Three ETFs to reduce US concentration risk

For investors looking to be less reliant on the fortunes of US tech giants one route is to consider ‘anti-concentration’ ETFs. A Morningstar analysts highlights three options.

9th June 2025 09:00

by Morningstar from ii contributor

Rising concentration has become one of the defining features of modern equity markets. While the largest stocks have been increasing their relative market share and driving growth globally, concentration has been particularly striking in the US, where the so-called Magnificent Seven stocks have come to dominate equity markets.

In the US, the market share of the top five constituents has more than doubled to 25% over the past decade to levels not seen since before the dotcom era.

- Invest with ii: Top ETFs| Index Tracker Funds | FTSE Tracker Funds

The importance of the largest players is also reflected in performance figures. Over the trailing five years, the five largest US stocks were responsible for half of all index gains.

In the US, a low-cost market-cap approach that harnesses the wisdom of the crowds has proved difficult to beat over long periods, and in turn has become the default options for investors in US equities.

However, many have become concerned that it might leave them too exposed to the largest stocks in the index. These concerns have been further validated by recent developments.

For example, after news spread about DeepSeek’s latest model, NVIDIA Corp (NASDAQ:NVDA) tumbled -17% on 27 January 2025, highlighting the fragility of tech valuations.

These tech giants may also be particularly exposed to geopolitical risk. For example, Elon Musk’s involvement with the US government contributed to Tesla Inc (NASDAQ:TSLA) stock plummeting by almost 50% from peak to trough for the year to date in 2025.

Moreover, the US deglobalisation policies, such as tariffs, cast doubts on its central role (and by extension, its largest tech companies) in the global economy. Additionally, non-US regions may retaliate against the largest US tech firms whose valuations rely on their global scale.

Others believe the tech giants have become too large and too powerful, pushing them into the crosshairs of anti-competition authorities as potential targets for break-up.

To mitigate this concentration risk, investors have turned to what we call “anti-concentration” exchange-traded funds (ETFs). These are funds that reduce the reliance on large-cap stocks dominating traditional indices. We’ve seen a significant rise in flows towards the anti-concentration strategies during the second half of 2024, estimated at close to $18 billion (£13.2 billion).

Anti-concentration strategies

Against the backdrop of rising market concentration, investors have been gravitating towards equally weighted strategies to reduce the impact of market cap dominance, while also shifting further down the cap spectrum by allocating to mid-cap strategies.

Three ETFs represent the different options: Invesco NASDAQ-100 Equal Weight ETF $ Acc GBP (LSE:EWQX), Xtrackers S&P 500 EW ETF 1C GBP (LSE:XDWE), and SPDR S&P 400 US Mid Cap ETF GBP (LSE:SPX4).

