Stockwatch: What to do with these bombed-out oil stocks?

Risk of equity value being slammed by heavy debts could spread more widely than these two oil stocks.

10th March 2020 12:07

by Edmond Jackson from interactive investor

Risk of equity value being slammed by heavy debts could spread more widely than these two oil stocks.

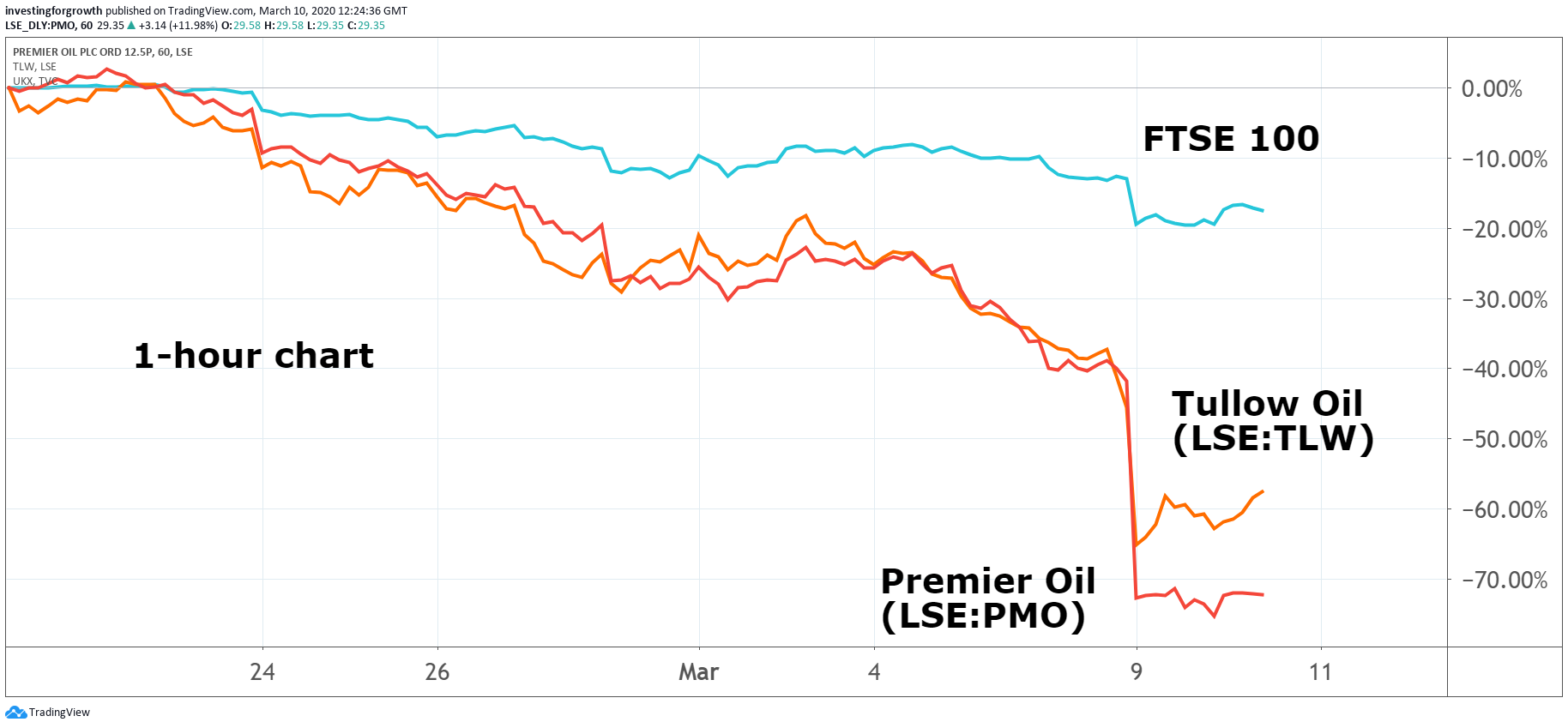

Premier Oil (LSE:PMO) shares hit 10p, first in the mid-1980s and then 1990s. The shares had been on a rollercoaster, with highs of over 100p. Oil price slumps were the chief culprit both times, but 10p has seemed a distant memory for a company you would think, from its project development and acquisitions, has advanced plenty over 30 years. But, after oil prices just fell by nearly a third, Premier and also Tullow Oil (LSE:TLW) touched 10p again.

Some would say it is just history repeating itself like human nature, in markets, and, in drawing attention to both stocks in the last six months, I’ve also noted the ever-present outlier risk – how force majeure very occasionally takes over oil markets, both ways. Read up on George Soros and “reflexivity” if you want to understand how trends get exacerbated.

Source: TradingView Past performance is not a guide to future performance

Losing a basic sense for financial risk management

But the real reason for this extent of plunge – with a modest parallel at BP (BP.) – is the extent of corporate debt. Premier and Tullow epitomise the big flaw – now sudden reconciliation – about how loose monetary policy since the 2008 crisis has encouraged multi-billion liabilities, through whichever currency you perceive them. The general message from profligate borrowers involved “optimising balance sheet structure,” yet those finance directors lost a basic sense of risk to withstand varied scenarios.

One oil analyst has described the current situation as portending “worse than the 1930s” as Covid-19 conflates with a Russia-Saudi Arabia war to halve oil prices. Tullow said last December it needed $60 a barrel to support its cashflow forecasts.

