Stockwatch: takeover bids imply stock market in recovery mode

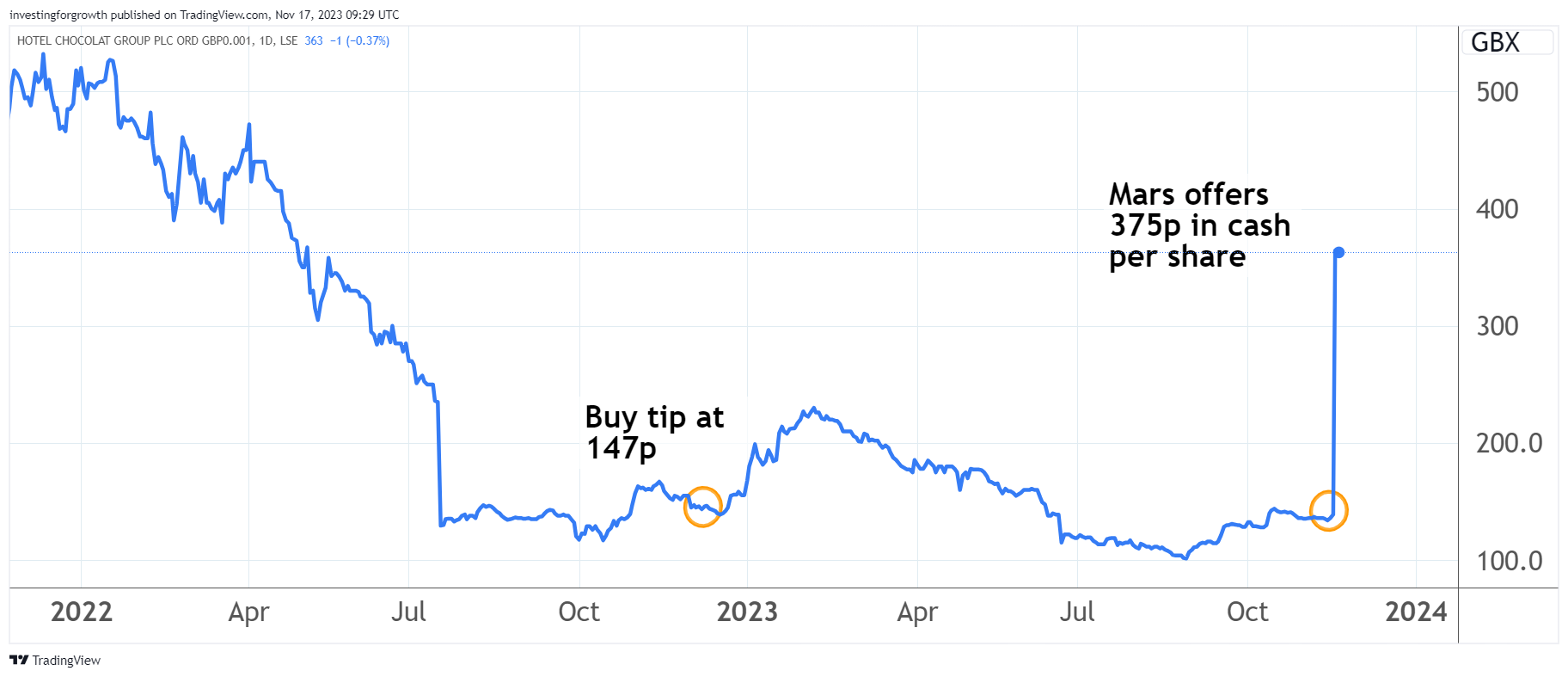

Mars is paying a massive premium for Hotel Chocolat, netting equity analyst Edmond Jackson a 155% profit on his tip. Here’s what he thinks about the UK takeover boom and the likelihood of further deals.

17th November 2023 10:41

by Edmond Jackson from interactive investor

A takeover trend is manifestly under way, at least at the smaller end of the market where modest valuations appeal to larger companies to achieve useful strategic bolt-ons.

There are various positive upshots. First, how larger companies are confident to do this at all when forecasts sway between the UK being in a stagflation or deflation trap. It implies their finances are in good order. Second, just look at the premiums being paid – far over the basic sense of “20% for control”, which implies material misevaluation in terms of “worth to a private owner”, the benchmark for genuine value investing according to Benjamin Graham, 20th-century dean of the art.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Relative to 2023 stock prices, car dealer Lookers is on the way out at a circa 65% premium, furniture retailer ScS Group (LSE:SCS) at 70%, and yesterday heralded news of City Pub Group (The) (LSE:CPC) attracting a bid at a 50% premium to its market value. But retailer Hotel Chocolat Group (LSE:HOTC) tops the lot, going for a whopping 170% premium.

The macro upshot, I believe, is acquirers positioning themselves for medium-term economic recovery – despite near-term recessionary risks. In stock chart terms, and if more bids materialise, it will support indices such that if there’s no wave of profit warnings going into 2024, technical analysts will talk more of a market low having passed.

