Stockwatch: a FTSE 100 share in the early stages of a bull market

It’s underperformed its closest rival in the blue-chip index over the long term but has had a great 12 months. Analyst Edmond Jackon thinks the good times might only have just begun.

3rd May 2024 11:12

by Edmond Jackson from interactive investor

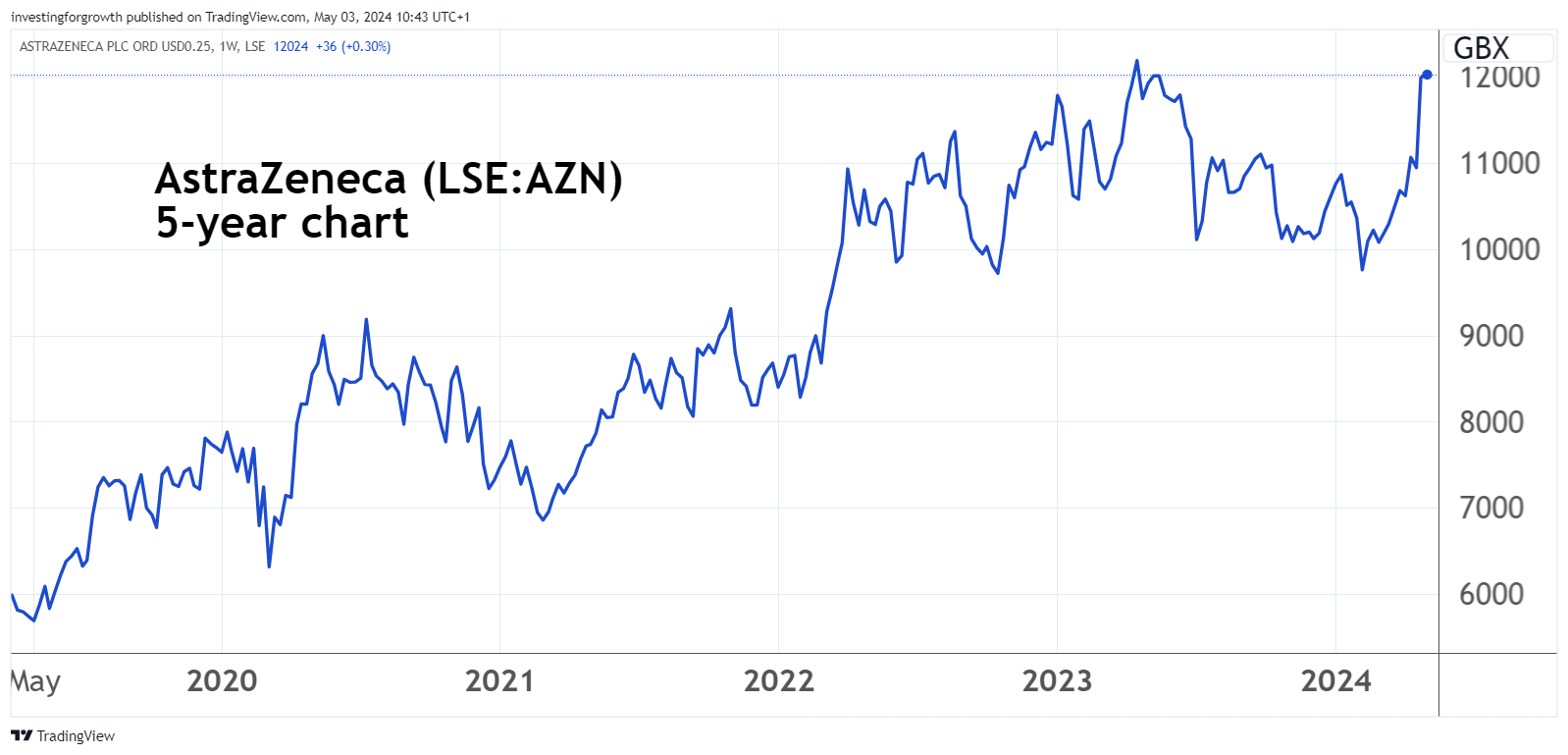

Is GSK (LSE:GSK) leapfrogging AstraZeneca (LSE:AZN) for share price performance and prospects, or does Astra have overall better vigour?

