Still life in this successful share tip

Results published this month were enough to propel one of America’s 20 biggest companies to new highs. Analyst Rodney Hobson explains why he still likes it. There’s also an update on Tesla.

29th October 2025 08:42

by Rodney Hobson from interactive investor

There was much to celebrate whenJohnson & Johnson (NYSE:JNJ)produced quarterly results. A splitting off of the orthopaedics business is potentially the best bit but it will not be a disaster if J&J hangs on to what is after all a big earner.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Sales at the healthcare company rose strongly by 6.8% to $24 billion in the three months to the end of September, prompting a modest upgrade of guidance for the full year to 3.5-4% against the previous range of 3.2-3.7%.

Profits rose more than sales, which is always a good sign, although the headline figure of a 91% leap in net earnings was distorted by one-offs. The underlying rise of 16% to $2.7 billion was impressive enough, though. Margins were improved by a 26% reduction in spending on research and development.

Another good sign was that growth came across the board, with both arms of the business, innovative medicine and MedTech, keeping pace with the overall growth in sales.

Earnings per share are still set to grow 8.7% to around $10.85 and, although that guidance was not upgraded after the latest figures, it does look easily achievable, with the risk on the upside.

The biggest announcement, though, was a declaration of intent to spin off the orthopaedics business into what will be called DePuy Synthes at some time in the next 18 to 24 months. While J&J stresses that there is no guarantee this will happen, we can assume that it will.

- Stock market bull run – a third year of stellar annual returns?

- ii Tech Focus: Applied Digital, IONQ, Nebius, Amazon, Alphabet

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Namal Nawana, former chief executive of British medical device manufacturer Smith & Nephew (LSE:SN.), has already been recruited to take charge of what will be the largest company of its kind in the world, with sales approaching $10 billion a year. He has already set up a privately owned platform to develop consumer diagnostic technologies and would not be looking to take over at DePuy Synthes if he was not sure it was a done deal.

The reorganisation, although possibly disruptive, does make sense, allowing the separated companies to concentrate on what they do best. It is, however, too much to hope that this will at last signal the end of the continuous restructuring of the business that has gone on since the $21 billion takeover of Swiss-based Synthes in 2012, a mega-deal that the latest proposal effectively unwinds.

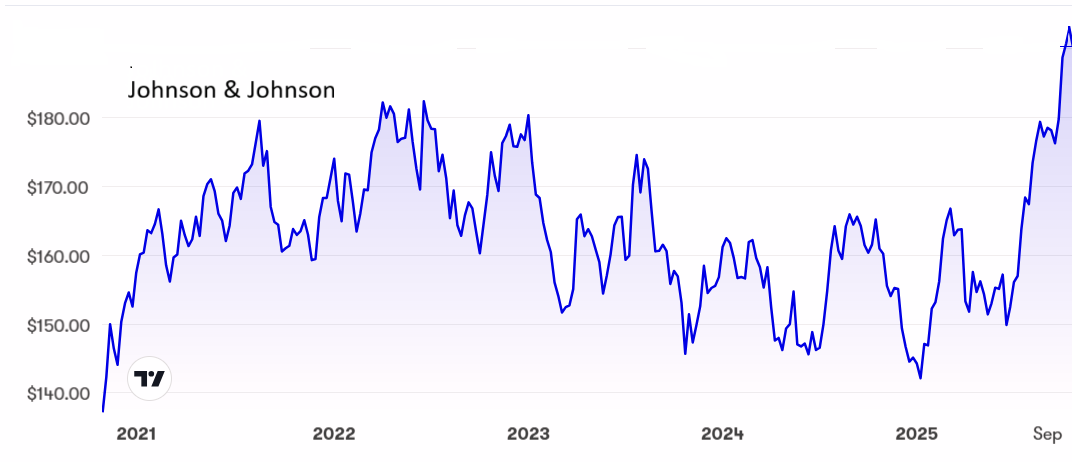

Source: interactive investor. Past performance is not a guide to future performance.

J&J shares have at last broken the $180 ceiling and pushed ahead to $190, where the price/earnings (PE) ratio is undemanding at 18.4 and there is a yield of 2.7%.

Hobson’s choice: I have rated the shares a buy several times, most recently in February when I lamented that the share price seemed stuck at $155. The best chance has now gone but the shares still rate a buy.

Update: At the risk of getting boring, it has to be said again: money invested in Tesla Inc (NASDAQ:TSLA) shares is as dead as a battery on an electric vehicle that has been driven beyond its range. Net income slumped 37% to $1.37 billion in the three months to September as Tesla continued to struggle.

It is true that revenue rose 12% to $28.1 billion, beating most forecasts, but in the end it is profits that count, and those did fall short of expectations. Ominously, production declined by 5% to fewer than 450,000 vehicles, with even production of the much-hyped Model 3/Y production slipping. While sales rose in the quarter, investors should bear in mind reports of collapsing sales in various markets over many months this year.

- Goldman doesn’t see an AI bubble, but the pattern does look…familiar

- ii view: P&G on track in challenging times

Tesla claims it is still focused on “long-term growth” and “value creation” but it admits that it is difficult to assess the impact of global trade and economic issues on its sales, on energy supply and on supply chains. The company is shifting its emphasis to AI products, thus substituting one cash-absorbing energy-intensive line of business for another.

Yet the shares have again been pushing up against a well-established ceiling around $460, where the PE ratio is a staggering 300. Yes, that figure is correct. I have not added an extra zero by mistake. Needless to say, there is no dividend and no prospect of one. And shareholders are locked in with a quixotic owner who is a law unto himself and who is demanding a pay package of up to $1 trillion. Sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.