Three ETF trends to watch in 2022

13th January 2022 11:04

by Monika Dutt from ii contributor

An ETF expert predicts key trends for passive investors this year.

Core equity ETFs to continue proving popular

In 2021, investors continued to pour money into broadly diversified, highly liquid, and low-cost exchange-traded funds (ETFs). In the equity space, US large-cap blend, global large-cap blend and the global emerging markets categories attracted the highest ETF inflows.

In 2022, we’re likely to continue seeing the same trend. This is because finding active funds that can outperform their passive peers in plain vanilla categories remains challenging.

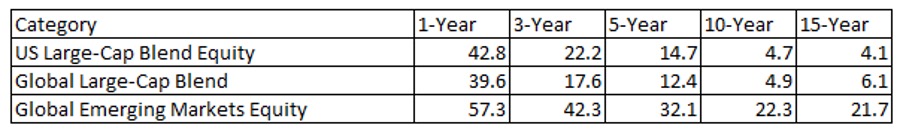

Our research suggests that over the past 10 years, only 4.7% and 4.9% of active funds survived and outperformed their passive peers in the US large-cap blend and global large-cap blend categories, as the table below indicates. Active funds had a higher 10-year success rate of 22.3% in the global emerging markets equity category.

Actively managed equity funds’ success rate by category (%)

Source: Morningstar. Data as of 14/10/2021. Past performance is not a guide to future performance.

- What are the cheapest ETFs to track global markets at the end of 2021?

- Active versus passive funds: a beginner’s guide

- Funds Fan: four predictions for 2022 and Allianz Technology interview

Expect more niche thematic ETF launches

In 2021, the menu of thematic ETFs continued to expand. Thematic funds aim to capture secular growth trends, such as changing demographics, technological innovation, and energy transition.

In the fourth quarter of 2021, assets in European-domiciled thematic funds increased to almost £31 billion, with flows of £1.7 billion over the quarter.

The five largest thematic ETFs domiciled in Europe are: iShares Global Clean Energy ETF (XETRA:IQQH), iShares Automation&Robotics ETF (LSE:RBOT), L&G Cyber Security ETF (LSE:USPY), iShares Global Water ETF (LSE:DH2O) and iShares Healthcare Innov ETF (LSE:HEAL).

This year, we expect to see more thematic fund launches. Investors are drawn to thematic funds, as they offer exposure to trendy stocks. They also often prey on investors’ impulse to chase performance. In that sense, they’re easy to sell.

However, thematic funds tend to carry a higher risk profile compared to their non-thematic counterparts, notably due to their narrower exposures. Thematic funds can also move further down the cap spectrum. With that in mind, we encourage investors to examine funds’ liquidity profiles before making a purchasing decision.

- Thematic ETFs: what investors need to know

- Nina Kelly's ETF to buy in 2022

- How to understand the liquidity risk of thematic ETFs

Our research shows that over the long term, success rates for thematic funds have also been low. This is partly because thematic funds tend to charge higher fees compared to their non-thematic counterparts. Also, not all thematic funds capture secular growth trends that have the staying power. As such, thematic fund buyers have the tall task of picking a winning theme.

For all these reasons, we encourage retail investors seeking exposure to thematic funds to conduct additional due diligence before making final fund selection decisions.

ESG expansion

In 2021, ESG ETFs (those that focus on environmental, social and governance factors) continued to attract assets and flows. We expect this trend to continue this year. ESG product development remains a key 2022 objective for many ETF providers. This year, we not only expect to see new ESG ETF product launches but existing products switching from non-ESG benchmarks to ESG-oriented indexes. While the bulk of ESG assets remains in equity ETFs, assets in fixed-income ESG ETFs increased in 2021, a trend that is likely to continue this year.

- ii Top 10…ways to avoid greenwashing with funds

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

We encourage investors to examine a fund’s sustainability focus, approach, sector profile, geographic biases, tracking error, and fees. Selecting a responsible asset manager who engages with companies on a variety of environmental, social, and governance issues is also important.

Monika Dutt is director of passive strategies research at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.