Stockwatch: what to do with Shell and Sainsbury’s shares

After a reality check for income seekers, our analyst gives his opinion on these fallen dividend stars.

1st May 2020 10:39

by Edmond Jackson from interactive investor

After a reality check for income seekers, our analyst gives his opinion on these fallen dividend stars.

Chartists say the FTSE 100 index has re-entered bull market territory, passing 6,000 for the first time in seven weeks. I say it is driven by central bank liquidity actions boosting demand for risk assets, and a fear of missing out (FOMO).

Investors who honed their skills in post-2008 'Fed-managed' markets are imbued to buy dips, and every time the US Federal Reserve supports them.

Retreated bears say a reality check of companies’ reporting – especially second-quarter results to be published this summer – will blow away the Alice-In-Wonderland valuations we see, particularly among FAANG stocks where US market gains are most focused.

I am pessimistic on the actual numbers for GDP and corporate losses, but optimistic that the market could see through them if countries’ attempts to ease lockdowns can happen without boosting Covid-19 re-infection – the 'R' value that must be kept below 1.

Germany in focus, yet America is the crux

Its experience looks worrying despite having attracted praise for dealing systematically with the virus. Since making tentative steps to ease lockdown, Germany’s R number has reportedly edged up from 0.7 in mid-April to about 1.0, hence people being urged to stay at home. Although another report I saw – from the Robert Kock Institute – on Thursday, puts R at 0.75.

We need to watch Germany carefully over the next two to three weeks, as to whether there is hope for restarting economies. Meanwhile, optimists can take heart that Australia’s situation looks encouraging – for now.

Yet the US is the crux, both for this pandemic and for global markets. Despite the US death toll expected to keep climbing in weeks ahead – already a third of cases worldwide – its federal government has eased restrictions this week. President Trump’s son-in-law and adviser says the US will be back to normal in June and “rocking” in July.

It looks a binary outcome: either Trump’s zeal to get America working will get affirmed or a medical chaos ensues, prolonging economic slump and compromising the impact of support measures if people’s lives get badly disrupted.

The mood could turn against Trump – also Prime Minister Boris Johnson here – if people end up feeling these optimists have led them down the garden path. Can Boris temper his bravado if the sterner reality is a long struggle ahead?

Mind rising costs for food retailers

On a classic measure of fundamental investment value – dividend capability – this week’s news of three prime FTSE 100 'defensive' companies slashing dividends is perturbing. Apologists say it is only prudent in the circumstances for Morrisons (LSE:MRW)Sainsbury's (LSE:SBRY) and Royal Dutch Shell (LSE:RDSB), but is a reminder how the net effects of this pandemic are damaging for investors – versus the Fed-induced global rally.

Food retail has been judged reliable for investment returns, especially while eating out is impossible during lockdown and, even come any easing, the over-50s are now being told to stay home.

With social distancing likely required until a vaccine is available, and smaller confined shops potentially worrying to frequent, big supermarkets should (excuse the pun) be on a roll.

Yet Sainsbury’s has instead revealed a £500 million annual hit due to social distancing measures plus falls in clothing and fuel sales, offsetting the recent surge in grocery trade.

I also picked up in a radio interview a quarter of staff are currently off-duty, and I notice in my own shopping that the chronic gaps on some Sainsbury’s shelves have led me to rivals.

You have to figure out who has got what according to your needs, which can disrupt regular patronage.

- FTSE 100 dividend stars step in after Shell and Sainsbury’s shockers

- A checklist for finding dividend shares in a crisis

So, and despite £450 million business rates relief, Sainsbury’s underlying profit is guided as broadly flat for the year to March 2021 (before what bad stuff can be rated as exceptional). There is a political angle, with the Sainsbury’s board wanting to avoid the criticism that Tesco (LSE:TSCO) generated when it paid £635 million to shareholders, because it can be construed as being propped up by taxpayers.

