These two stocks are the best way to celebrate end of lockdown

After the most difficult year since the Second World War, this sector will help create a party mood.

17th February 2021 10:05

by Rodney Hobson from interactive investor

After the most difficult year since the Second World War, this sector will help create a party mood.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The fizz has gone out of champagne sales over the past year, but we could see a resurgence as fun lovers try to make up for lost drinking time. If so, share prices are about to pop.

Being at the premium end of the sparkling wines market has its advantages. Champagne is still the drink of choice at any event where the hosts want to impress, including festivals, weddings and special celebrations.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

Alas, these are the kind of gatherings that have been cancelled or at least postponed during the coronavirus pandemic, while cheaper prosecco and, to a lesser extent, cava, have become a popular substitute for less formal occasions. All in all, 2020 was reckoned by champagne producers to have been probably the most difficult since the Second World War, with global sales taking a hit and profits suffering even more.

- Your 50 most-popular US stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Investing in the US stock market: a beginner’s guide

- What is earnings season?

Last April, with much of the world in lockdown, champagne shipments were running 68% lower than the same month in 2019 and, despite some easing of social restrictions, the percentage dip remained in double figures for most of the summer.

Total sales in 2020 came in at about 245 million bottles, a drop of 18% from the 300 million sold in 2019, and there was also a shift to less expensive brands, exacerbating the fall in income, which was about €1 billion lower. The major markets of France, the UK and the US saw a 20% fall in the number of bottles sold, while Japan registered a 28% slump.

This year’s figures will have got off to a suppressed start with a new wave of lockdowns, but the situation could have been far worse. Forecasts last April were for a 30% drop in sales for the whole of last year.

The spread of vaccinations has led to encouraging early signs that the pandemic can be brought under control, although France, a major market for champagne, is lagging, like much of the European Union, in its vaccination programme. This year will still see subdued demand for champagne throughout the early months, at least and some wholesalers have excess stock from last year to release before they order more supplies.

The hope among champagne producers, though, is that the world will decide to party like never before once restrictions are eased. If that happens, then share prices of champagne producers will recover.

- ii view: Disney streaming growth overshadows park challenges

- Why you must spread your investing wings in 2021

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

A word of warning. The choice of investment is limited and production is largely in the hands of family groups, so outside investors may have little say in how the undoubted challenges for the industry are handled.

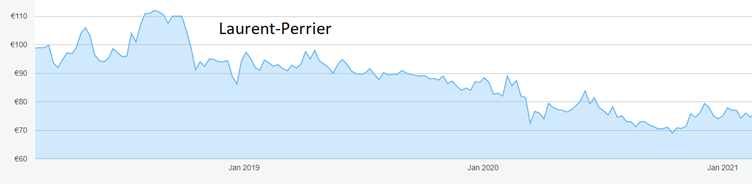

Laurent-Perrier (EURONEXT:LPE) is principally a champagne producer with four main brands selling through wholesalers and retailers. It also owns some foreign vineyards but champagne is the major product. First-half results were inevitably disappointing, with revenue down 28% and net income down 31%, but the second half should see a smaller decline and the summer months this year offer plenty of scope for a bounceback.

Source: interactive investor. Past performance is not a guide to future performance

Its shares are well down from the €112 peak recorded in August 2018, but a two-year decline eventually found a floor at €70 and there has been a slight recovery to €77, where the yield is 1.4%.

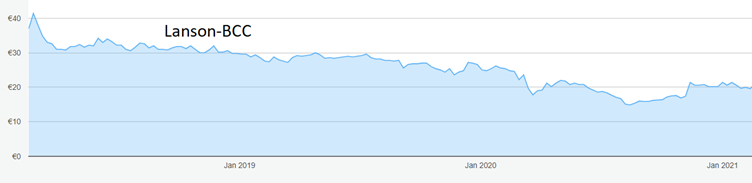

Lanson-BCC (EURONEXT:ALLAN) shares peaked three years ago at €41 and similarly have seen a long slide, to €15, flowed by a slight uptick. There was no dividend in 2020, but Lanson is forecast to pay 29 euro cents this time, giving a yield of 1.46%, and increase the payout in the next two years.

Source: interactive investor. Past performance is not a guide to future performance

Hobson’s choice: Buy Laurent-Perrier up to €80. The short-term target is €93. Lanson looks less appealing but if you are tempted, stay below €21.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.