Stockopedia: 10 mid-cap high flyers leading the FTSE 250

The ‘quality and momentum’ investment style can help spot strong shares, but not without risks.

13th January 2021 15:04

by Ben Hobson from Stockopedia

The ‘quality and momentum’ investment style can help spot strong shares, but not without risks.

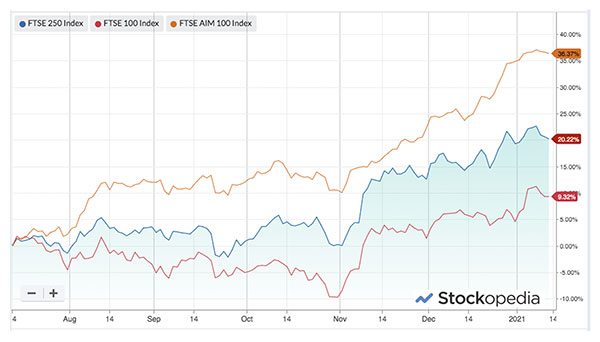

Looking back at some of the trends in UK shares last year, it’s clear that speculative, smaller stocks were some of the biggest winners overall. By comparison, the economic devastation of Covid-19 and uncertainty over Brexit pegged back larger indices such as the FTSE 100 and FTSE 250. But there are signs that a change is under way, and that middle-sized stocks in particular are picking up the pace.

Much of 2020 was a year to forget for the FTSE 250. As an index that sits between large blue-chips and smaller growth shares, it drifted through much of the year. But last November there was notable change of gear among the mid-sized stocks - suggesting that the market was starting to take more of an interest. In fact, over six months the FTSE 250 is now up by 20.2% against the FTSE 100, which has managed just 9.3%.

The FTSE 250 often gets labelled a ‘bellwether’ of the UK economy. Its revenues aren’t quite as strongly exposed to international markets as those in the FTSE 100. But equally, its stocks aren’t as vulnerable as you might find in the FTSE Small Cap or AIM indices. And when you look at some of the individual mid-sized company share performances over the past six months, there have been some impressive gains. But how should you approach this index?

One option is to use an investment style that’s worked very well in small and mid-sized shares in recent years: quality and momentum (Q&M). Exposure to a combination of both solid financial health, and positive price and earnings trends is a strategy that can detect some of the strongest shares in the market.

They’re the ones with solid balance sheets and robust business models that have a habit of surprising to the upside. The market loves them - and sometimes their valuations can stretch. But in a period when value has been out of favour as a consistent factor, quality and momentum have proved very powerful.

Strong shares on the move

The hallmarks of a high Q&M strategy is that it’ll often direct you to profitable, popular names. It will help you avoid ‘story stocks’ and value traps and also keep you away from shares that are unloved and underperforming.

The risk of using momentum in any strategy is that it can reverse when the market gets spooked. But the quality element of this strategy helps to provide some insulation from that risk.

Here is a snapshot of UK FTSE 250 mid-sized companies with the highest overall exposure to quality and momentum right now - based on calculations and rankings of financial and technical measures right across the market (from zero (poor) to 100 (excellent). The risk ratings are an indication of the share price volatility of each share, which in this list ranges from speculative to balanced.

Name | Mkt Cap £m | Quality + Momentum Rank | P/E Ratio | Risk Rating | Sector |

2,682 | 99 | 20.0 | Adventurous | Technology | |

1,212 | 99 | 8.66 | Speculative | Financials | |

3,229 | 99 | 13.5 | Balanced | Financials | |

3,430 | 99 | 17.6 | Balanced | Industrials | |

2,950 | 98 | 28.7 | Adventurous | Industrials | |

997.4 | 98 | 29.9 | Adventurous | Industrials | |

1,111 | 98 | 31.6 | Adventurous | Technology | |

1,936 | 98 | 61.5 | Speculative | Technology | |

2,025 | 98 | 5.83 | Speculative | Basic Materials | |

1,369 | 97 | 40.1 | Speculative | Technology |

There is a strong technology theme in these top Q+M shares, with companies like Computacenter, Oxford Instruments, AO World and Kainos all scoring well - and all operating in different industry areas.

- 10 high-quality shares on the AIM market

- Are you saving enough for retirement? Our calculator can help you find out

Others, such as the financial trading platforms CMC and IG, are clues to the strong price and earnings trends of online trading firms in volatile conditions. There is also a solid base of industrial stocks here, including shares such as IMI, Rotork and XP Power.

Clues to outperformance

Quality and momentum are two very influential drivers of stock market profits. Used in tandem, they can be a pointer to stocks that are worth taking a closer look at. In recent years, this strategy has been successful, but it doesn’t come without risk. Quality can deteriorate and momentum can reverse suddenly. So it’s important to do your research and be wary when momentum causes valuations to become very stretched.

But in the search for mid-sized companies that might be able to capitalise on the very early signs of an improving outlook, this could be an approach worth thinking about.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.