A strategy to find high-quality companies in the stock market

Stockopedia’s Ben Hobson explains the hallmarks of a quality business and why they make dependable.

15th July 2020 15:08

by Ben Hobson from Stockopedia

Ben Hobson explains the hallmarks of a quality business and why they make dependable investments.

Owning shares in high-quality companies with the power to protect their valuable cashflows from competition is an investment strategy that intuitively makes sense. It’s an approach that has the fingerprints of successful investors like Warren Buffett all over it. But how do you find these shares, and can they really offer protection from the kind of wild volatility we’ve seen this year?

Quality is an all-weather factor that crops up in strategies of all stripes. Value investors, for instance, often rely on company quality as the catalyst that will sooner-or-later trigger a price re-rating. Momentum investors, meanwhile, often view quality as a factor that can help sustain upward price trends. Without quality, these two popular strategies are arguably much less powerful.

Importantly, quality can manifest itself in different ways in different businesses. Classically, so-called moat investors will look for business models that are very well-defended and have loyal customers. This may be because the company has strong, popular brands, or has complicated manufacturing or distribution systems or just that customers find it hard to walk away.

For all these reasons, companies can be very profitable and competitors find it hard to intrude.

So what are the hallmarks of quality and what do they tell you?

Well, long-term profitability is naturally one of the key indicators. And one of the most-popular measures of profitability is to look at how much bang a company gets from the pounds it invests in itself. This is called return on capital employed - or ROCE. A high ROCE, particularly over a long period, can be a pointer to stocks with strong and defensible brands and franchises that can be rolled out very profitably.

A second signpost to strong profitability is the percentage that a company keeps from selling its products after all costs have been deducted, or operating margin. High margins are often a hallmark of companies that can command high prices from their customers and have strong competitive advantages.

Competitive advantage is also something that can be explored by looking at what’s known as return on equity. This is the technical term for comparing a company’s net income to all the cash that investors have put into it. It’s a popular way of comparing the profitability of companies in the same sector. ROE varies from industry-to-industry, but 15% is generally thought to be desirable.

Another check in the hunt for profitability is a ratio called free cash flow to sales. This useful comparison measures the proportion of sales revenues that actually turn into cash after everything else has been paid. Companies are sometimes criticised for producing impressive-looking accounts yet fail to generate hard cash. This cash flow ratio should help to spot them.

Screening for high quality

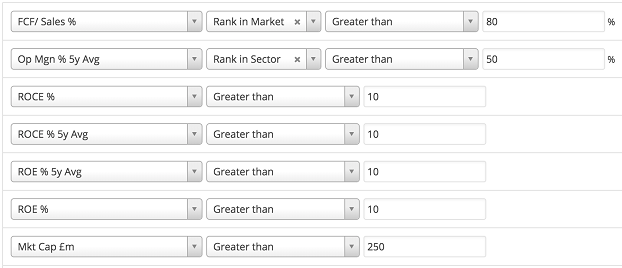

With some of these ideas in mind, we screened the market for companies with a market-cap greater than £250 million using the following rules:

- A minimum average 10% return on capital employed and return on equity over five years

- Companies producing above average operating margins in their respective sectors over five years

- Companies in the top 20 percent of the market based on their percentage of free cash flow to sales

The table includes the current price-to-earnings (PE) ratio and the relative price strength of each share against the market over the past three months and one year.

| Name | Mkt Cap £m | Forecast PE Ratio | FCF/ Sales % | ROCE % | Relative Price Strength 3m | Relative Price Strength 1y |

|---|---|---|---|---|---|---|

| Rightmove (LSE:RMV) | 4,837 | 34.7 | 63.4 | 384.2 | 5.17 | 25.7 |

| PayPoint (LSE:PAY) | 398.9 | 10.4 | 20.2 | 145.5 | -4.46 | -23.2 |

| Games Workshop (LSE:GAW) | 2,724 | 46.2 | 22.2 | 69.3 | 56.3 | 110.2 |

| Auto Trader (LSE:AUTO) | 4,971 | 30.5 | 52.6 | 54.7 | 15.8 | 10.9 |

| Moneysupermarket (LSE:MONY) | 1,564 | 17.6 | 25.4 | 47.8 | -11.4 | -13.3 |

| Fevertree Drinks (LSE:FEVR) | 2,674 | 50.2 | 25.1 | 31.8 | 62.3 | 26.7 |

| iEnergizer (LSE:IBPO) | 443 | 12.4 | 28.5 | 29.9 | 32 | 22.8 |

| RELX (LSE:REL) | 34,553 | 19.1 | 21.7 | 27.4 | -6.12 | 9.83 |

| Integrated Diagnostics Holdings (LSE:IDHC) | 408.8 | 15.7 | 21.5 | 27 | -12.7 | -11.3 |

| Craneware (LSE:CRW) | 450.7 | 32.2 | 20.9 | 26.5 | -20.1 | 7.26 |

Because the rules focus on five-year averages, the companies that pass these rules don’t actually move in and out of the screen results very often. These are consistently some of the market’s higher quality companies - and they come with a range of market-caps and PE ratios: from mega-cap RELX (LSE:REL) to small-cap PayPoint (LSE:PAY).

Not all of them have held up under the market pressure over the past year. But on average, the three-month relative strength of this group has been 11.7%, rising to 16.6% over 12 months. So this small sample gives a hint that a focus on quality can offer at least some protection from volatility. In this case it achieved a very solid return - but that’s not guaranteed.

Overall, good-quality, profitable companies can be some of the most dependable investments in the stock market. While they aren’t immune to setbacks, they can recover quickly. In the investor toolkit there are various ways of measuring that profitability - and they can be used on any occasion to separate those firms that are flattering their figures from those that are genuinely profitable.

It’s worth remembering that high quality stocks can end up with expensive valuations that put them out of reach of investors with an eye for value. But from time to time, even the most popular names go on sale.

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

interactive investor readers can get a free 14-day trial of Stockopedia by clicking here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.