A risky investing craze: GameStop’s most volatile day

A phenomenal rally grabbed headlines, but wild swings in stock price that followed are a warning to all.

28th January 2021 20:02

by Lee Wild from interactive investor

A phenomenal rally grabbed headlines, but wild swings in stock price that followed are a warning to all.

As the bells chimed in the New Year, few had heard of a small American computer games and electronics chain called GameStop (NYSE:GME). How times change.

A few weeks later and it’s the only thing investors want to talk about. Even Tesla (NASDAQ:TSLA) feels like old news just hours after its results. But while some lucky investors are reaping massive rewards from the latest share boom, there is a serious warning here for those tempted to play this particular game.

What just happened?

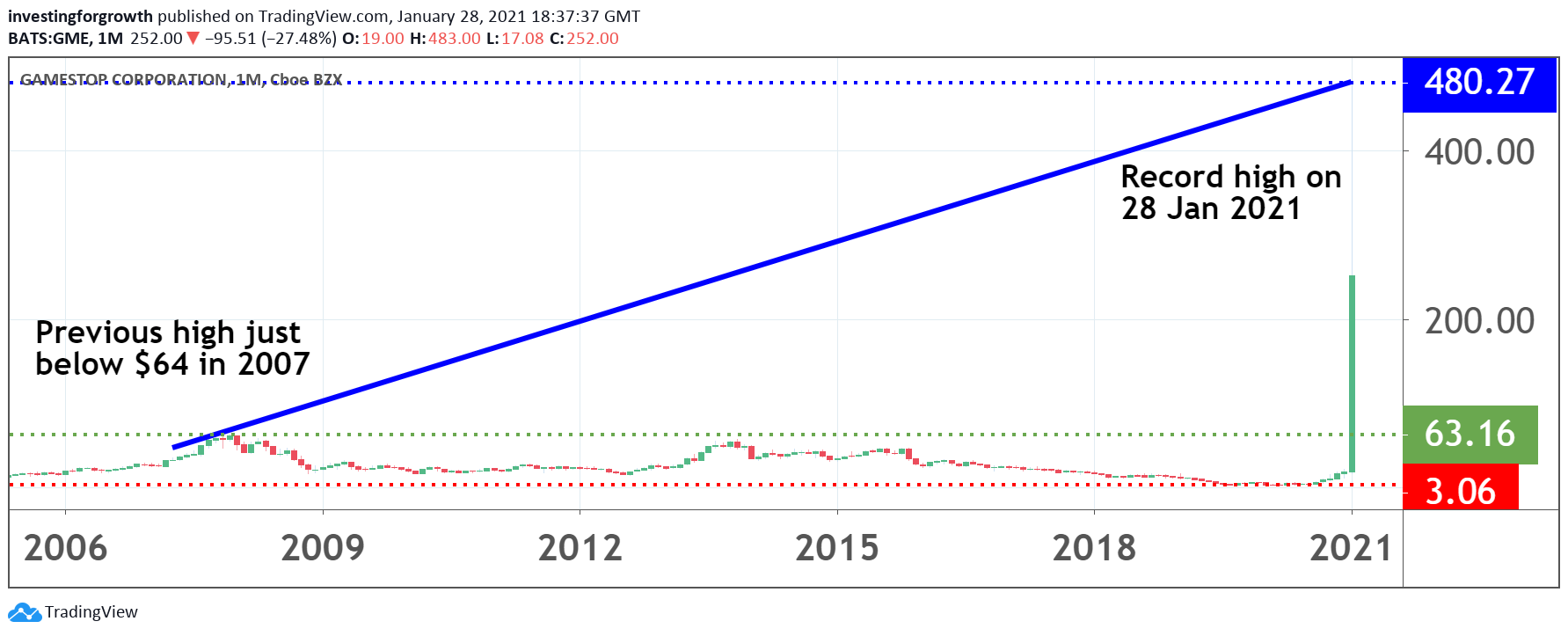

At the beginning of 2021, you could have bought a share in GameStop on the New York Stock Exchange for less than $18. On Thursday 28 January, you could have sold them for as much as $483. That’s a profit of more than 2,580% in just a few weeks.

In all its time as a listed company, GameStop shares had previously only traded above $60 briefly at the end of 2007, just before the Great Financial Crisis.

