Share Sleuth: what I learned from attending my first AGM since 2019

2nd February 2022 10:45

by Richard Beddard from interactive investor

One of the advantages of going to an AGM is that you get colour that no annual report can deliver.

On Wednesday, I attended my first Annual General Meeting (AGM) in person since 2019, and what a Treatt it was.

I witnessed people actually working in an office, and of course shareholders mingling with directors. At AGMs shareholders can hold directors to account and ask about the business, how it makes money, how it might make more, and what could get in the way.

Treatt (LSE:TET), a supplier of flavours, was a great choice for my AGM comeback. Whenever I visit the company I am infected by the enthusiasm of the chief executive and the generally positive vibe that imbues staff and shareholders.

This time was no different even though its new headquarters was half-empty, the result, no doubt, of some people working from home and the fact that the company has not yet finished moving in.

- Your AGM guide: what you can do and how to do it

- Shareholder voting & information. Have your say on the companies you invest in

I arrived with executive pay at the top of my mind. It is significant this year because Treatt shareholders were asked to vote on the company’s remuneration policy, which only happens routinely once every three years.

Generally, I fear there is intractable inflation in executive pay because boards compare their pay to those of similar companies, whose pay is also going up. Other factors may come into play, but the competitive market for executives wins.

My request was a simple one. To bring one of those other factors more to the fore by publishing the ratio of chief executive pay to median staff pay even though Treatt is not required to. Happily, the company says from next year it will publish this statistic.

- Richard Beddard: six value share tips for 2022 – and beyond

- Share Sleuth: here’s how the portfolio could change in 2022

Quantifying growth

I also wanted to get a better impression of the difference in financial terms the new headquarters might make. Outgoing finance director Richard Hope reminded us of his long-standing expectation that the company will earn an incremental return on investment from the new facility of 10% - 15% two or three years after manufacturing commences later this year.

Earlier, I had been discussing the company’s many good qualities with one of my fellow shareholders. All very well, but there is always the question of the share price, he said. My own evaluation of Treatt basically gives it the thumbs up for quality and the thumbs down for price.

Mr Hope’s expectation though gives us an inkling of what investors may be thinking when they are prepared to pay an enterprise multiple of about 40 times profit for Treatt.

According to my adjusted figures, Treatt made £17 million profit in 2021. It will probably make more in 2022, but let us stick with what we know. A 10% return on about £40 million invested would be £4 million extra and a 15% return would be £6 million. Other things being equal, the company might make between £21 million and £23 million in the not too distant future, sufficient to bring the forward multiple down to between 30 and 33.

Other things probably will not be equal though.

Mr Hope’s figures only include efficiencies he is reasonably confident about, due to the rationalisation of the company’s footprint from six buildings to one integrated facility and the installation of the latest equipment.

- Bargain hunters told to target these five top growth shares

- 10 shares to give you a £10,000 annual income in 2022

- Watch our share, fund and trust tips, plus outlook videos for 2022

One of the advantages of going to the AGM is you get colour that no annual report can deliver. To give shareholders an example of how much less carting around of drums of orange oil will take place, chief executive Daemonn Reeve told us the company is cutting its fleet of forklifts from 27 to seven.

To illustrate the technology upgrade, he said people at Treatt will no longer need to use marker pen to mark the positions of levers on distillation equipment now it has a digital control room.

But the move was about more than efficiency. Treatt’s old fragmented footprint with its makeshift laboratory was hindering collaboration. The new facility should enable employees to work better with each other and scientists from beverage companies and flavour houses as they perfect new flavours together.

Treatt has grown every year since 2012 as it has launched new and innovative ingredients such as iced tea flavours and aromas that improve the taste of artificially sweetened drinks. I expect that growth to continue. It has literally laid the foundations in its new headquarters. It sees more opportunities in China, as well as for trendy new flavours like cold brew coffee.

These developments should increase revenue. Quantifying how much would be guesswork, but if all goes to plan, higher revenue will increase profit and reduce the multiple further.

We can prop up our expectations with forecasts, or, as I tend to, with confidence in the strategy and culture of the business. I may have made some progress understanding strategy at this year’s AGM too.

Treatt has gradually been transforming itself into a manufacturer of flavours. The flavour is the critical ingredient in a drink yet, as Mr Reeve told us, Treatt’s component of the overall cost of a beverage is between 0.1% and 1%.

Paying a little extra for a Treatt ingredient instead of something less natural or authentic should not, therefore, eat into the customer’s profits too much. Selling more “added value” flavours at higher prices has a big impact on Treatt’s profit margins though.

The bear case is that the flashy new building is a big folly, a £40 million waste of money, but everything else I know about the company makes this a distant and diminishing possibility.

No trades

I have not made any trades this month, although I am still determined to reduce the portfolio to no more than 25 shares from the current 28. The aim of this mini-rationalisation is to enable me to score and rank more new shares each year, and increase the competition for berths in the portfolio.

The next portfolio member to be re-scored is tenpin bowling and crazy golf franchise Hollywood Bowl (LSE:BOWL). It is a prime candidate for removal because last year’s score ranks it 39 out of the 40 shares in my Decision Engine.

It is near the bottom of my pile of good long-term investments. Unless that changes in my re-evaluation I may be better off investing the money in one of the higher-ranked shares instead.

