Should I go for an ETF tracking the FTSE 100 or FTSE All-Share?

While it may seem like the FTSE All-Share and FTSE 100 are very similar, there are key differences.

16th July 2021 09:58

by Dimitar Boyadzhiev from ii contributor

While it may seem like the FTSE All-Share and FTSE 100 indices are very similar, there are key differences.

Conventional wisdom dictates that large companies outperform small companies during periods of extreme market uncertainty. This is because investors tend to flock to less risky assets during equity sell-off periods. Not surprisingly, small caps tend to be less liquid, profitable, and mature compared to their larger-cap counterparts. Indeed, the risk-off sentiment in March 2020 caused UK small-cap stocks to decline by 10% more than their large-cap counterparts over the month. However, tilting a portfolio towards large caps doesn’t always guarantee better returns during challenging market environment.

- Invest with ii: Top ETFs | Index Tracker Funds | FTSE Tracker Funds

When it comes to size bets, it’s difficult to time the market. The pandemic has provided us with even more evidence that a diversified approach towards the UK equity market can better protect investors’ portfolios during equity drawdown periods. For this reason, Morningstar analysts rate passive funds tracking the FTSE All-Share, an index offering exposure to all caps, more highly than those tracking the better-known, mega-cap heavy FTSE 100. In this article, we compare the portfolio construction characteristics of the two flagship indices.

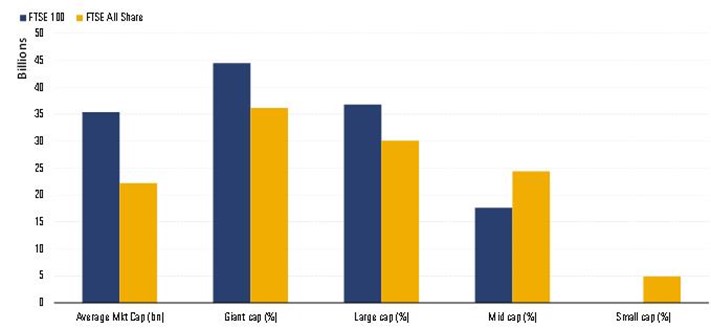

Market capitalisation profiles differ

At first blush, it may seem like the FTSE All-Share and FTSE 100 indices are very similar. Both benchmarks provide broad access to the UK equity market. But under the hood, there are a few notable differences. First, the FTSE All-Share index captures the entire UK equity opportunity set, offering exposure to the full market capitalisation spectrum. As the exhibit below indicates, the FTSE 100 index is overweight to giant and large-caps and underweight to mid-caps compared to the FTSE All-Share Index. Additionally, the FTSE 100 index does not provide exposure to small caps. As a result, companies in the FTSE 100 have a higher average market capitalisation compared to those in the All-Share index.

Since the pandemic started, UK equity funds offering a more diversified approach to market capitalisation recovered more quickly compared to their more concentrated counterparts. From January 2020 through to the end of May 2021, the average annualised return for passive funds tracking the FTSE All-Share was around 0.5%. Meanwhile, the corresponding figure for passive funds tracking the less representative FTSE 100 was negative 2.3%.

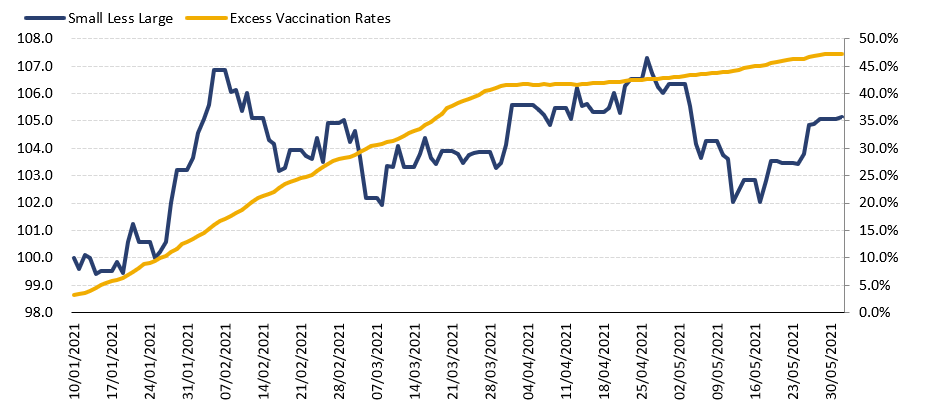

In 2021, investors’ negative sentiment towards small caps changed. From January 2020 through to May 2021, UK small-cap stocks outperformed UK large caps by 5% on an annualised basis. This is because small caps tend to outperform large caps during economic recoveries. Additionally, small caps derive a higher portion of their revenue from the domestic market compared to large caps, which are more sensitive to international drivers.

Positive UK small-cap performance can partly be explained by the country’s successful vaccination roll-out. In the exhibit below, the blue line represents UK small-cap performance less UK large-cap performance. In periods when the slope of the line is rising, UK small caps outperformed UK large caps. Meanwhile the yellow line represents the UK’s excess vaccination rates compared to the rest of the world. For the period ending May 2021, we observe that the UK vaccinated 50% more of its population compared to the rest of the world.

