Stockopedia: top-quality FTSE shares that bounce back from turmoil

These stocks have defensive models that can deliver long-term returns.

18th November 2020 14:11

by Ben Hobson from Stockopedia

Some of the best stocks have defensive models that can deliver shareholder returns over the long term.

The prospect of a long-awaited Covid-19 vaccine has boosted stock-market prices over the past week. But, as many investors will know, the main FTSE indices are still way off the levels seen before the March crash. The FTSE 350 index of the UK’s largest quoted companies is down by 14.7% on where it started 2020.

For those trying to position their portfolios this year, one of the biggest questions has been about the sectors that can hold up best in such uncertain economic conditions. Where travel, hospitality, construction and some retail stocks and sectors have come under pressure, others have done better. Namely defensives, precious metals, pharmaceuticals and some technology industries.

But while sector exposure is an important issue in portfolio construction, there have been other important factors that have defined some of the best performing shares this year.

One of those is financial and business quality - and one of the clearest views we’ve had of that is with stocks that have signs of strong competitive advantages - or competitive ‘moats’.

- Stockopedia: 10 value stocks on the move

- Stockopedia: 10 FTSE 350 stocks where dividends are bouncing back

In his book, The Little Book that Builds Wealth, Pat Dorsey, a fund manager and former Morningstar analyst, explained the appeal of these features.

He said:

“The company with the moat is worth more today because it will generate economic profits for a longer stretch of time. When you buy shares of the company with the moat, you’re buying a stream of cashflows that is protected from competition for many years. It’s like paying more for a car that you can drive for a decade versus a clunker that’s likely to conk out in a few years.”

Competitive moats take many forms, and we have often explored them in these articles in the past. It could be that a business sets itself apart by offering low costs or has powerful brands (or patents).

It could be sheer size and scale in areas like manufacturing and distribution that make it hard to compete with. Or it could just be too costly or undesirable for customers to switch to other companies. Equally, some services have a network effect, where they become more valuable as more and more people use them.

Searching for durable companies

Understanding what makes a business highly competitive can take a lot of qualitative analysis. But often, the first clue to a high-quality company like this can be found in its financials. Here’s a checklist of quality measures that can help in this search:

- High rates of free cash flow - the measure of a thriving company.

- High return on capital employed (ROCE) - the measure of a company growing efficiently and profitably.

- A five-year average ROCE of more than 12%- a pointer to strong efficiency.

- High return on equity (compared to peers) - the measure of a company making good profits from its assets.

- High operating margins (compared to peers) - the measure of a company with pricing power.

With these profitability measures in mind, this week’s Stockopedia screen puts them to work to get an idea of which FTSE 350 stocks are the most profitable. The results are sorted by ROCE, because it’s a useful initial starting point in the search for profitability and efficiency.

- Stockopedia: 10 beaten up large-caps showing signs of recovery

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The table also includes the forecast price to earnings (PE) ratio of these stocks, to give an idea of how much investors are having to pay for them.

| Name | Forecast PE Ratio | FCF/ Sales % | ROCE % 5y Avg | ROE % 5y Avg | Op Mgn % 5y Avg | Relative Price Strength 1y |

|---|---|---|---|---|---|---|

| Rightmove (LSE:RMV) | 33.3 | 57.6 | 1,233 | 1,407 | 73.2 | 17.1 |

| Plus500 (LSE:PLUS) | 8.18 | 57.8 | 116.7 | 98.2 | 55.4 | 122.4 |

| Hargreaves Lansdown (LSE:HL.) | 31.3 | 45.3 | 74.6 | 66.6 | 64.1 | 3.59 |

| Games Workshop (LSE:GAW) | 28.8 | 29.6 | 61.1 | 56.8 | 27.4 | 91 |

| Moneysupermarket (LSE:MONY) | 17.7 | 24.4 | 48.8 | 44 | 29.4 | -16.2 |

| Auto Trader (LSE:AUTO) | 29.6 | 52.5 | 58.1 | 163.3 | 66.7 | 16.6 |

| Ashmore (LSE:ASHM) | 17 | 59 | 23.3 | 21.4 | 64.6 | -3.15 |

| Victrex (LSE:VCT) | 24.2 | 21.4 | 24.1 | 22.1 | 38.7 | -2.05 |

| Next (LSE:NXT) | 18.4 | 22.5 | 47 | 155.3 | 20 | 13.6 |

| Ashtead (LSE:AHT) | 21.3 | 21.4 | 15.3 | 28.4 | 26.4 | 52 |

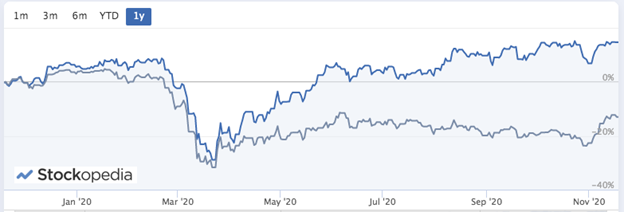

One of the notable points of this table is that the majority of these higher quality FTSE 350 names have outperformed the FTSE by a considerable distance over the past year. Indeed, taken as a simulated portfolio, you can see that they would have produced a solid return this year (up 14.9%).

Past performance is not a guide to future performance

Among the best performers on the list have been names like Plus500 (LSE:PLUS), Games Workshop (LSE:GAW), Ashtead (LSE:AHT) and Rightmove (LSE:RMV).

While no single strategy will guarantee consistency, higher quality, competitive names show signs of having rebounded strongly on average this year.

It is worth remembering that highly profitable stocks can end up with expensive valuations that put them out of reach of investors with an eye for value. But even so, what we’ve seen this year is that some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.