Some long-term context is useful to appreciate the underlying corporate and market valuation dynamics. Also, how a multi-year view is appropriate to exact the best returns.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

AstraZeneca affirms a modest PE, high-yield approach

I drew attention to Astra as a long-term “buy” originally in April 2012 at around 2,700p equivalent when it offered a 7% yield twice covered by earnings, and a forward price/earnings (PE) multiple easing below eight times. Remarkably, looking back, the PE was at a 45% discount to the rating for what was then called GlaxoSmithKline.

Versus this cautious investor sentiment, Astra’s drugs pipeline had 79 projects in clinical development and a further seven approved or launched. I therefore suggested: “The balance of progress could weigh in Astra’s favour in due course, at which point the low PE and high yield combination means the shares would re-rate...”

As an investment principle, this could apply to any industry sector, although pharmaceuticals are especially useful given the pace of medical science and resilient government expenditure on health globally. As and when the risk/reward is attractive, they merit a place in a diversified portfolio.

Astra began to rise but it took five years to truly embark on a bull run, and the various projects to fully bear fruit.

Source: TradingView. Past performance is not a guide to future performance.

You see this vigour maintained in Astra’s news flow last month, including a stream of approvals for treatments with wide applications. First quarter 2024 results showed (at constant currency) a 19% surge in revenue, with “core” earnings per share (EPS) up 13% and by 30% at the reported level.

Not only is the existing business performing very well, but Astra says: “our strong pipeline momentum continued and already this year we announced positive trial results...that were unprecedented in lung cancer...we are also looking forward to seeing the results of several other important trials throughout the year.”

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- ii view: AstraZeneca extends shares rally after cancer drugs boost

Over a month, all this has sent Astra shares up 20% to 12,170p, an all-time high - representing a forward PE more like 18x and a 2% yield.

Not surprisingly, some profit-taking has crept in – the shares are down to 12,050p this morning. The rating is a modest premium to “core” earnings per share (and revenue) guided at low teens to low double-digit growth. You can see a status change from a classic “value” type rating to “growth” with an element of expectation. It would take quite a major setback to stall this, but Astra is well-diversified to cope, hence: Hold.

AstraZeneca - financial summary

Year ended 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover - $ million | 23,002 | 22,465 | 22,090 | 24,384 | 26,617 | 37,417 | 44,351 | 45,811 |

| Operating margin - % | 21.3 | 16.4 | 15.3 | 12.0 | 19.4 | 2.8 | 8.5 | 17.9 |

| Operating profit - $m | 4,902 | 3,677 | 3,387 | 2,924 | 5,162 | 1,056 | 3,757 | 8,193 |

| Net profit - $m | 3,499 | 3,001 | 2,155 | 1,335 | 3,196 | 112 | 3,288 | 5,955 |

| Reported EPS - cents | 276 | 188 | 170 | 103 | 243 | 7.9 | 211 | 381 |

| Normalised EPS - cents | 252 | 137 | 85.4 | 149 | 189 | 277 | 353 | 341 |

| Cash flow/share - cents | 327 | 282 | 207 | 228 | 365 | 418 | 629 | 662 |

| Capex/share - cents | 183 | 128 | 108 | 189 | 198 | 154 | 165 | 242 |

| Free cash flow/share - cents | 145 | 155 | 98.4 | 39 | 167 | 264 | 464 | 420 |

| Dividend/share - cents | 270 | 274 | 275 | 289 | 283 | 284 | 289 | 290 |

| Earnings cover - x | 1.0 | 0.7 | 0.6 | 0.4 | 0.9 | 0.0 | 0.7 | 1.3 |

| Return on capital - % | 10.4 | 7.8 | 7.6 | 6.8 | 11.1 | 1.3 | 5.4 | 11.6 |

| Cash - $m | 5,902 | 4,554 | 5,680 | 6,218 | 7,992 | 6,398 | 6,405 | 5,962 |

| Net debt - $m | 10,906 | 13,253 | 13,433 | 12,009 | 12,388 | 24,383 | 22,827 | 22,660 |