Thirty years or so ago I recall Premier’s finances being relatively conservative, hence, when oil recovered, its equity would reliably shoot up. Yet this time around there’s a sudden fear that creditors will end up calling the shots if oil remains down for any length of time.

Medium-term scenario is very tricky to call

It is impossible to predict when Russia and Saudi might resume negotiations, likewise the extent and longevity of Covid-19 disruption. Russia seems in the relatively stronger position given its national budget is estimated to balance at $42.5 oil, with $570 billion (£436 billion) of international reserves currently, supposedly over 60% higher than during a previous price war. So, President Putin is by no means acting impulsively. It looks as if Russia can sustain a drawn-out battle of price cutting.

- Is the oil price really heading to $15?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

During 2014 to 2015, an oil price slide was interpreted as a boost for the global economy, but if Covid-19 persists to disrupt travel, then the demand side will be compromised. Also, if highly indebted energy companies default (possibly US shale producers first), this could start a tightening of credit conditions generally with the inevitable impact on economies. And, while Asian equities are up today as traders bet these countries will benefit as oil importers, oil producing nations/companies will see lower revenues.

Much also in the demand equation will depend on the extent that America is afflicted by Covid-19 panic and lockdown, given its economy is strongly geared to consumers and services. The dilemma for authorities everywhere is they are damned if they assert lockdown – prioritising public health but slamming businesses – and damned if they don’t, once hospitals run out of beds.

Flirting with status as long-dated stock options

Premier and Tullow shares will thus remain highly volatile, as leveraged plays on oil price shifts. Following a circa 7% recovery in oil prices overnight, Premier is up 17% to just over 30p and Tullow 4% near 17p. They are the most dramatic examples of how high debts can wreck equity value, but it is imperilled at any company where business slowdown coincides with swollen balance sheets.

- Commodities outlook: Buy gold, sell oil?

- Hold, fold or buy? How real investors are reacting to coronavirus

Oil price hedging provides some relief for 2020; the crux being what oil prices will prevail once the hedges run out. From Premier’s 2019 prelims last Thursday, under “Financial risk management” within the financial review, it states how Premier took advantage of improved oil prices at times during 2019 - in a circa $42 to $64 price range - to increase hedging to protect free cashflows and covenant compliances.

Quite what can be negotiated thereafter – where the true risk lies – is anyone’s guess. If Covid-19 largely blows over in three months and Russia/Saudi recognise mutual self-interest, Premier could be out of the woods.

Otherwise, its 2019 numbers were broadly encouraging. Production of 78,400 barrels of oil equivalent a day was at the top end of guidance; profits and cash flow rose, notably free cash flow up 30.3% to $327 million, helping net debt ease 14.6% to $1.99 billion. The operations review read well for development projects and a sale process for an interest offshore Mexico is expected to conclude this year. Were it not for the twin macro hits of early 2020, you would hold or buy any dips.

Tullow has published $60 oil as a key benchmark

A 9 December update cited liquidity headroom over $1 billion and no near-term debt maturities, relative to 2019 interim results showing $2.9 billion net debt as of end-June. Cutting capital expenditure, overheads and operating costs were anticipated to generate at least $150 million at $60 oil after capital investment.

Mercifully, Tullow also declared “no near-term debt maturities” despite having to downgrade production expectations, although a $30 range for oil – if sustained any length of time – throws such reassurances into doubt, also for longer-term hedges when renewed.

Otherwise, and again similarly to Premier, from an operations perspective Tullow had looked stable enough after its share price drop from about 60p in the New Year to a 40-50p area. It has yet to report 2019 results, but a 15 January pre-close update affirmed the downgraded guidance for 2019 oil production averaging 87,700 barrels a day; and in contest of gross profit around $700 million and capital expenditure of $490 million, free cashflow expected is expected at $350 million with net debt reduced to $2.8 billion – implying financial gearing around 2x.

It looked as if Dorothy Thompson, the new executive chair, had a firm grip, and this boosted reason to hold Tullow equity. The key question is whether a dicey macro context will roll positively enough to prove her talent.

A less-than-pretty sight

Despite adequate finances at $60 oil, high debts are now anything but “optimal balance sheet structure,” hence Premier/Tullow are revealed as compromised for 2021 onwards – should oil prices remain de-rated. It is impossible to assert any clear-cut stance. “Events dear boy, events” will dictate the outcome.

I should declare a mental interest and potential bias, following such stocks, given I started investing via Premier Oil after a wave of privatisation stocks, and did very well from it and others – especially from the late 1990s.

Nowadays, I don’t hold, but do genuinely feel I had missed a turning point – likewise in Tullow – last autumn. For a certain generation of investors/analysts, our perspective could be weighted by a sense to buy exploration & production (E&P) stocks when oil prices go into a tailspin. Yet longer-term they may remain market laggards in the lower carbon world ahead. If low oil prices persist, then takeovers will happen as the industry consolidates, albeit potentially at the behest of creditors than shareholders.

In six months’ time, it will be interesting to look back and see whether a simple adage to “be greedy when others are fearful” proved more practical than much analysis. But, where big debts are involved in the current environment, my judgement tips to capital protection. Hang on for now if you already hold, though with fresh money: Avoid.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.