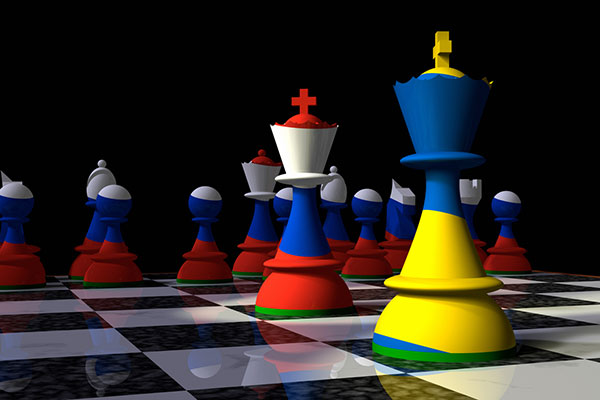

Stockwatch: what could Ukraine invasion mean for investors?

21st January 2022 11:00

by Edmond Jackson from interactive investor

Uncertainty abounds, but some sectors seem set to do well out of what could be a perfect storm ahead, says our companies analyst.

Yesterday morning, I parsed RNS announcements for worthwhile material, after another plunge in US indices reminded me how risky high US stock valuations are as the Federal Reserve attempts to tighten monetary policy.

Construction group Kier (LSE:KIE) was an interesting follow-through to my piece on Tuesday. Its update says it is coping with inflationary pressures (at least for now), hence expectations for its six months’ trading to end-December 2021 will be met.

The order book affirms my gut sense that civil construction and the like should benefit from state spending as the Tories try to deliver on ‘levelling up’. But without specifics on ‘coping with inflation’ it was impossible to quantify variables as to whether Kier might constitute a ‘buy'.

- 27 dividend stocks for income seekers in 2022

- Stockwatch: exciting times for these two shares

- Where to invest in Q1 2022? Four experts have their say

Meanwhile, radio voices in the background maintained the British media’s obsession with unseating Boris Johnson. But all such noise is small beer compared with the imminent prospect of Russia kicking back against NATO’s eastern expansion since German reunification.

Investors need to consider possible scenarios, which I think at a minimum will involve still higher oil and gas prices.

Last chance for diplomatic breakthrough

US and Russian foreign ministers meet in Geneva today, after recent talks seemed only to result in positions hardening. The crux is the West’s refusal to concede to Russia’s demand that Ukraine should never be admitted to NATO.

Each side accuses the other of expansionism, although looking back to 1990 it does seem Russia was given assurances against the spread of NATO; since when 14 new members have joined in Eastern Europe, including several countries of the former Soviet Union. While we view all such developments as the result of democratic choices, Russia sees an ever-expanding Western sphere of influence.

Ukraine’s significance is clear from President Vladimir Putin’s July 2021 essay, On the Historical Unity of Russians and Ukrainians. This leaves no doubt that he sees Ukraine as a buttress against Western Europe. He also supported the 2015 Minsk II settlement, which aimed to end fighting in the Donbas area of south-eastern Ukraine that flanks Russia, although Ukraine’s government was unwilling to do so.

Russia is therefore most unlikely to retreat without some form of concession; but the West seems unlikely to budge much for fear of repeating 1930s appeasement.

Meanwhile, its window for military action closes after mid-February because tanks would get bogged down as the ground thaws. The likely game plan would seem to involve air strikes as a first initiative, given that Russia has massive air superiority; then a ground campaign, the extent of which is impossible to predict.

But Ukraine capitulated to peace deals in 2014 and 2015 after Russian incursion, and Moscow may consider it can topple what it sees as a Western client government in Kiev.

Oil & gas prices will likely continue to soar

Europe derives around 25% of its oil and 40% of its gas from Russia.

Despite rises that expose businesses and consumers to considerable inflation, they could go much higher in the short term – not least because hedge funds will sense a momentum trade.

OPEC must then seriously get its act together to raise output, or it will face a big hit to medium-term demand as the global economy suffers.

Other commodities – such as aluminium and titanium – are also involved, which illustrate the difficulty of applying tough sanctions without damaging Western economies.

Dilemma for central banks facing rate rises

‘Hopefully’ the effects of higher oil and gas prices, by reducing economic activity, would be deflationary enough to moderate any further need to curb inflation. But the risks of stagflation seem to be increasing if interest rates rise according to recent guidance.

This Ukraine crisis could disrupt a delicate balance of sentiment in regard to high US equity valuations, whereby investors currently assume several very slight rate increases will be enough to bring inflation back towards central banks’ 2% target.

Federal Reserve chair Jerome Powell has only just recently testified that the US Fed would resume stimulus in the event of a recession – which is a possibility if war in Ukraine becomes extended or even triggers wider hostilities.

In that case, investors could be right to assume the Fed will once again ‘protect their backs’ should equities destabilise, to help mitigate a negative wealth effect on the economy.

- What other investors are reading right now

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Defensive investments already making headway

In recent pieces, I have argued why oil & gas exploration, production and service companies should be an investment priority, and also banks, given that rising interest rates benefit their business models. British American Tobacco (LSE:BATS) was also a choice pick over Imperial Brands (LSE:IMB) because of its superiority in new products. Finally, 2022 could be the year investors recognise the circa 8% yields offered in these tobacco stocks.

Care is needed to assume “success” from the first three weeks of a new year, when stocks also traditionally perform well in January. But these three sectors and the stocks discussed have been relatively strong performers despite no fresh news from the companies.

This testifies to the significance of thematic shifts in the market towards higher energy prices and interest rates, and also following the “out of technology, into value” meme that is lifting tobacco despite its unethical status. At this stage, bear in mind how sensitive financial stocks can be to a major shift in market sentiment, should the Ukrainian situation deteriorate.

The weeks ahead will also be a test of “safe haven” assets such as precious metals (equities) and more recently cryptocurrencies.

Don’t underestimate Russia

The sense is of Russia being a relative economic pygmy, unable to sustain the costs of a major invasion. Biden threatens to unleash economic sanctions of a kind Putin has never seen.

But sanctions since 2014 have fostered domestic independence, such that Russia is now estimated to have over $620 billion equivalent in total foreign currency reserves. Strength in oil & gas prices is projected to boost its sovereign wealth fund from near $200 billion cash over $300 billion by 2024.

Conservative fiscal policy also means that government debt as a percentage of GDP is only around 20% and foreign corporate debt has halved since 2014. Few international investors own Russian government bonds.

- Watch our share, fund and trust tips, plus outlook videos for 2022

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Russia is therefore in quite a strong position to withstand further sanctions. As Ukraine develops military strength, Moscow may recognise an argument it will cost less financially (and fewer lives) to act now instead of later.

A very different prospect compared to Iraq

In 1991 and 2003, US military technology swiftly knocked out weaker foes in Iraq. In the run-up to military action, stocks fell and oil & gas prices rose, only to revert. Investors who tried to second-guess market events typically got whipsawed compared with those who took no action or bought the drop.

This time around, however, key Western nations say they do not intend to get sucked into conflict beyond supplying Ukraine with arms and training. In military terms, Russia will therefore dominate. A gas supply dilemma could end up persisting and embed higher costs in Europe.

It seems a pretty big hope that the Fed can ride to the rescue yet again. As inflation soars, the one certainty ahead is that we’ll hear plenty more about a ‘perfect storm’.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.