Super Thursday's biggest share price falls

2nd August 2018 12:51

by Graeme Evans from interactive investor

It's been a big week for corporate updates, but there have been some major casualties. Graeme Evans runs through recovery potential for these strugglers.

As is fitting for a Super Thursday, some hefty share price movements have left investors either cursing their luck or eyeing opportunities to tap up undervalued stocks.

Whilst miners were the biggest casualties in the FTSE 100, their losses were modest in comparison to the damage done at Ferrexpo and KAZ Minerals. This mid-cap pair were star performers in 2017 after doubling in value, but that’s now a distant memory as news today has accelerated recent falls.

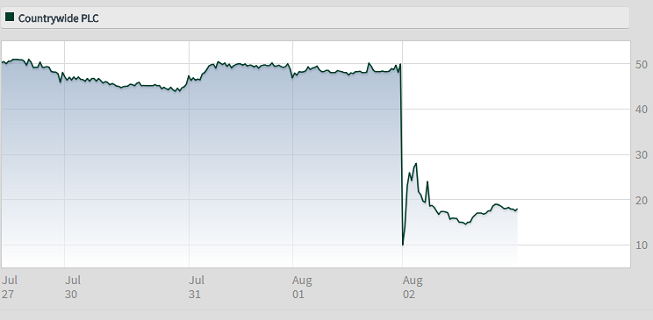

The most troubling story of all came from estate agency business Countrywide, which slid more than 60% after announcing a heavily-discounted equity raising. And among the AIM stocks, there was a big fall for veterinary services group CVS Group.

Turning firstly to the mid-cap miners, KAZ Minerals has put investors in a quandary after its transformational US$900 million deal to buy the Baimskaya copper project in the Chukotka region of Russia.

KAZ describes it as one of the world's most significant undeveloped assets, with the potential to become a large scale and low cost open pit copper mine.

But as the company estimates the capital expenditure needed to achieve this will be in the region of $5.5 billion, investors were spooked by the cost and the challenges involved in its first move into Russia’s Far East.

Shares fell more 20% at one stage to leave the stock where it was last summer. The decline also extends the weakness seen since May, when the Kazakhstan-based company stood above £10 for the first time since 2012.

Source: interactive investor Past performance is not a guide to future performance

Peel Hunt, which had a price target of 1,035p prior to today, estimates the project would require roughly a US$6,800 copper price in order to generate a 10% cash return on the acquisition cost plus capex budget.

UBS has a price target of 940p, but its analysts warned that the risk profile of this project looked to be much greater than other major KAZ developments.

Iron ore pellet producer Ferrexpo has followed a similar share price path, with the stock rocketing during 2017 due to commodity prices and debt reduction efforts before losing steam this year.

Shares topped 300p in March, helped by the award of a record dividend amid stronger demand from the steel industry. They've fallen back to 170p since then, with today’s lacklustre reaction to half-year results causing a 15% decline

Chairman Steve Lucas said Ferrexpo was having to contend with a lower underlying iron ore price, as well as higher costs, which are expected to continue into the second half.

Despite these pressures, cash generation remains strong and has allowed the company to increase capital expenditure and pay down debt as well as support last year’s higher dividend.

For Countrywide, its market value continues to plummet after an emergency £140 million fundraising saw it offer new shares to existing investors at just 10p — a whopping 80% discount to their value last night.

In better times for the property market in 2015, shares in the Bairstow Eves and Hamptons International owner were trading at more than 500p. They are now changing hands for 18p after a 64% slump today.

Source: interactive investor Past performance is not a guide to future performance

Whether this represents the bottom is likely to depend on economic conditions and the performance of internet rivals. But executive chairman Peter Long described the capital refinancing as a significant milestone, enabling the company to kickstart a return to growth following a series of profit warnings.

He said: "Although it is still very early in the turnaround, we are encouraged by the operational improvements that we are making."

While underlying earnings more than halved to £10.7 million in the six months to June 30, Countrywide said it expects to benefit from an improved sales pipeline in the second half of 2018.

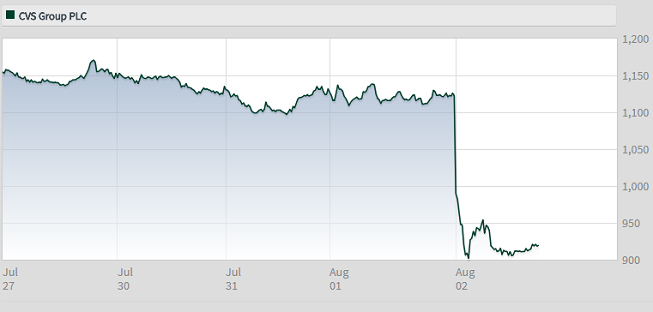

For CVS, the impact of blizzards and freezing weather in February and March cost the company £1 million in lost sales. Even though it expects September’s annual results will still meet consensus forecasts, the company’s shares slumped 19% to 911p.

CVS noted the weaker-than-expected performance of some acquisitions, having spent more than £50 million on 52 surgeries in the year to June 30. However, it said the struggling new additions have since improved and that like-for-like growth since the year-end was similar to the previous year.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.