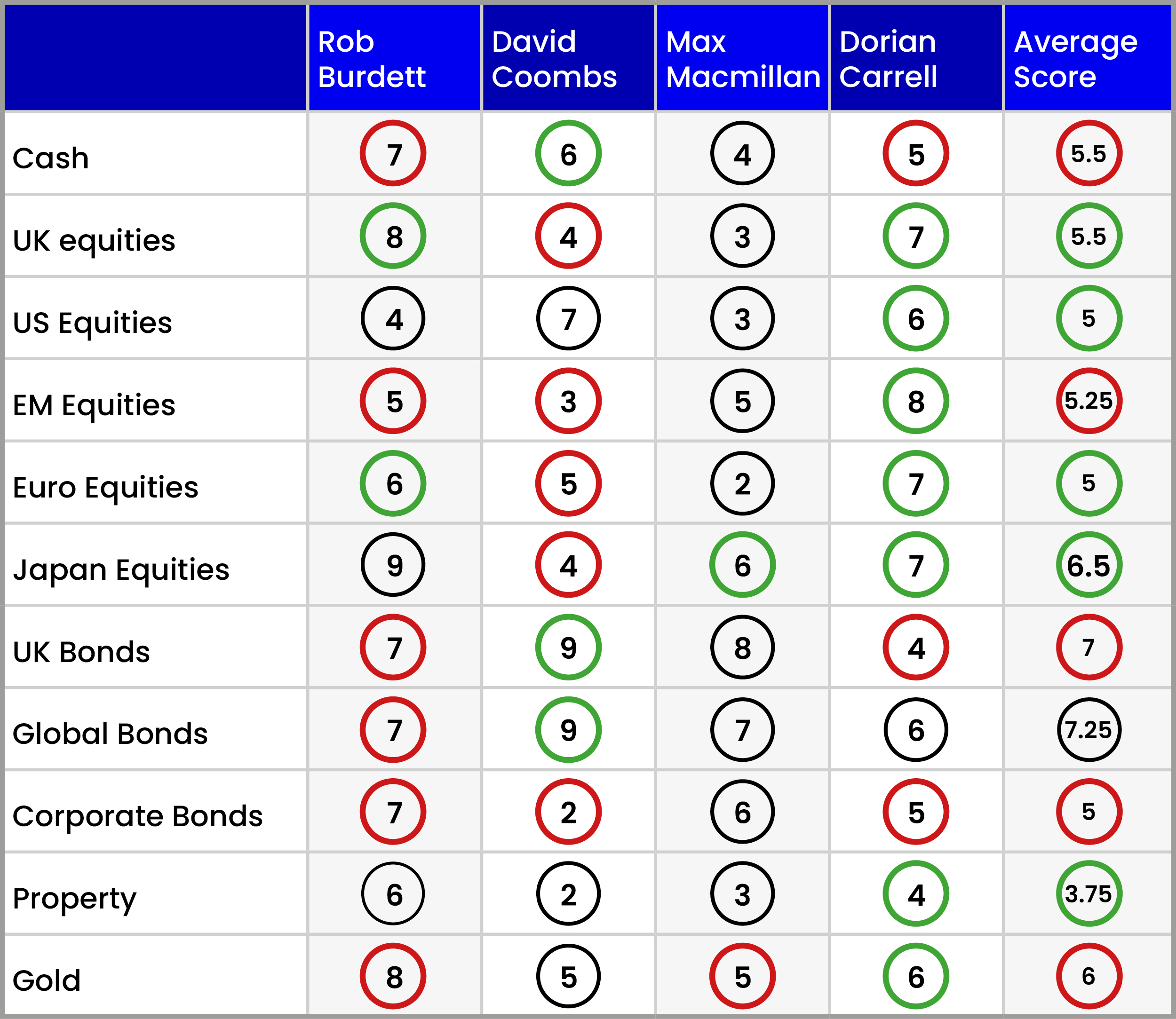

Where to invest in Q1 2024? Four experts have their say

Our panel of four professional asset allocators give their outlook for equities, bonds, property and gold.

26th January 2024 09:08

by Jim Levi from interactive investor

For so long an unloved and underperforming “also ran” of financial markets, UK equities are suddenly back in favour for 2024. Goldman Sachs is now saying the UK stock market could outperform Wall Street, eurozone markets and even Japan this year.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Climbing aboard this unexpected bandwagon are two members of our own asset allocation panel: Dorian Carrell and Rob Burdett. New panel member Carrell, head of multi-asset income at Schroders, replaces his Schroders’ colleague Keith Wade who has retired.

UK equities more in favour

Giving UK equities a score of seven, Carrell says: “UK equity market valuations are extremely low and this has prompted a pick-up in merger and acquisition activity.” Food giant Mars has splashed out £534 million for Hotel Chocolat Group (LSE:HOTC) - almost triple the average valuation of the company in the two months prior to the bid. And US private equity giant KKR is snapping up an Aim stock called Smart Metering Systems (LSE:SMS) for £1.3 billion. Takeover gossip has revived in Throgmorton Street with retailer Halfords Group (LSE:HFD) among the rumoured targets.

Carrell argues the political background could help our home-grown equities. “The prospect of an election before the end of the year is driving expectations of tax cuts,” he says. “We may even get two budgets and in the current political climate fiscal responsibility just does not seem to be on the agenda.”

