These three luxury stocks just became affordable

After coronavirus wiped billions from company valuations, these exclusive brands look good value.

26th February 2020 10:27

by Rodney Hobson from interactive investor

After coronavirus wiped billions from company valuations, these exclusive brands look good value.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Most of the attention surrounding the economic effects of the coronavirus outbreak has been on the disruption to supply chains in the West; less has been written about the potential loss of sales of luxury goods into China.

There are rich people wherever you are in the world, and China had a rich, politically favoured class long before it developed an aspirational middle class. The country has long been a target market for makers of luxury goods such as Burberry (LSE:BRBY). Furs, handbags, watches and spirits have found a lucrative outlet there, and elsewhere in the Far East.

- Invest with ii: Top UK Shares | Most-traded US Stocks | Open a Trading Account

The severe restrictions on movement in affected areas has made a trip to a shopping mall something of a luxury in itself. It is therefore unsurprising that share prices in this type of company have crashed alongside the general market this week.

- How this AIM stock returned 3,500% so quickly

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It is now clear that the crisis will continue for some time. Restrictions on the movement of people in Wuhan, the seat of the outbreak, then the whole Hubei province, then much of China, then the wider world have failed, like Canute, to hold back the tide. Finding a vaccine, then producing millions of doses, is no quick solution.

Some sales will inevitably be lost forever. That always proves to be the case whenever any sector suffers from a hiatus, even where the goods are not perishable. Some people will always decide to wait for the next model or the next upgrade.

However, it is reasonable to hope that some sales of luxury goods have merely been delayed and there will be some catch-up later this year. Coronovirus is clearly able to spread rapidly so the effects may not be as drawn-out as the World Health Authority fears.

In any event, we have seen stock markets around the world slump on similar outbreaks – for example SARS – only to bounce back after a possibly severe but comparatively short-lived outbreak. Life goes on.

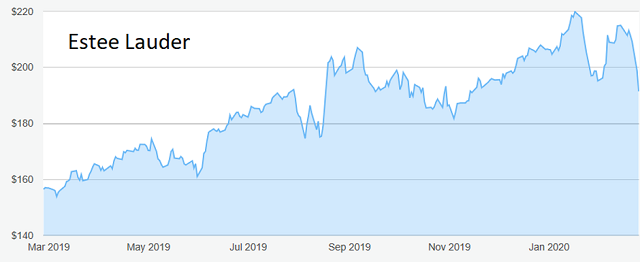

One company worth a look on that basis is The Estee Lauder (NYSE:EL), the US skincare, fragrance and beauty group. Its shares slumped from $215 to $191 in six trading days, a fall of 12%. That factors in quite a bit of bad news, though the shares are still way up on the $150 price at which interactive investor companies analyst Edmond Jackson tipped them on this site in February last year.

Source: interactive investor Past performance is not a guide to future performance

Estee Lauder goes to great lengths to maintain the exclusivity of its products, controlling the outlets in which they are sold and maintaining prices. It is unlikely to undermine this strategy by reducing prices to shore up sales so shareholders may have to bite the bullet until better times return.

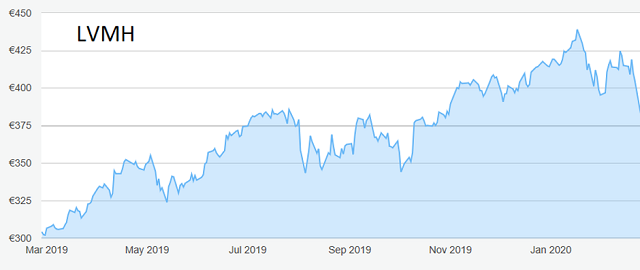

LVMH (EURONEXT:MC), with its wide range of luxury goods, has a similar strategy, eschewing discounting and end-of-season sales. Its share price slump from €425 to €380 in nine trading days represents a fall of 11%.

Source: interactive investor Past performance is not a guide to future performance

In both cases the fall has come after a strong 12-month upward run so a correction was probably overdue. The slippage could continue a little longer, as the shares are still not cheap. LVMH is on a sharp price earnings ratio of 27.1 and a meagre yield of 1.6%, while Estee Lauder’s figures are slightly less appealing at 39 and just under 1% respectively.

Rémy Cointreau (EURONEXT:RCO) is a drinks maker, so anything that is not drunk now is unlikely to be consumed in a wild binge later in the year. Sales lost are most certainly down the drain. The recent share price peak came later than at Estee Lauder and LVMH, on 19 February at €103.5, and the fall has been slightly less severe so far, 8% to €95.25.

Source: interactive investor Past performance is not a guide to future performance

However, it should be noted that Remy shares had a far less happy 2019 and had already tumbled from €140 since the beginning of September. Its yield of 1.7% is now more attractive.

Hobson’s choice: Buy Remy Cointreau below €95, LVMH below €375 and Estee Lauder below €195, although you should be able to beat these limits comfortably.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.