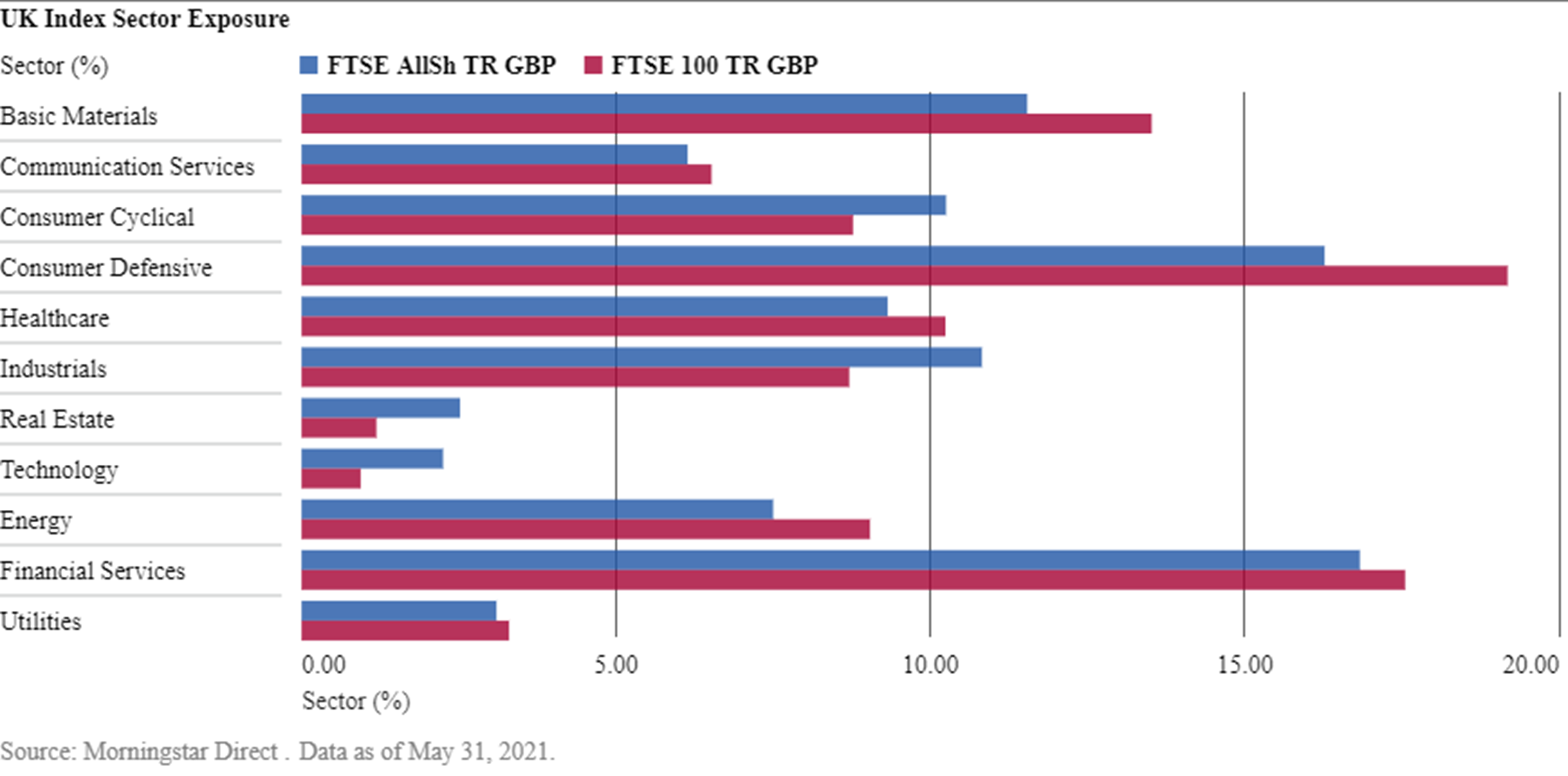

Sector bets

The FTSE All-Share Index is also well balanced from a sector perspective. Compared to the FTSE All-Share index, the FTSE 100 has an overweight to consumer defensive, basic materials, and energy. Meanwhile, the largest underweights are to industrials, consumer cyclical, real estate and technology.

As the exhibit below shows, the FTSE All-Share is more diversified across sectors compared to the FTSE 100. Equity sector performance is often unpredictable. For this reason, maintaining a well-diversified sector posture can help prepare the portfolio for market downturns.

The cheapest All-Share trackers

With around 70 passive funds currently available, the UK large-cap equity category is a competitive space for passive fund providers. This is a huge benefit that is passed on to UK investors in the form of rock-bottom fees. There’s a variety of products to choose from, including Vanguard’s FTSE All Share Index and the L&G UK Index. Both products track the FTSE All-Share Index and hold Morningstar analyst ratings of silver. These funds offer a strong degree of diversification at low fees. Additionally, they are widely available across UK retail platforms. Both funds are appealing choices for a “set-and-forget” long-term UK equity holding.

Dimitar Boyadzhiev is senior analyst for manager research and passive strategies at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.