Terry Smith’s buying spree: should investors be concerned?

15th August 2022 08:35

by Sam Benstead from interactive investor

The Fundsmith Equity manager, who rarely trades, has been taking advantage of the dip in stock markets this year to expand his portfolio.

Volatile stock markets this year have jolted “buy and hold” investor Terry Smith into action, prompting the star manager to purchase four stocks since January.

His giant £22.7 billion Fundsmith Equity fund, a member of the interactive investor Super 60 list, added creative software giant Adobe and Alphabet shares for the first time this year, following on from his first purchase of another tech buy in Amazon (NASDAQ:AMZN) stock last summer.

He also revealed another new holding last month in Mettler-Toledo International, a manufacturer of scales and analytical instruments, and told investors that he has started building another new position, which will be disclosed only once he has accumulated enough shares.

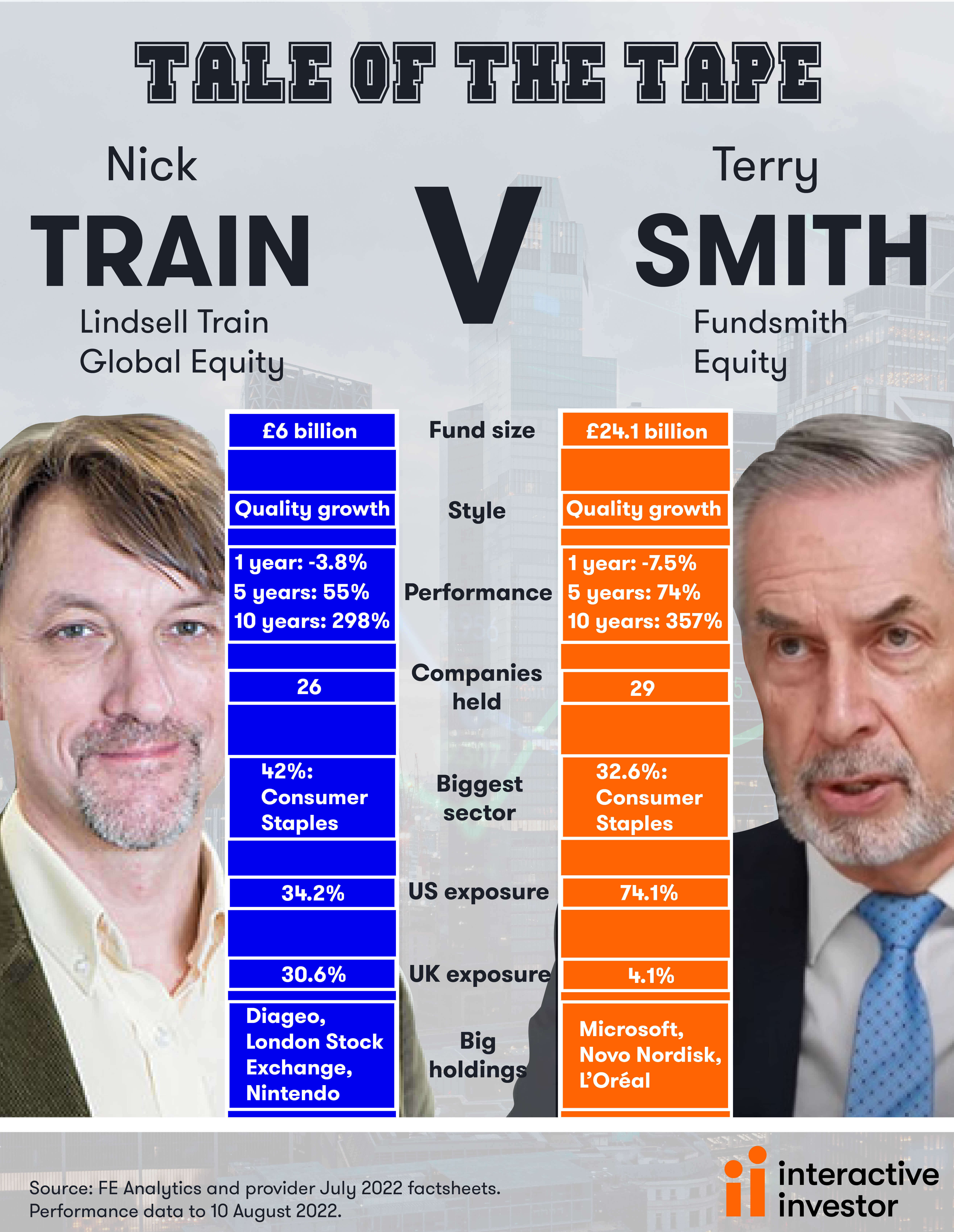

In contrast, rival investor Nick Train has been sitting on his hands, only selling publisher Pearson (LSE:PSON) and buying American data analytics company Fair Isaac Corporation for his global fund. Like Smith, Train invests in quality growth companies, and rarely trades.

