned over the last six years to calculate the multiple. It is, I think, a prudent guess. It values the company at 22 times normalised profit.

Does the business make good money? [1]

+ Decent average return on capital and profit margins

+ Good cash conversion

− Unsure how well demand would hold up in recession

What could stop it growing profitably? [1]

+ Fragmented competition

? Significant financial obligations

? Growth depends on successful roll-outs continuing

How does its strategy address the risks? [2]

+ Distinctive family focus

+ Investment in format and systems increases efficiency

? New Puttstars concept could be a winner

Will we all benefit? [2]

+ Experienced management

+ Customer/employee focused culture

? Executive remuneration

Is the share price low relative to profit? [0]

? No. A share price of 253p values the company at about 22 times normalised profit

A score of 6 out of 9 means Hollywood Bowl is probably a good long-term investment. It is ranked 30 out of 40 good businesses scored and ranked in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Hollywood Bowl.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.