Should you keep taking profits in the tech titans?

20th December 2021 12:06

by John Burford from interactive investor

Technical analyst John Burford homes in on one of the tech giants and asks what the insiders are doing as ‘walls of worry’ stack up.

Last week was pivotal in stock markets. On Wednesday, the Federal Reserve confirmed what many people had feared – they would accelerate the pace of 'tapering' (severely cut the Fed's bond-buying programme) and raise policy rates several times next year to 'combat inflation'.

If you believe that the Fed's quantitative easing (QE) programme (releasing tsunamis of 'funny money' into financial markets) that started in 2008 in response to the credit crunch was the main factor behind the aggressive buying of shares, then you may believe its imminent withdrawal might put an end to the bull run in leading shares. Especially so if you believe the old adage “Don't fight the Fed”.

Since the advent of QE in 2008, the S&P that started at 700 traded last week above 4700 and has thus gained an astonishing 570% – a huge rate of almost 50% a year – way above historic norms. Of course, most of us have become inured to these massive and historic gains, especially in the big name tech titans that include Alphabet (NASDAQ:GOOGL), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), Microsoft (NASDAQ:MSFT) and many others.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Read more articles by John Burford here

Indeed, most investors remain convinced that even greater gains lie ahead – and that belief is entirely normal at major defining tops. Highs in the market are never made when everyone is short (or into cash) or expressing bearish views. Only a few contrarian mavericks do that.

In recent weeks, I have been making my case that taking profits in Facebook/Meta (NASDAQ:FB) (COTW of November 1), Apple (COTW of November 29), Tesla (COTW of December 6) would be a very prudent move. Events of the past week, extending into this week, have strengthened my view.

As another example, below is the Alphabet (Google) chart showing the typical steep rise in recent months since the Corona Crash, when even greater tsunamis of support were unleashed. As a measure of this government 'generosity', many US workers were paid more to be furloughed watching Netflix on the couch at home than they made at work previously.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Subscribe to the ii YouTube channel for our latest interviews

No wonder the stay-at-home newbie traders had nothing to do with this largesse except to open a stock trading account on Robinhood – and pile into the most unlikely shares, such as money-losing GameStop (NYSE:GME), which zoomed from sub-$10 to $484 in a matter of days. I consider that a full-blown mania, which characterises many markets today.

And the professional traders likewise jumped on the bandwagon and pushed up the FAANGs and many others with abandon as the FOMO theme worked its usual magic.

Past performance is not a guide to future performance.

But now with the spectre of the Fed tightening next year, do we have multiple whammies staring investors in the face as we head into 2022? And will a new bear trend in Alphabet be marked by a break of my trend-line?

Here are a few Walls of Worry for investors:

- Consumer price inflation is rearing its ugly head again, discouraging retail sales

- Energy costs are high, discouraging the manufacture of goods

- The little-watched carbon credit markets are high, also discouraging manufacturing. But last week, this overblown market likely reversed, indicating the end of the net-zero fantasy, and likely disrupting the 'renewable' energy market

- The Fed and Bank of England will be raising rates next year, encouraging a switch from speculation to conservation (cash levels are now rising)

- The Fed will be rapidly slowing the pace of its balance sheet growth and heralding a deflationary phase (credit growth will reverse)

- And now another lockdown season is upon us with severe implications for economies.

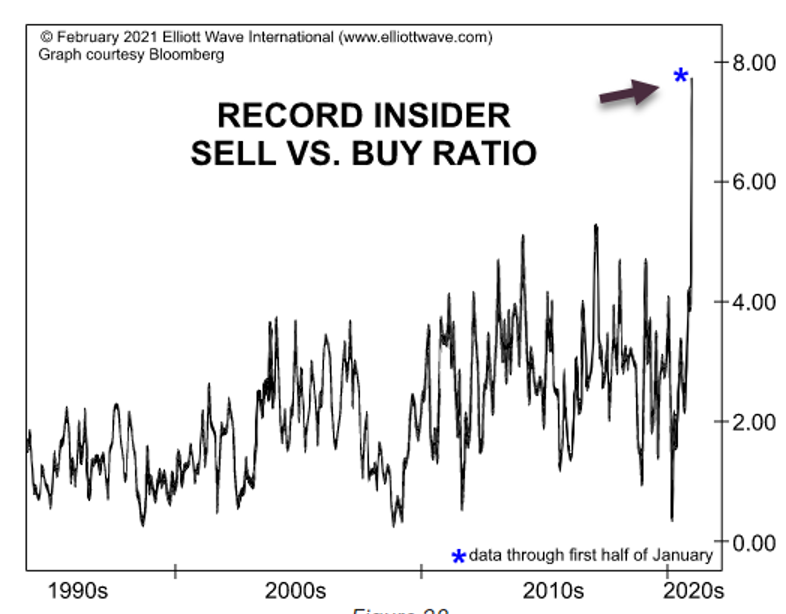

Last but not least, while investment pros and retail investors alike have been scooping up shares for years with little regard to risk, what are the insiders (corporate officers) doing? It's useful to know since they above all should know the true state of their businesses and its prospects. Have they expressed confidence in the future? Here is a very revealing chart:

Past performance is not a guide to future performance.

No! In fact, US insiders are selling their own shares at a record sell/buy ratio going back at least to 1990 (and probably well before that).

Do they know something most of us don't?

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.