This has potential to conflate with positive sentiment about how interest rates have peaked, hence investors might consider re-positioning portfolios to engage more risk.

Although in examples such as SCS and Hotel Chocolat, the takeovers look motivated by microeconomic – company specific – reasons, of gaining benefits from integration. It is still of macro relevance, though, how bidders want to get on with this, as if they should not push their luck for stock values to remain lower for longer.

Hotel Chocolat - financial summary

Year-end 2 July

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 105 | 116 | 132 | 136 | 136 | 167 | 226 | 205 |

| Operating margin (%) | 11.3 | 11.4 | 10.8 | -4.4 | -4.4 | 4.6 | -2.9 | -1.9 |

| Operating profit (£m) | 11.9 | 13.2 | 14.3 | -6.0 | -6.0 | 7.7 | -6.6 | -4.0 |

| Net profit (£m) | 8.8 | 10.0 | 10.9 | 7.5 | -6.5 | 3.7 | -9.4 | -6.2 |

| EPS - reported (p) | 9.8 | 8.8 | 9.5 | -6.4 | -5.5 | 2.9 | -6.9 | -4.5 |

| EPS - normalised (p) | 7.8 | 9.0 | 9.6 | 9.6 | 0.4 | 6.5 | 11.7 | -4.5 |

| Operating cashflow/share (p) | 9.8 | 10.8 | 16.5 | 19.4 | 19.4 | 12.1 | 6.8 | 11.2 |

| Capital expenditure/share (p) | 7.4 | 10.3 | 7.7 | 12.1 | 12.1 | 16.0 | 18.9 | 7.5 |

| Free cashflow/share (p) | 2.4 | 0.5 | 8.8 | 7.3 | 7.3 | -3.9 | -12.1 | 3.7 |

| Dividends per share (p) | 0.0 | 1.7 | 1.8 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings (x) | 0.0 | 5.2 | 5.3 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Return on total capital (%) | 31.9 | 30.7 | 27.0 | -5.8 | -5.8 | 7.8 | -4.5 | -3.0 |

| Cash (£m) | 8.5 | 0.2 | 5.8 | 28.1 | 28.1 | 10.0 | 17.6 | 11.2 |

| Net debt (£m) | -1.6 | 0.0 | -5.8 | 18.9 | 18.9 | 30.2 | 37.0 | 38.8 |

| Net assets (£m) | 31.2 | 39.6 | 39.6 | 49.3 | 67.0 | 65.8 | 98.4 | 93.5 |

| Net assets per share (p) | 27.6 | 35.1 | 35.1 | 43.7 | 53.4 | 52.3 | 71.6 | 68.0 |

Source: company accounts

Mars motivated by Hotel Chocolat’s quality international brand

To anyone familiar with modern standards of American chocolate, it is hardly surprising Mars has popped up saying it has long-admired product quality of this British firm founded in 1993.

The deal’s logic is partnering with a multinational’s global reach. Remember Hotel Chocolat ran into the classic mishap of smaller London-listed companies trying to expand abroad – in particular, America, where five shops had to be closed.

It also therefore rings true how British “design” has needed American marketing and supply-chain capability to fully extract value, and where Mars is willing already to pay a substantial premium at £534 million, or 375p a share.

I drew attention as a “buy” at 147p last December following the after late publication of Hotel’s annual results to late June. (The excuse was £30 million one-off costs and adjusting items, plus some re-statements for the 2021 year). A normalised net profit near £14 million still flagged a decent-quality business, and its international brand could be attractive to acquire and weak sterling empowered multinationals.

Stake-building by Phoenix Asset Management and Odey Asset Management’s special situations fund affirmed my hunch. And this at a time when the listed sausage-skin maker Devro was being bought by a European group.

Source: TradingView. Past performance is not a guide to future performance.

City Pubs will bolster Young’s growth prospects

The rationale, as set out by Young & Co's Brewery Class A (LSE:YNGA), is to take advantage of “a rare opportunity to acquire a high-quality pub and bedroom portfolio of scale, allowing Young’s to increase its pubs by over 20% and bedrooms over 25%”.

Taking out head office costs and applying purchasing synergies looks like it will improve margins, and both companies have a similar culture offering customers quality experiences in London and the South East.

City Pub’s rationale for selling out is also relevant. They say expansion has become compromised as the economy adjusts to higher interest rates, group head office costs are relatively high, and costs generally have risen. All that in addition to the imposition of duty and business rates taxes.

- Stockwatch: is this speculative tipple to your taste?

- Stockwatch: can UK retail sector withstand fall in money supply?

Essential economics of remaining a smaller listed company are thus compromised – at least in this segment – which needs bearing in mind for those remaining independent It’s also a reason why takeovers like this will continue.

Young’s interim results are sound but need stimulus

Simultaneously declaring its half-year numbers to 2 October, management billed them as “a record performance with a proven strategy delivering industry-leading profitability”.

True, adjusted pre-tax profit rose 12% to £28 million and, although like-for-like revenue was below 4%, there was a strong comparator. However, this is set against generally bland dynamics and valuation criteria demanding better.