Smith is not a dedicated technology investor, but pledges to “buy good companies” – those that have loyal customers, high profit margins and reliable growth. He says he refuses to overpay for such companies, tending to use periods of market weakness to initiate positions.

Following the recent portfolio activity, should investors be worried or excited? Dzmitry Lipski, head of funds research at interactive investor, says Smith’s excellent track record shows that he knows how to take advantage of stock market movements to deliver good risk-adjusted returns to investors.

- Terry Smith: Fundsmith valuation at cheapest level in five years

- How Terry Smith is investing as markets crash

- Three big fund alternatives to Fundsmith

Lipski said: “Smith has beaten his peer group (data firm Morningstar’s large-cap global investment sector) this year, as well as over one, three and five years, and since launch in 2010.

“Performance since 2020 has been weaker versus the market as expected due to his ‘growth’ style but has still outperformed the sector. Although the strategy is untested in a prolonged bear market, returns have been excellent since inception.”

Lipski adds that Fundsmith Equity will be vulnerable to further interest rate increases if inflation does not begin to fall, as economists predict.

He said: “Defensive, high-quality equities tend to underperform as central banks begin to tighten monetary policy and bond yields rise.

“While the funds’ performance was hurt during the ‘Taper Tantrum’ in 2013, when bond yields rose quite sharply, and consumer staples were among the hardest hit, the fund held up well in 2016 outperforming its peers and the benchmark when there was a very strong rotation from growth stocks into value.

“The fund is invested in defensive companies that can sustain high rates of return on capital, in cash, often through intangible assets such as brands or franchise that deter competition. Therefore, consumer staples businesses feature heavily in the fund.”

Smith has made bold investment decisions before. He bought Facebook, now known as Meta Platforms (NASDAQ:META), in 2018 and held on as it battled with the Cambridge Analytica political interference scandal. He also bought Microsoft (NASDAQ:MSFT) when he launched his fund before it turned into the cloud computing juggernaut that it is today. At the time, many other fund managers regarded the company as past its heyday.

- Terry Smith on Warren Buffett and how to find good companies

- Terry Smith continues tech buying spree as shares drop

However, his pandemic purchase of Starbucks (NASDAQ:SBUX) did not work out particularly well. While the shares rallied after Smith bought them in March 2020, he sold them at around the same share price in June this year.

His technology purchases in 2022 have been caught up in the broader market sell-off this year, but delivered better than expected earnings when they reported spring quarterly numbers. Since the bottom of the market in mid-June, Amazon and Adobe have risen more than 20%, and Alphabet is up about 15%.

Sticking with his strategy

Smith is not shifting from his approach of buying “quality”, established companies that can consistently growing earnings and dominate their respective markets.

In his half-year update to investors, he said there was still no alternative to buying shares, given that inflation erodes the real income from bonds. He maintained that investing in high-quality businesses was the best approach.

He said: “It may be tempting to sell equities and go into cash as this may enable you to avoid further falls in the equity market. Timing is of the essence in doing this and if you haven’t done it already, I think we can safely say you missed the top. Meanwhile, time spent in cash while waiting is hardly a good bolthole from inflation.

- Terry Smith buys Alphabet for Fundsmith

- Terry Smith on why Fundsmith Equity fell slightly short in 2021

“Finally, even if you accept the ‘there is no alternative to equities’ mantra, maybe equities of the sort in our portfolio are still not the best place to be for a while.

“This is really a subset of the market timing approach: sell quality equities, buy lowly rated ‘value’ stocks and then reverse this when the time is right. I wish you luck if you intend to pursue this approach not least because I am fairly sure how lowly rated stocks, most of which are heavily cyclical, have low profit margins and returns on capital, will fare in a recession.”

Activity fees

Despite the relatively busy period for Fundsmith, with portfolio turnover at 3.2% in the first six months of the year, fees barely increased for investors, who are billed by the fund manager for voluntary dealing (trades not caused by redemptions or new subscriptions).

Voluntary dealing costs were £392,705 during the half year, adding just 0.002% to fees. The Ongoing Charges Figure for the T Class accumulation shares was 1.04% and with the cost of all dealing added, the total cost of investment was 1.05%. Investors on the interactive investor platform can buy I Class shares, which cost 0.94% plus dealing fees.

Fundsmith Equity has returned 16.4% since inception, compared with 11.8% over the same period for the MSCI World index, and 9.8% for the typical global investor. The strategy has lost 12% this year.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.