Rob Burdett at Columbia Threadneedle shares Carrell’s enthusiasm for UK equities. He is raising his score from seven to eight. “There is now much talk of a UK-specific ISA for shares and there are also signs of pension fund money returning to UK equities after the dramatic withdrawal in recent years,” he says.

- Funds and trusts four professionals are buying and selling: Q1 2024

- Interest rate fund and trust losers stage a recovery – but will it last?

It would be comforting to claim that the two other panel members, David Coombs of Rathbones and Max Macmillan at abrdn, support this optimistic view of the UK equity market. But this is not the case. Coombs has gone underweight the UK again in lowering his score to four (with five a neutral score), while Macmillan keeps his score at a lowly three.

The pros are divided on US stock market

At heart, the difference of opinion centres on the outlook for the US economy. While Schroders predicts 2% growth for the US this year and a so-called soft landing, both Coombs and Macmillan fear a recession.

And even Burdett sounds a note of caution: “Expectations are for lower interest rates and lower inflation this year,” he says. “But there is so much geopolitical tension that nobody can quite trust it. There could be a lot of volatility.”

Burdett has therefore hedged his bets a little. He is trimming some profits from the recent good run in the bond markets - scores in all three categories are down from eight to seven. At the same time, he is increasing exposure in UK and European equities while maintaining his enthusiasm for Japanese equities with a score of nine. His stance on Japan has been fully justified of late where the main index has (in local currency terms) gained nearly 40% in the past year. And Japan remains the most highly rated equity sector for the panel with an average score of 6.5.

Burdett argues: “We believe it is a major beneficiary of de-globalisation. In some instances, it is now becoming cheaper to make things in Japan than in China, and it has the advantage of being a political ally of the US whereas China is not.”

- This market is the most obvious contrarian bet right now

- Income investing: do ‘cheap’ UK shares trump going global?

On US equities, Burdett keeps his score at four. “I don’t want to be too underweight there,” he says. “It is undoubtedly the world’s best economy but it is just a little bit pricey for me and the presidential election is as unpredictable as Donald Trump’s hair!”

In our last asset allocation survey in October, Coombs was the only panel member to remain overweight on Wall Street. The S&P 500 ended the year up more than 20%, while the Nasdaq finished almost 40% higher. Coombs’ investment portfolio includes US tech giants Microsoft Corp (NASDAQ:MSFT), Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN) and Alphabet Inc Class A (NASDAQ:GOOGL) (Google).

While he is keeping faith with US equities for the time being, he is raising his cash holdings and trimming back not only in the UK share market but also in emerging markets, European equities and even in Japan.

Caution prevails due to recession risk

He balances that out by going even more heavily into both UK and global bonds with scores up from eight to nine. “Overall, I am a bit more cautious going into 2024,” he says. “There is room for disappointment and at current levels equities are not cheap. We have more exposure to government bonds than we have ever had before.”

Macmillan remains the most bearish member of the panel in his outlook for equities in 2024. He has tweaked up his score for Japan from five to six, but stays underweight US, European and UK equities. “I remain very cautious on equity risk because of probable disappointment about a soft landing for the economy and the risk of a recession,” he says.

Macmillian adds: “We are really talking about interest rate cuts following a reduction in inflation, but we are not really talking about a resumption of economic growth.” He remains overweight in government bonds.

- Fund Spotlight: a fresh approach to quality-growth investing

- How to find winning stocks during a cost-of-living crisis

The most favoured asset allocation sector three months ago was the UK bond market (gilts) where the average score was 7.5. This time around it is Global Bonds with an average score of 7.25, and where all panel members remain firmly overweight on the hopes of further interest rate cuts this year.

The one note of caution comes from Schroders’ Carrell who has gone underweight UK bonds - lowering the score from six to four. It is based on his belief that inflation in the UK is likely to remain higher than in either the US or in the eurozone.

He argues: “Current yields on gilts do not give you much protection if inflation does prove to be sticky. With tax cuts in prospect ahead of the election, I find it hard to be particularly positive on gilts.”

The pros still going for gold

Only Burdett is making positive noises about the property sector where he believes the market already knows all the bad news. But Macmillan thinks any recovery in property “will have to wait until the end of this economic cycle and for growth to recover at the beginning of the next cycle”.

Property retains the wooden spoon status with the panel as the least-favoured sector.

The recent strength of the gold price has prompted some modest profit taking in the yellow metal by Burdett and Macmillan. Carrell has an initial score of six for gold. “We expect quite a lot of interest rate cuts in the coming months,” Carrell says, “and that will make gold more attractive while the geopolitical scene does look very volatile this year.”

There is a broadly positive consensus among the panel members on the gold price but no such general agreement either on European equities or emerging market equities.

Macmillan scores only a two for European shares as he fears even lower interest rates will not be enough to trigger a recovery. But Burdett believes the eurozone is already bouncing back and boosts his score from five to six.

Lack of consensus also features in the emerging markets sector. On the one hand, Carrell gives the sector an 8 - his highest score for any sector - while Coombs has cut his score from five to three as part of a general reduction in equities exposure everywhere except the US.

Carrell argues: “There are huge divergences in valuations in emerging markets and I see a lot of scope for switching investments between regions and countries.”

Note: The scorecard is a snapshot of views for the first quarter of 2024. How the panellists’ views have changed since the fourth quarter of 2023: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent. Dorian Carrell has replaced Keith Wade as a panellist.

Panellist profiles

Rob Burdett is head of multi-manager solutions at Columbia Threadneedle Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.