I didn’t anticipate the cost hit: my reason for being wary of the food retailer rally in the second fortnight of March was this becoming a momentum trap once realities of excess industry capacity/competition resume.

Such buying was more a thematic trade than long-term investment, although some brokers were promoting food retail as medium-term defensive.

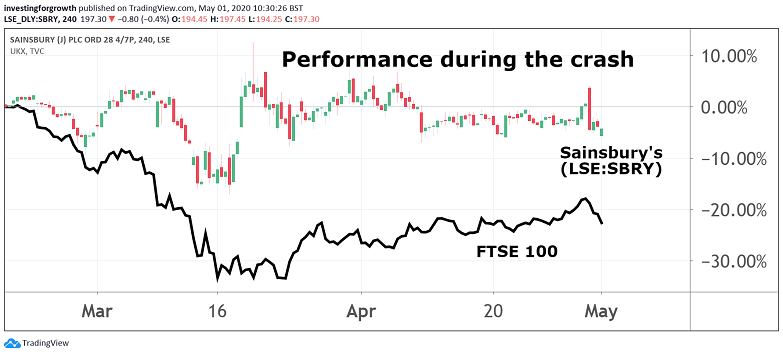

In response, Sainsbury’s shares have dipped only 5% or so to about 195p which is median a sideways’ range over the last year.

I wouldn’t dispute a Hold stance on this and other food retailers if you already do, but this episode implies assumptions be humble rather than strident amid Covid-19.

Source: TradingView Past performance is not a guide to future performance

Shell affirms bears on fundamentals of the real economy

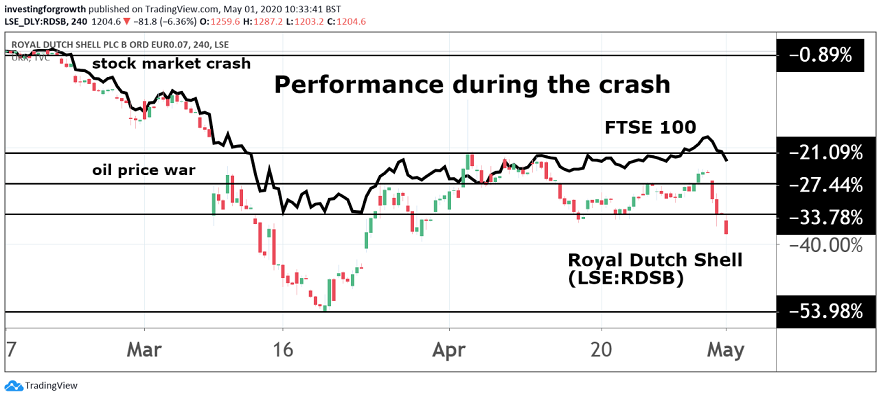

Royal Dutch Shell is the second big reality check. Describing a contrarian 'buy' rationale on 17 March at around £10 a share, after this year’s plunge from over £22, I was very aware of the risks to cash flow from much lower oil prices.

The board had guided for $28-33 billion of free cash flow this year albeit based on $65 a barrel oil. An annual dividend of around 155p per share costs just over $15 billion.

Apparently, Shell needs $30 oil to be profitable, hence the current $20 range implies payouts would be reliant on debt. My hope that Shell could find ways to muddle through was based on industry-wide cuts to production in the months ahead, sowing seeds for a sharp rebound in prices – oil traders and hedge funds leading the way – at the earliest signs of economic recovery.

This would imply a V-shaped prospect for oil prices even if economies perform a rather distorted U.

- Royal Dutch Shell deals massive blow to income investors

- Chart of the week: FTSE 100 could do something spectacular very soon

- Is Shell’s share price rally on borrowed time?

- Oil sector share tips: bargains and dividends after the crash

The extent of crude oil now being stored tempers such a scenario, and Shell’s draconian dividend cut implies wariness that energy demand may not substantially recover for years. Effectively this subscribes to the second or third of three scenarios for the global economy: a V-shaped recovery; or U-shaped with whatever length of trough you care to speculate on; or one where demand is permanently impaired.