| Net assets/share - cents | 1,174 | 1,181 | 984 | 1,000 | 1,190 | 2,534 | 2,390 | 2,525 |

Source: historic company REFS and company accounts.

Is there broad potential for GSK bull market?

I cite this 12-year context on Astra given a sense of parallel with my “buy” case for GSK on 2 January at 1,450p when I explained “why GSK now fits the bill for a sound inexpensive investment”. The forward PE rating was a modest 9.3x and prospective yield 4.2% with 2.6x earnings cover and free cash flow trending strongly. It was partly because investors remained sceptical about what a new CEO since April 2017 was achieving, amid somewhat erratic financial performance:

GSK - financial summary

Year-end 31 Dec

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 27,889 | 30,186 | 30,821 | 33,754 | 24,354 | 24,696 | 29,324 | 30,328 |

| Operating margin (%) | 9.3 | 13.9 | 17.8 | 20.6 | 24.6 | 17.5 | 21.9 | 22.2 |

| Operating profit (£m) | 2,598 | 4,181 | 5,486 | 6,961 | 5,979 | 4,321 | 6,433 | 6,746 |

| Net profit (£m) | 912.0 | 1,532.0 | 3,623 | 4,645 | 5,749 | 4,385 | 14,956 | 4,928 |

| EPS - reported (p) | 23.3 | 66.0 | 88.0 | 116 | 111 | 69.2 | 104 | 120 |

| EPS - normalised (p) | 40.9 | 118 | 107 | 169 | 78.9 | 68.1 | 114 | 140 |

| Operating cashflow/share (p) | 165 | 175 | 212 | 200 | 209 | 196 | 181 | 165 |

| Capital expenditure/share (p) | 59.9 | 55.7 | 45.2 | 53.9 | 55.6 | 72.3 | 55.3 | 57.0 |

| Free cashflow/share (p) | 105 | 119 | 167 | 146 | 154 | 124 | 126 | 108 |

| Dividends per share (p) | 80.0 | 100 | 100 | 100 | 100 | 100 | 61.3 | 58.0 |

| Covered by earnings (x) | 0.5 | 0.7 | 0.9 | 1.2 | 1.1 | 0.7 | 1.7 | 2.1 |

| Return on total capital (%) | 6.5 | 14.0 | 15.4 | 12.5 | 10.3 | 7.8 | 17.2 | 17.8 |

| Cash (£m) | 4,986 | 3,911 | 3,958 | 4,786 | 6,370 | 4,335 | 7,877 | 4,992 |

| Net debt (£m) | 13,804 | 13,178 | 22,106 | 25,722 | 20,780 | 19,838 | 13,110 | 13,026 |

| Net assets (£m) | 1,124 | -68.0 | 4,360 | 11,405 | 14,587 | 15,055 | 10,598 | 13,347 |

| Net assets per share (p) | 28.6 | -1.7 | 111 | 288 | 363 | 374 | 263 | 329 |

Source: historic company REFS and company accounts.

There has also been concern about US litigation over cancer risks with Zantac after this heartburn drug was withdrawn in 2019, and is why there are occasional announcements of “undisclosed settlements without accepting liability”. In the US state of Delaware, for example, some 70,000 cases are filed against various drugs companies, although in 2022 a Florida court dismissed some 50,000 claims as not supported by sound science. A trial now under way in Chicago is the first attempt to persuade a jury after all previous cases were settled or dropped.

