Shares slump as Ted Baker gets sums wrong again

One of the worst-performing stocks of the past few years, this is another blow to investor confidence.

22nd January 2020 14:30

by Graeme Evans from interactive investor

One of the worst-performing stocks of the past few years, this is another blow to investor confidence.

Having been about £32 in March 2018, Ted Baker (LSE:TED) shares were trading back below £3 today after the former stock market darling delivered another unwelcome surprise to investors.

The fashion brand continued the pattern of a dreadful 2019 by revealing that the value of its inventories had been overstated by much more than it had originally suggested.

An independent review by Deloitte put the figure at £58 million, compared with the preliminary assessment of between £20 million and £25 million announced in early December. No further details were given.

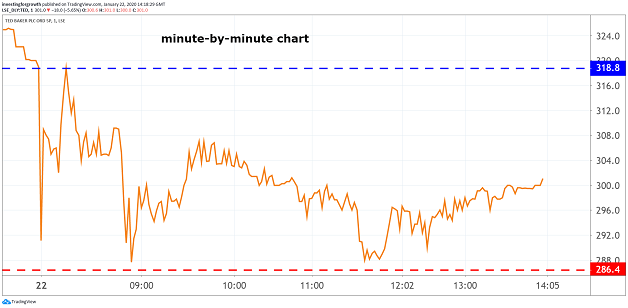

While the figure relates to previous financial years and is a non-cash item, the disclosure dealt another blow to already fragile confidence in the group. Shares were as much as 10% lower at 286.4p, with only a brief rebound in mid-morning suggesting much appetite from bargain hunters.

Source: TradingView Past performance is not a guide to future performance

The stock is already down sharply from 440p at the start of 2020, with evidence from other retailers of tough Christmas trading contributing to the pessimistic mood. Ted Baker is not due to update on its own festive performance until annual results in March, having already downgraded City expectations in December with another profit warning.

Baker said poor November and Black Friday trading would leave profits for the year to January closer to £5 million, rather than the £27 million the City had been forecasting following three previous downgrades. This was accompanied by the suspension of the 58.6p a share full-year dividend.

As far as those potential bargain hunters are concerned, it remains hard to take a view on when or if things will get better for the business. The market cap is now less than the £141 million reported debt, while the search for a new permanent CEO to replace Lindsay Page has only just begun.

Page, the former finance director, took the helm in April following the departure of founder Ray Kelvin in the wake of harassment allegations. One theory doing the rounds in the City is that Kelvin, who still owns 35% of the company, may seek the opportunity to reclaim control through a private equity-backed takeover.

Source: TradingView Past performance is not a guide to future performance

The group is now being run on an interim basis by Rachel Osborne, who only joined Ted Baker in November as chief financial officer.

While the brand remains a powerful force on the high street, the company's exposure to the structural challenges of the department store sector is far from helpful.

Consumers are also being drawn to cheaper alternatives in the current uncertain trading climate. This trend is highlighted by the success of Boohoo (LSE:BOO), whose shares have been at a record high after upgrading guidance based on strong November and December trading.

As a result of increased promotional activity, Ted Baker said recently it was taking a more proactive approach to stock management and inventory sell through.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.