Team17 shares near record high after riding out the storm

There’s no stopping this games developer, which seems largely immune from macro events.

10th March 2020 14:13

by Graeme Evans from interactive investor

There’s no stopping this games developer, which seems largely immune from macro events.

With stay-at-home activities set to become more popular than ever, it's no wonder investors seeking safe havens have alighted on video gaming and successful players such as Team17 (LSE:TM17).

After all, a spell in self-isolation is the ideal opportunity for some binge gaming, especially when your company's top-selling franchises are called The Survivalists and The Escapists.

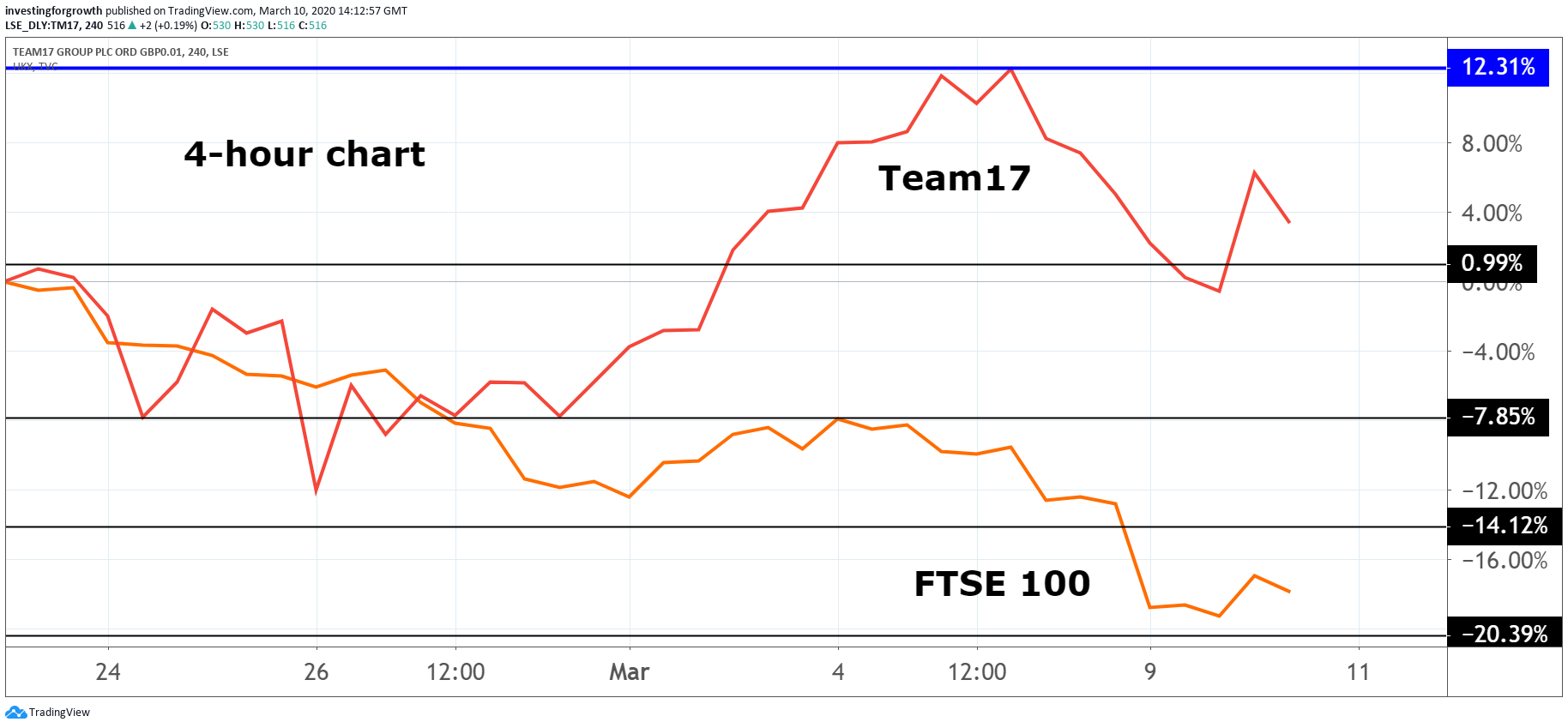

This potential is reflected in the stock market performance of Wakefield-based Team17, whose share price is up so far this year and only fell by 4% during yesterday's stock market carnage. Some of those losses were put back today following impressive annual results in which the 30-year-old company's earnings per share more than doubled to 12.9p for 2019.

Source: TradingView Past performance is not a guide to future performance

The latest record financial performance followed the launch of seven new games during the year, helping revenues to jump by 43% to £61.8 million. There are already ten new titles in the pipeline for 2020, a year in which the global games market is predicted to grow 8.2%.

This should be supported later in the year by the launch of next generation consoles from Sony and Microsoft, although concerns remain about how coronavirus might impact the industry's China-reliant supply chains.

As Team17 targets the indie market, it benefits from a presence in a niche sector with a typically loyal fanbase across many genres and platforms. Its portfolio now comprises over 100 games, including the Worms and Overcooked franchises. As well as developing its own games in house, Team17 also partners with independent developers worldwide.

Our own Lee Wild picked the company in December as one of his three speculative growth tips for 2020, when the shares were trading at 316p. The others were Gamma Communications (LSE:GAMA) and 4imprint (LSE:FOUR), who we wrote about in positive terms last week.

- Six speculative UK share ideas for 2020

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

Exposure to companies like Team17 doesn't come cheap, however, with the stock now trading ahead of its peers on a forward price/earnings multiple of more than 40 times. It only listed on the stock market in 2018 and has doubled in valued since then.

That said, analysts at Goodbody reckon the company is well placed to outperform market expectations, based on its solid release profile. They add that a balance sheet showing £41.9 million of cash means there's also ample headroom for further acquisitions,

The broker said: “Given the portfolio strength, and stickiness of the back catalogue, we currently model 15% organic growth against a 10% consensus forecast.”

Shore Capital upgraded its forecasts this morning to reflect the strong full-year results and “exciting pipeline” forming for the 2020 financial year. The timings of games launches, however, means revenues for the year are likely to be weighted towards the second half of the year.

That growth should be supported by the 20% expansion in headcount during the last year, as well as the recent deal to buy software developer Yippee Entertainment for £1.4 million. That has enabled the company to establish a second UK studio and tap into the recruitment potential offered by a presence within MediaCityUK in Manchester.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.