Is the oil price really heading to $15?

Despite a bounce back from Monday’s collapse, this analyst believes the oil price still looks fragile.

10th March 2020 09:21

by Alistair Strang from Trends and Targets

Despite a bounce back from Monday’s collapse, this analyst believes the oil price still looks fragile.

The markets are producing movements never before experienced. We’re more than a little concerned as, despite any possible near-term rebound, an awful lot of triggers were demolished which permit further weakness into the realms of doom.

Brent proved a case in point. Our last report had $39 as “bottom”, a number which was ignored when the market gapped the price down at the open of trade.

Equally, gold is supposed to be a defensive commodity, we’d guess the metal’s density making it useful to hit anyone suspected of carrying Covid-19. Gold, thus far, has avoided making serious panic gains above the $1,700 level. Perhaps toilet paper shall prove to be the new gold if panic buying is a reliable indicator!

The price of Brent is a certain concern, gapped down to open the week at 37.50 dollars. Usually, we’re able to back test this sort of thing in an attempt to find the trend we’d previously missed. Unfortunately, on this occasion, we’re far from comfortable as crude dropped further than we’d normally expect, now residing in a region with some pretty dire drop potentials.

- Commodities outlook: Buy gold, sell oil?

- Hold, fold or buy? How real investors are reacting to coronavirus

Just over four years ago, Brent hit a market bottom at 27.8 dollars, a number we’d first mooted when it was trading at 107. And, to be honest, while we mentioned the potential, we also ridiculed it, thinking the potential highly improbable. This time, we’re not being as cautious!

The situation now calculates with weakness below 31 dollars allowing reversal to an initial 25 dollars. If (or doubtless, when) broken our secondary works out at a bottom of 15 dollars.

We believe, if 15 dollars ever makes an appearance, Brent must bounce. Several reasons support such a theory. Firstly, since 2016, three quite distinct scenario now allow an eventual bottom of 15 dollars. Secondly, we cannot calculate anything below such a level.

- Commodities outlook: Could oil hit $26 as investors buy gold?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

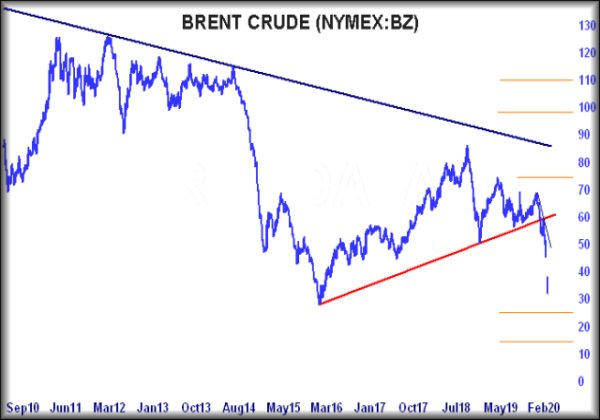

Shown on the chart below is the immediate downtrend, suggesting the product price needs to almost double to once again rejoin prior trends. Perhaps of greater concern should be the proposed target levels, each below the market’s prior disaster level of 27.8 dollars.

The implicit suggestion therefore is the best we can hope is an entirely new trend will develop in the future, one which shall find difficulty taking the product to prior levels.

Unless, of course, something happens in the world and proves able to change the perception of “demand” for crude oil.

Source: Trends and Targets Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.