US shares to put in your ISA in 2024

America gives UK investors access to some of the best companies in the world and sectors not available over here. Overseas investing expert Rodney Hobson urges us to spread our wings with these buying opportunities.

20th March 2024 08:52

by Rodney Hobson from interactive investor

If it’s March, it must be time to start panicking about unused ISA allowances. The first thing to remember is that it is not necessary to make in haste any actual share purchases that may be regretted at leisure. It is enough to get any spare available cash into the wrapper before 6 April. Second, vow not to leave decisions to the last minute in the next financial year. The sooner you start to invest, the sooner you start to earn money.

If you are a frequent trader, it is best to put your active trades into your ISA and avoid paying capital gains tax. But if you are a long-term investor looking to maximise income from dividends, look for solid dividend payers so you can minimise income tax.

- Invest with ii: Open an ISA | Buying US Shares in UK ISA | Transfer a Stocks & Shares ISA

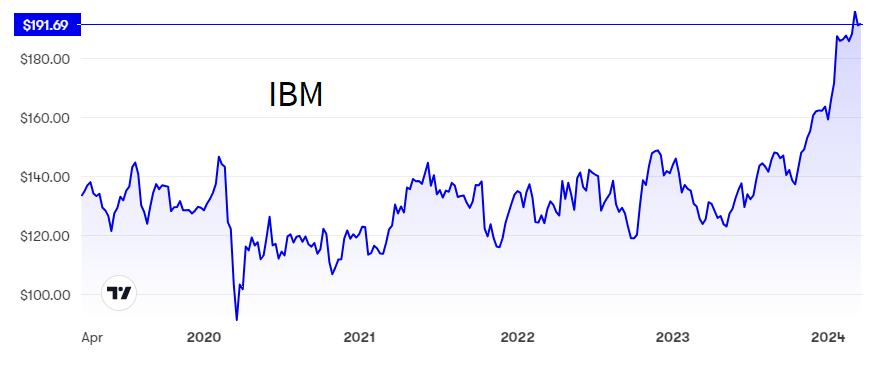

International Business Machines Corp (NYSE:IBM) is one such possibility. It has a finger in just about every IT pie, selling software, hardware and consulting in 175 countries. It manages 90% of all credit card transactions and about half of all wireless connections.

Last year IBM saw profits bounce from an artificially low $1.2 billion in 2022 to $8.7 billion, with revenue edging higher, from $60.5 billion to $61.9 billion, alongside strong cash flow.

What is particularly encouraging is that revenue grew in all parts of the business in the final quarter, driven by cloud computing and artificial intelligence, the two big IT developments of the moment. Demand from clients for AI is said to be accelerating, with some products doubling in sales from the third to the fourth quarter.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- What you can learn from how ISA millionaires made their fortunes

- Will ‘Electric Eleven’ stocks outshine the Magnificent Seven?

The company expects revenue to continue to grow in mid-single digits, which does not look at all unachievable. Cash flow is projected to reach an impressive $12 billion.

The shares are up from $120 last May to around $190 now but the yield is still 3.5%, not bad for a company of this quality.

Source: interactive investor. Past performance is not a guide to future performance.

The banking sector is always worth considering for an ISA, although yields for some American finance companies are only moderately attractive. Citigroup Inc (NYSE:C) stands out with a yield of 3.65%, as does Morgan Stanley (NYSE:MS) where the figure is a fraction higher, while The Goldman Sachs Group Inc (NYSE:GS) is just a little way behind at 2.8%.

As Graeme Evans reported in an enlightening article on dividend payments, banks gave a great boost to dividend payments last year.

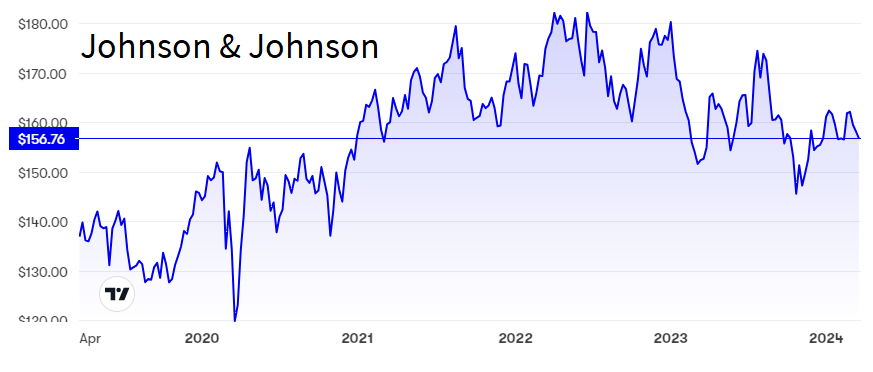

As Johnson & Johnson (NYSE:JNJ) enjoys the ranking of being the world’s largest and most diverse healthcare firm, it should continue to benefit from the ageing population in wealthier nations. Its solid earnings and yield around 3% should underpin the share price despite a solid-looking ceiling at $165, just a few dollars above the current price.

Source: interactive investor. Past performance is not a guide to future performance.

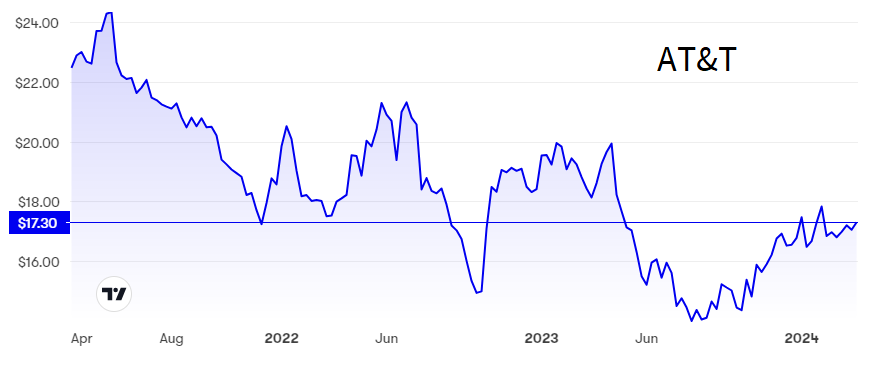

It is always wise to be cautious of companies whose yield has strayed above 6%, but telecoms company AT&T Inc (NYSE:T) returned to profitability and cash generation last year after a difficult end to 2022. Further progress looks likely this year.

Source: interactive investor. Past performance is not a guide to future performance.

The imminent demise of the oil industry has been forecast for at least a quarter of a century, but it continues to thrive. The decision of Opec and linked producers to continue to restrict supply will probably mean demand rising above supply later this year, thus underpinning the price of crude.

Chevron Corp (NYSE:CVX) shares have slipped well back from a peak near $190 in November but the price is underpinned by a yield of nearly 4%, making this a potentially attractive purchase for those who disregard ethical considerations.

Similar arguments apply to Exxon Mobil Corp (NYSE:XOM). Although the shares have risen by about 25% from January’s low point, the yield is still a reasonable if slightly less attractive 3.3%.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.