I am reminded of this ongoing risk, although tend to regard it as the proverbial “wall of worry” a bull market can climb and which has contributed to a modest valuation versus GSK’s rising underlying momentum.

During January, the stock benefited initially from investors rotating from highly rated “growth”, then from February came a stream of positive news on different drugs. Last Wednesday provided a financial sense of it all: first-quarter revenue ex-Covid medicines was up 13% in context of total sales up 10%. Guidance for 2024 was raised (since the 31 January annual results): revenue goes to the upperend of a 5-7% range, “core” operating profit to 9-11% from 7-10%; and core EPS growth of 8-10% from 6-9%.

- GSK extends share price rally after very healthy results

- The hidden beneficiaries of the weight-loss drug boom

The shares have since risen around 4% to test 1,740p – continuing to rise this morning, versus profit-taking in Astra. The forward normalised PE looks around 10x and prospective yield 3.4% based on guidance for a 60p per share dividend in respect of 2024.

Again, like Astra, the rating is now roughly in line with earnings growth, but the market is starting to sense underlying momentum potentially for further upgrades in the medium to longer term.

GSK is yet to break out in chart terms; this marks the fifth sharp rally in over a decade after which it has fallen back each time. Strictly, break-out would be past the 1,820p level achieved in 2020, although that high was exceptional due to Covid boosting the sector.

Source: TradingView. Past performance is not a guide to future performance.

Adjusting for Covid’s boost in the 2022 results, consensus for £6.4 billion net profit (due upgrade) this year and £7.2 billion in 2025 certainly does mark operational break-out.

Mind, this is on a “normalised” basis. There is a “contingent liability charge” that GSK does not adequately explain in a forest of pharmaceutical detail; a key depressant on the reported income statement is a £533 million “other operating expense” which had been £297 million a year before. There is also a £152 million charge which includes “significant legal”, possibly litigation settlements over Zantac.

It shows a sentiment shift, how investors are prepared to focus on revenue dynamics despite the differential between £2,443 million “core” operating profit and £1,490 million at the reported level which is 28% down like-for-like. It meant like-for-like first-quarter operating profit fell 28% from £2,082 million to £1,490 million and earnings per share from 37.0p to 25.7p.

- Stockwatch: does this spectacular bull run have further to go?

- 10 hottest ISA shares, funds and trusts: week ended 26 April 2024

Net debt continues to fall, from £17.2 billion at the end of 2022 to just below £15 billion currently, helped by selling down shares in Haleon HLN which was de-merged. This still leaves net gearing at around 109% versus 68% for Astra, based on its £20.3 million equivalent net debt.

Operational progress means I believe GSK is now in the early stage of a bull market. Be aware of the Zantac liabilities continuing to smoulder, where the market now sees little chance of fire. Hold or buy a drop.