Source: TradingView. Past performance is not a guide to future performance

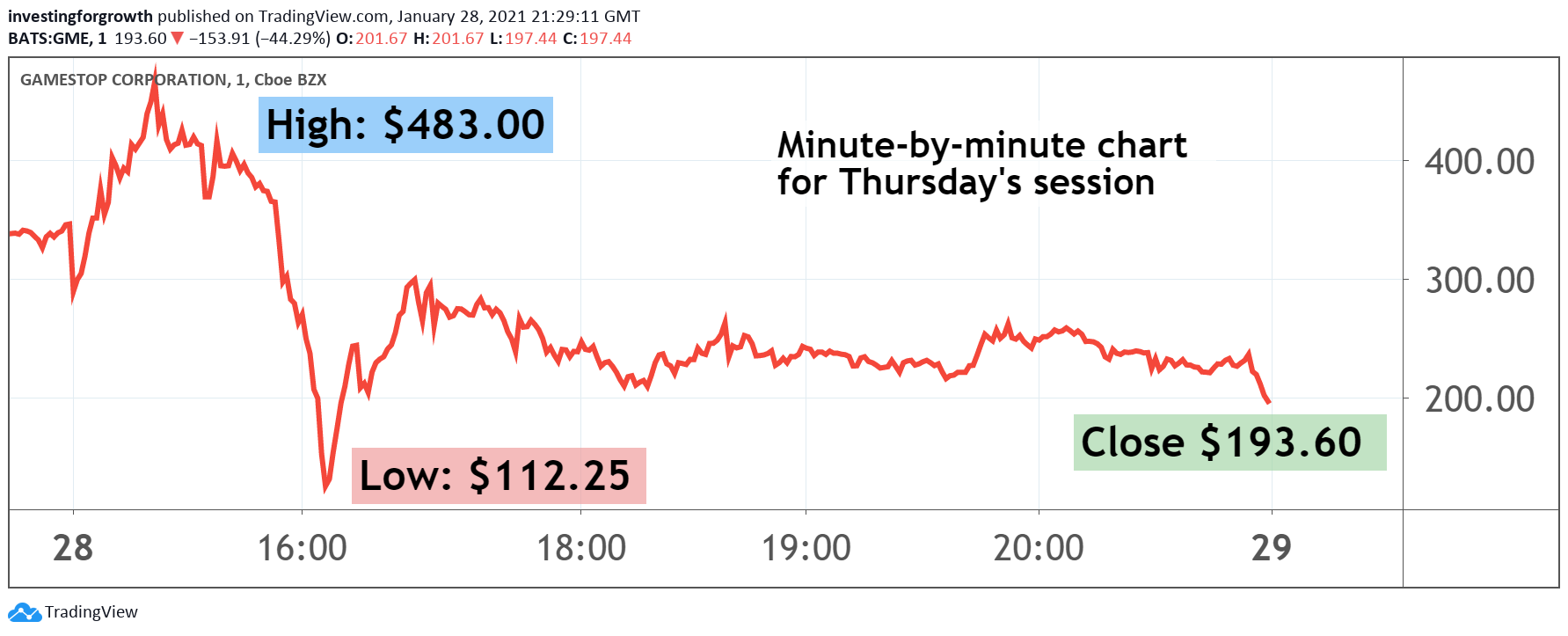

This has been the most volatile day in GameStop’s history, with price swings making and losing fortunes for investors tempted to play.

The situation was made worse when many online brokerages in the US put restrictions on trading in GameStop and other highly volatile stocks. The move was blamed on possible problems settling the trades.

GameStop shares ended Wednesday’s trading session at $347.51. Within half-an-hour of the opening bell in New York on Thursday they were up 39% at $483. Less than 90 minutes later they had plummeted 77% to below $113. Over the next 45 minutes they rallied more than 180% to $319 as ‘bargain hunters’ piled in, before ending the session at $193.60, down 44% on the day.

Source: TradingView. Past performance is not a guide to future performance

What’s the story?

In a nutshell, it's being billed as David vs Goliath, or an anti-establishment trade, where amateur investors in the US took a different opinion to hedge funds (investors who sell stock in unloved companies in the hope of buying them back cheaper at a later date) and professional traders on Wall Street. Both had been happily selling shares in GameStop to anyone who would buy them. That’s because bricks and mortar stores have struggled during the pandemic, and its business model looks outdated.

But two weeks ago, when GameStop hired new directors to turn the business around, the amateur investors using Reddit, a social news aggregation and online discussion website, decided the shares were oversold and began buying.

News spread across Reddit’s WallStreetBets forum and buying of Gamestop shares snowballed.

So great were the numbers involved there were far more buyers than sellers. This forced the stock price higher. Hedge funds panicked because they had sold stock and have to buy it back at some point in the future. If they sold at, say, $20, they lose money for every dollar the price moves above $20. Many hedge funds rushed to buy back GameStop shares to limit losses, causing what’s called a ‘short squeeze’. However, they are reported to have lost billions of dollars because GameStop's share price rocketed so fast.

What next?

There’s talk that this event is evidence we are in a colossal bubble and may have marked the top of the US tech bull run. And it is certainly reminiscent of the dotcom boom 20 years ago in so much as a company with limited tangible value is chased to prices that appear completely unrealistic. In both cases, investors use gossip and rumour in chat rooms, discussion boards and now social media to ramp up share prices.

Investors must now decide if GameStop, a company that was worth less than $2 billion a few weeks ago, is suddenly worth over $30 billion at its recent peak.

The same amateur investors are using these chat forums to target other stocks that have been heavily shorted by big hedge funds, most recently American Airlines (NASDAQ:AAL). Others could follow.

interactive investor’s head of markets Richard Hunter warns that UK investors should approach these share price moves with extreme caution.

“This is a very dangerous game. The best way to get your voice heard against the establishment is to vote. And that applies to either side of the Atlantic.

“As with any investment or indeed trade, investors should research the company and understand its business before committing capital, as opposed to surfing a buying wave which may – or may not – have any merit. Equally, social media posts should be cross checked with the latest information available on the company for a balanced view.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.