Combine that with kicks from Greta’s boot and world leaders demanding green investment, and Shell has lost its halo as king-of-yield.

Promoters say, be realistic, a circa 3.5% yield remains good relative to the FTSE 100 and is effectively a reversion to the mean – e.g. yield levels roughly between 1990 and 2005. Yet consider what change has happened to animal spirits within Shell; a company that saw fit to pay a 50% premium (over market price) to acquire BG Group during the late 2015 oil price crash.

| Royal Dutch Shell - financial summary | ||||||

|---|---|---|---|---|---|---|

| year end 31 Dec | ||||||

| reporting in US$ | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover ($ million) | 421,105 | 264,960 | 233,591 | 305,179 | 388,379 | 344,877 |

| Operating margin (%) | 4.7 | -1.2 | 0.4 | 5.3 | 8.7 | 6.7 |

| Operating profit ($m) | 19,891 | -3,218 | 858 | 16,246 | 33,656 | 22,947 |

| Net profit ($m) | 14,874 | 1,939 | 4,575 | 12,977 | 23,352 | 15,843 |

| Reported EPS (cents) | 2.36 | 0.30 | 0.58 | 1.58 | 2.80 | 1.95 |

| Normalised EPS (cents) | 2.09 | 0.70 | 0.58 | 1.95 | 2.41 | 2.34 |

| Price/earnings multiple (x) | 5.4 | |||||

| Op. Cashflow/share ($) | 7.14 | 4.66 | 2.61 | 4.56 | 6.36 | 5.20 |

| Capex/share ($) | 5.05 | 4.09 | 2.80 | 2.66 | 2.76 | 2.83 |

| Free cashflow/share ($) | 2.09 | 0.58 | -0.19 | 1.90 | 3.60 | 2.37 |

| Dividend/share ($) | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 | 1.88 |

| Earnings cover (x) | 1.25 | 0.16 | 0.31 | 0.84 | 1.49 | 1.04 |

| Yield (%) | 11.6 | |||||

| Cash ($m) | 21,607 | 31,228 | 18,781 | 20,192 | 26,484 | 78,370 |

| Net debt ($m) | 23,933 | 27,151 | 73,695 | 65,473 | 50,340 | 186,476 |

| Net asset value ($m) | 171,966 | 162,876 | 186,646 | 194,356 | 198,646 | 186,476 |

| Net asset value/share ($) | 27.3 | 25.5 | 22.9 | 23.4 | 24.3 | 23.7 |

| Source: historic Company REFS and company accounts |

Continued drop reflects disillusioned selling

Broker reaction to Shell appears near-universally “buy this latest drop” (after a rebound from 916p to near £15 in early April), although it is unclear whether they were promoters when the stock traded at over £20 during the last four years, hence are mentally “vested”.

Thursday’s trading pattern implied investors taking a more cautious view; there being enough intra-day selling to take price down from Wednesday’s £14.50 to close at £12.86. The fall continued this morning to below £12.20. Stock markets have fallen also, but yesterday the international benchmark of Brent crude jumped around 10%.

Source: TradingView Past performance is not a guide to future performance

So, I expect quite a tussle of sentiment, with the balance tipping to sellers in the short run. Some investors will be disillusioned, Shell’s yield is no longer anything special, moreover its story remains substantially 'dirty' – not to the extent of tobacco, where British American Tobacco (LSE:BATS) yields 7.3% and is even working on a plant-based Covid-19 cure.

Others will take the view that oil & gas will remain essential to the global economy and, once we are through the worst of this pandemic, oil prices will at least recover to enable progressive dividends. The near-term equilibrium price will therefore depend where these views balance out, for supply versus demand.

On a behavioural finance view, I think 'sell' is overly harsh unless you fancy the likes of BAT. Pragmatically, the stress-induced low sub-£10 looks to be in, unless a US medical catastrophe shatters confidence all-round. Broadly therefore: Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.