Valuations remain modest versus US peers

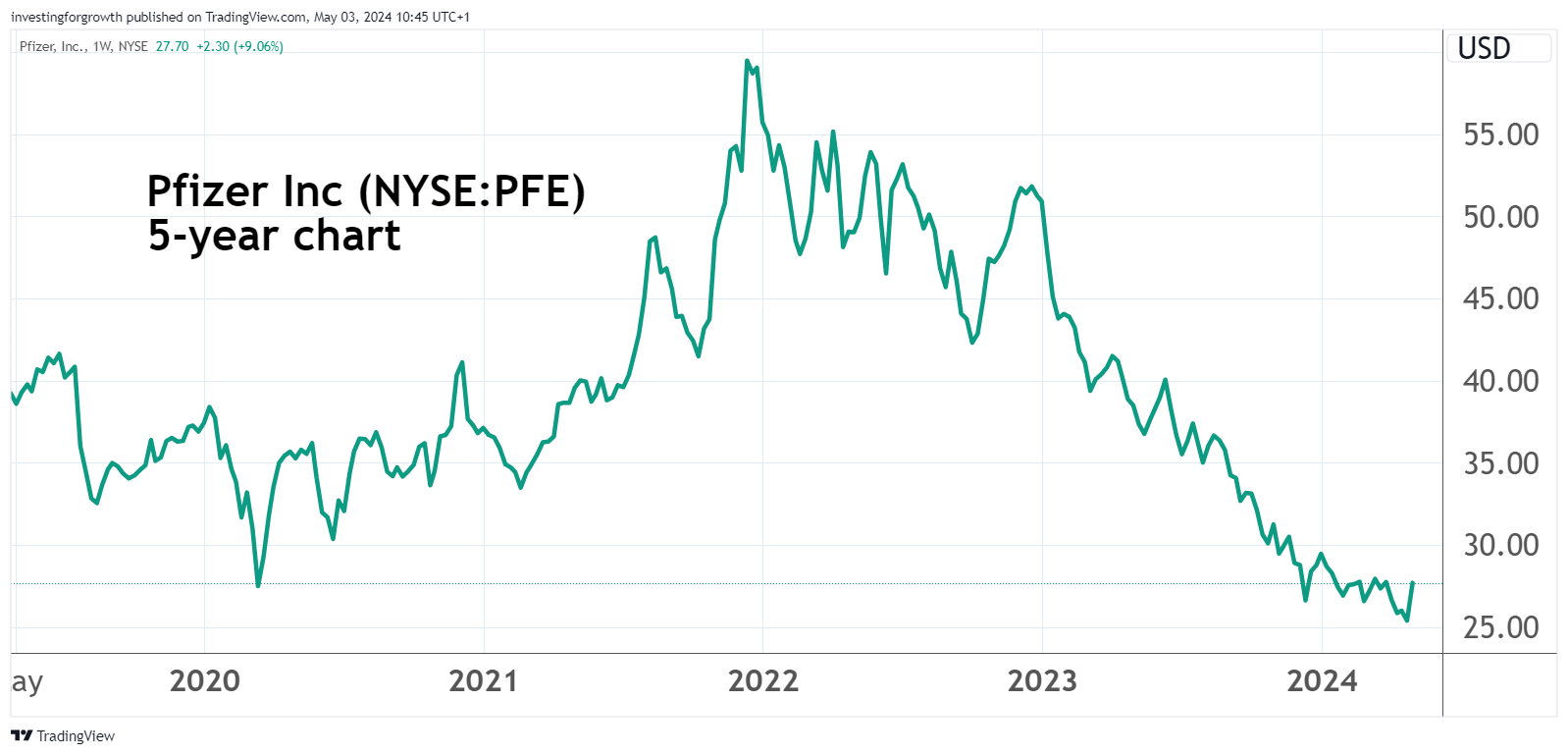

Johnson & Johnson (NYSE:JNJ) enjoys a trailing PE above 22x and prospective yield just over 3%. Pfizer Inc (NYSE:PFE) looks to be on a PE of around 15x but interestingly it sports an attractive yield above 6%.

Perhaps Pfizer is another example of an unloved big pharma stock with long-term potential for status change. It jumped 7% Wednesday after beating first-quarter revenue expectations versus caution that Pfizer is without any near-term “blockbuster” drugs, and with Covid vaccines waning. Mind, it is also caught up in Zantac litigation.

The stock is up from a $26 low a week or so ago but still down around 30% over the last year. While the downtrend could represent mean-reversion after the exceptional boost from Covid, the recent $43 billion acquisition of Seagen provides opportunities for new product launches.

Source: TradingView. Past performance is not a guide to future performance.

Pfizer also faces patent expiries on some of its biggest drugs. I have not had time to assess all this in context of a $157 billion (£125 billion) company, to derive a rating. Yet it could potentially be a “buy” and is relevant to compare with Astra and GSK.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.