Reported net profit is down 9% to £17 million, not helped by a rise in the tax charge. Net operational cash flow has fallen 25% to £34 million and October cash has plunged from £39 million below £1 million, given £39 million was invested during the period, £6 million was handed out in dividends and the group paid down debt/leases.

Young & Co's Brewery - financial summary

Year end 30 Mar

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 227 | 246 | 269 | 279 | 204 | 312 | 90.6 | 309 | 369 |

| Operating profit (£m) | 41.5 | 38.4 | 42.7 | 43.5 | 44.6 | 37.9 | -35.1 | 51.7 | 43.4 |

| Operating margin (%) | 18.3 | 15.6 | 15.9 | 15.6 | 14.7 | 12.2 | -38.7 | 16.7 | 11.8 |

| Net profit (£m) | 26.7 | 26.6 | 30.0 | 30.1 | 31.5 | 19.3 | -38.3 | 34.4 | 29.7 |

| Reported earnings/share (p) | 55.1 | 54.7 | 61.5 | 61.6 | 64.3 | 39.3 | -68.2 | 42.6 | 50.7 |

| Normalised earnings/share (p) | 42.7 | 59.0 | 68.6 | 69.3 | 72.5 | 53.6 | -143 | 25.0 | 64.2 |

| Operating cashflow/share (p) | 89.8 | 108 | 115 | 107 | 122 | 120 | -41.0 | 174 | 142 |

| Capital expenditure/share (p) | 66.9 | 85.6 | 70.7 | 62.2 | 69.2 | 67.1 | 34.0 | 63.1 | 68.7 |

| Free cashflow/share (p) | 22.9 | 22.6 | 43.9 | 44.8 | 53.3 | 53.2 | -75.0 | 111 | 72.9 |

| Dividend per share (p) | 16.5 | 17.5 | 18.5 | 19.6 | 10.0 | 21.4 | 0.0 | 18.8 | 20.5 |

| Covered by earnings (x) | 3.4 | 3.1 | 3.3 | 3.1 | 6.5 | 1.8 | 0.0 | 2.3 | 2.5 |

| Cash (£m) | 0.2 | 13.2 | 6.6 | 7.2 | 8.5 | 1.1 | 4.7 | 34.0 | 10.7 |

| Net debt (£m) | 129 | 130 | 127 | 141 | 164.0 | 280 | 249 | 174 | 165 |

| Net assets (£m) | 407 | 453 | 493 | 549 | 593 | 591 | 645 | 700 | 724 |

| Net assets per share (p) | 840 | 930 | 1010 | 1124 | 1212 | 1205 | 1,104 | 1,197 | 1,238 |

Source: historic company REFS and company accounts

In such a context, Young’s funding for the deal needs explaining – rather than just declare a cash and shares-based offer, which implies debt must rise from around £100 million (before £177 million lease liabilities, including those deferred).

I can see operationally why the interim payout is rising 6% to near 11p a share, although you could say this may end up being paid with extra debt – in the near term anyway. If consensus on the annual dividend is delivered on – for 21p rising to over 22p in respect of April 2025 – then the prospective yield is around 2% covered three times by expected earnings.

This is nothing special for income, meanwhile the 12-month forward price/earnings (PE) ratio is close to 30 times. What rescues Young’s valuation is a market price of 1,110p being an 11% discount to net asset value (NAV) of 1,250p a share – where only 4% constitutes intangibles and NAV has risen 3% over a year.

- Richard Beddard: a new score for my top 10 company

- Share Sleuth: better to buy high-quality firms amid recession fears

So, the stock is sound but unexciting and, despite news on the acquisition, it was unchanged yesterday, even at a heavy price – as if investors have quite lost interest. Young’s does therefore rather need this deal.

Its outlook statement cites the last six weeks trading up 5.8% or by 3.3% like-for-like, helped by the Rugby World Cup. Two freehold acquisitions have completed and ongoing investment means several major schemes will complete over coming months.

Mind, it concludes on a note of uncertainty for consumer sentiment, especially “the significant impact of further rail strikes” on trade in the lead up to the festive period.

Young’s did very well post 2008 but costs were lower

Lest you find me negative, I would cite how the company defied fears operationally – if benefiting from exposure to relatively affluent customers – because it met essential social needs. British people keep eating and drinking out, and perhaps Young’s benefited as some traded down from restaurants, similarly as Wetherspoon (J D) (LSE:JDW) has lately enjoyed a boost from people seeking cheaper prices.

From around 400p at end-2008, Young’s achieved a long consistent bull market to highs over 1,800p in May 2019 before suffering Covid disruption, and then expectations of higher interest rates since mid-2021. The latter wiped out a speculative premium above Young’s circa 1,200p, net asset value, returning the stock to a modest discount that is more typical of those property-related firms over the long run.

While I drew attention to Young’s as a “buy” at around 600p in November 2012, costs for pub operators were lower back then. I would want to see how the annual accounts pan out and whether the group is adding to debt, before rating it such again. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.