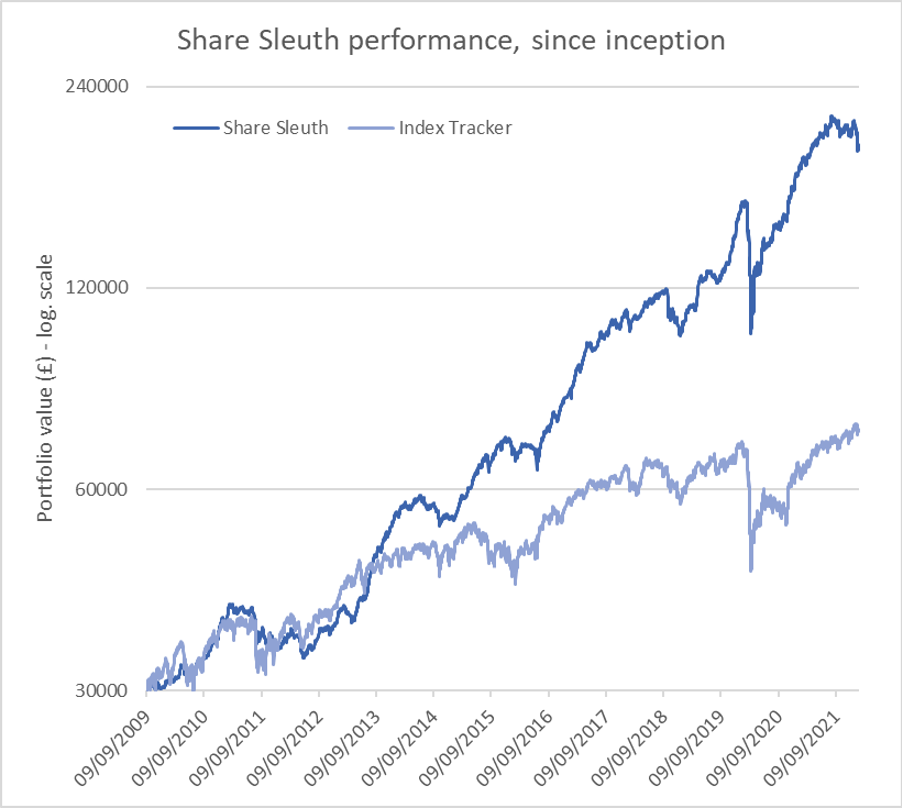

Share Sleuth performance

At the close on Monday 31 January, the Share Sleuth portfolio was worth £194,828, which is 549% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

Past performance is not a guide to future performance.

This is considerably less than the £212,395 it was worth on 5 January, last time I updated you.

I wish I could say this does not hurt, but I am glad to say it only hurts today because I have checked the portfolio’s value to update this article. The rest of the time I have been blissfully researching businesses, not watching what is happening to their share prices.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 4,302 | ||||

Shares | 190,526 | ||||

Since 9 September 2009 | 30,000 | 194,828 | 549 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,632 | 63 |

BMY | Bloomsbury | 2,676 | 8,509 | 10,142 | 19 |

BNZL | Bunzl | 201 | 4,714 | 5,562 | 18 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,046 | 12 |

CHH | Churchill China | 341 | 3,751 | 5,098 | 36 |

CHRT | Cohort | 1,600 | 3,747 | 7,360 | 96 |

D4T4 | D4t4 | 1,528 | 3,509 | 4,508 | 28 |

DWHT | Dewhurst | 532 | 1,754 | 8,352 | 376 |

FOUR | 4Imprint | 190 | 3,688 | 5,320 | 44 |

GAW | Games Workshop | 76 | 218 | 6,034 | 2,668 |

GDWN | Goodwin | 266 | 6,646 | 8,352 | 26 |

HWDN | Howden Joinery | 1,368 | 8,223 | 11,108 | 35 |

JDG | Judges Scientific | 159 | 3,825 | 12,116 | 217 |

JET2 | Jet2 | 456 | 250 | 6,010 | 2,304 |

LTHM | James Latham | 400 | 5,238 | 4,960 | -5 |

NXT | Next | 106 | 6,071 | 7,948 | 31 |

PRV | Porvair | 906 | 4,999 | 6,070 | 21 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,605 | -7 |

QTX | Quartix | 1,085 | 2,798 | 4,177 | 49 |

RM. | RM | 1,275 | 3,038 | 2,375 | -22 |

RSW | Renishaw | 92 | 1,739 | 4,173 | 140 |

SOLI | Solid State | 986 | 2,847 | 10,649 | 274 |

TET | Treatt | 763 | 1,082 | 8,050 | 644 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,600 | 290 |

TRI | Trifast | 2,261 | 3,357 | 3,561 | 6 |

TSTL | Tristel | 750 | 268 | 3,150 | 1,074 |

VCT | Victrex | 534 | 10,812 | 10,904 | 1 |

XPP | XP Power | 240 | 4,589 | 11,664 | 154 |

No additions or disposals in the last month.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested in accumulation units of a FTSE All-Share index tracking fund over the same period would have appreciated to £73,555.

The portfolio’s cash balance has swelled to £4,302 thanks to dividends from D4t4, James Latham, XP Power and a special dividend from Next.

The cash balance is almost sufficient to fund new additions at my minimum trade size of 2.5% of the portfolio’s total value (about £4,900).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Treatt.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.