Solid dividends are reward for owning these great companies

When bad news is good news and vice versa, things can get confusing, so overseas investing expert Rodney Hobson tries to make sense of reaction to news from these American giants. At least one of them is still a buy.

31st January 2024 08:46

by Rodney Hobson from interactive investor

A funny thing happened during the start of US results season. Consumer goods group Procter & Gamble Co (NYSE:PG) reduced its profit forecast and wrote down the value of assets, whereupon its shares promptly rose 4.1%. Johnson & Johnson (NYSE:JNJ), which has hived off its consumer goods arm to concentrate on health products, beat expectations and saw 1.7% immediately wiped off the value of its shares. The stock market can certainly behave in unexpected ways.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Not for the first time, P&G has written down the value of its Gillette razors business, this time by $1.3 billion. Men seem to be shaving less in developed countries since the business was bought for $54 billion nearly 20 years ago.

P&G did manage to increase total group sales by 3.2% but that was more than accounted for by a 4% increase in prices. Sales by volume were flat. Headwinds include currency changes, post-pandemic work habits and weak demand in China. That hardly bodes well for a near-term improvement, especially as it is becoming harder for household goods manufacturers to pass on price increases while inflation continues to have an impact on raw materials and production and distribution costs.

The group now expects sales in the year to mid-2024 to be no better than in the previous 12 months and, if anything, to be a fraction lower, reducing previous guidance of 6-9% growth.

Meanwhile, profits have taken a nosedive, down 12% to $3.5 billion in the second quarter to 31 December as higher selling and administrative costs plus increased interest payments on borrowings took their toll.

Management remains optimistic, though, that the company is heading in the right direction and has raised the quarterly dividend by 3% to 91.33 cents.

The shares are bumping up against a ceiling around $157, not much short of the $163 peak. The price/earnings (PE) ratio is quite toppy at 26 while the yield is decent but not overwhelming at 2.4%.

Source: interactive investor. Past performance is not a guide to future performance.

J&J is more into health after spinning off consumer goods in Kenvue Inc (NYSE:KVUE) last year. Fourth-quarter sales rose 7.3% to $21.4 billion, beating expectations, while net earnings shot up 28% to $4.13 billion despite the setting aside of $84 million to cover the restructuring of the orthopedics business. This quarter was a big improvement on the performance earlier in the year. For the whole 12 months, sales increased by a lower 6.5% while net earnings were down 19%.

That improvement should carry over into the current year, with sales projected to rise 5-6% and earnings per share by around 7.4% during 2024. In particular, the medical device business is flourishing as surgeons catch up on operations such as joint replacements that were postponed during the pandemic.

- US results: what to expect from America’s biggest tech stocks

- Find out who's reporting when this US Earnings Season

- Where to invest in Q1 2024? Four experts have their say

There are reports that J&J has finally settled litigation in 40 states over its talc products, which have been linked to hotly disputed cancer claims. It will cost $700 million but that is better than having highly expensive court proceedings with adverse publicity dragging on indefinitely.

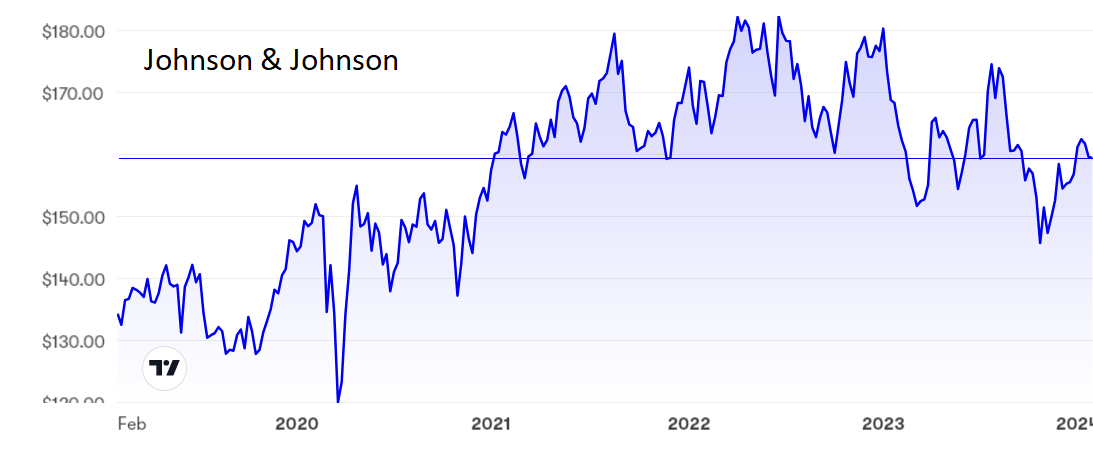

J&J shares have swung wildly between $145 and $175 for the past three-and-a-half years. They are currently around the middle of that range at $159, where the PE is quite demanding at a touch over 30 and the yield is just under 3%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have tipped Johnson & Johnson before, both just above and just below the current level, and although the shares have failed to take off there is at least a decent income stream. Still a buy.

It is hard to see P&G as a buy until there is better news on trading, but shareholders should continue to hold on and enjoy the solid dividend.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.