Size exposure

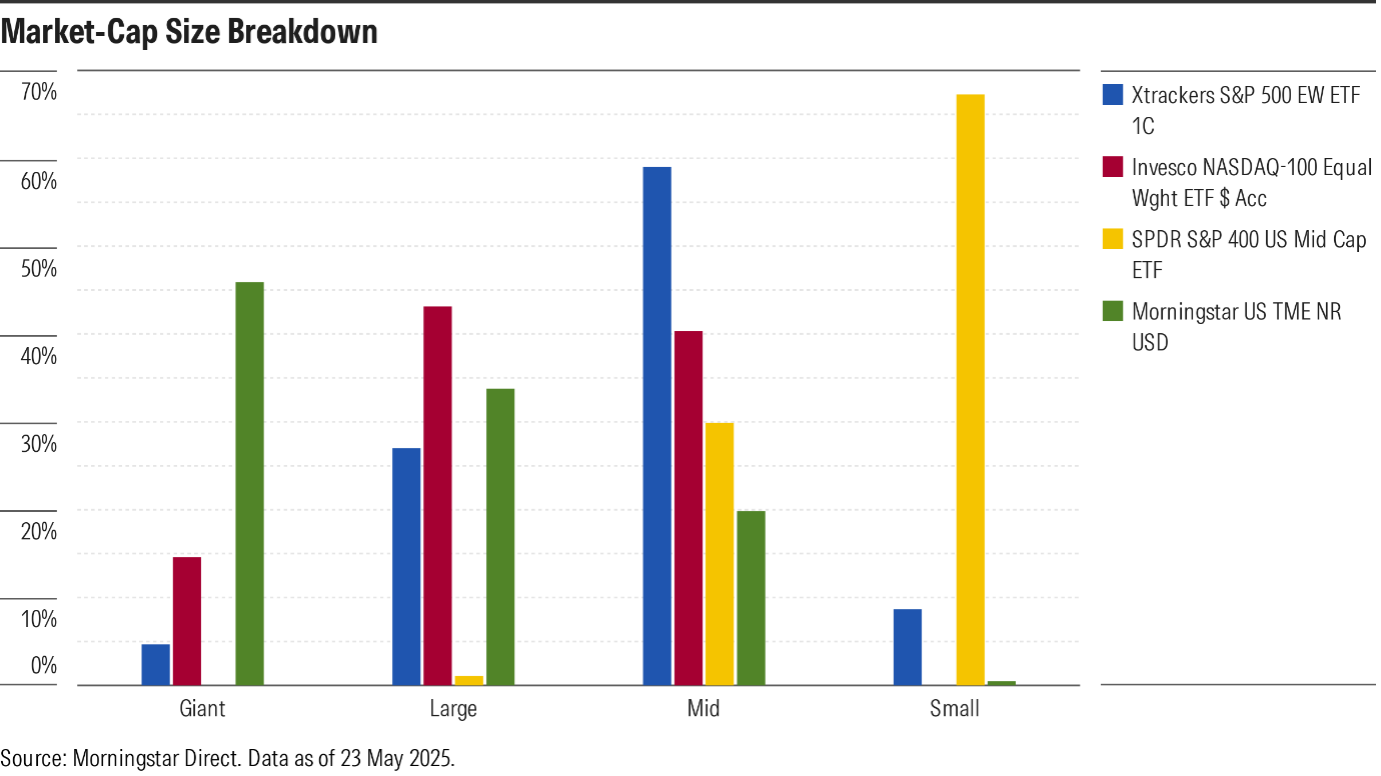

The goal of anti-concentration strategies is to reduce exposure to mega-cap stocks, and all the options offer lower exposure than standard market-cap-weighted large-cap exposure as proxied by the Morningstar US Target Market Exposure index. However, Invesco Nasdaq-100 Equal Weight ETF still maintains some exposure to these stocks.

Meanwhile, Xtrackers S&P 500 EW ETF has a much larger mid-cap allocation compared with the other alternatives. The ETF’s equal weighting of its constituents effectively transforms it into a mid-cap focused fund.

SPDR S&P 400 US Mid Cap ETF’s allocation largely falls under small-cap stocks in Morningstar’s classification, illustrating the lack of overlap with US large-cap exposure.

Representativeness

Representativeness refers to how a fund captures an opportunity set within a specific investing segment; this enables diversification when investing in US large- and mid-cap equities.

Invesco Nasdaq-100 Equal Weight ETF lacks representativeness of the US large-cap investment segment. The fund excludes financial firms and over-represents technology companies. This means that investors in that fund are making significant bets against the broader market. Additionally, the fund’s index only includes stocks listed on the Nasdaq exchange, therefore prominent stocks such as Uber Technologies Inc (NYSE:UBER) and Oracle Corp (NYSE:ORCL) are excluded because of their listing on the New York Stock Exchange. This further limits its investment universe and reduces diversification.

- DIY Investor Diary: how I earn a return from churn

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

In general, equal-weight strategies emphasise smaller companies, which translates into somewhat arbitrary bets versus the broader market. For example, Xtrackers S&P 500 EW ETF’s equal weighting tilts the fund's exposure towards smaller-cap and value stocks. Moreover, sector weights are determined by the number of holdings in each sector, not their market valuations. Xtrackers S&P 500 EW ETF illustrates this as the fund significantly underweights the Information Technology sector and Communication Services sectors, and overweights Industrials.

Looking at the SPDR S&P 400 US Mid Cap ETF, its solidly constructed market-cap weighted benchmark is largely representative of the US mid-cap segment and is well diversified. However, its sector, size and style is very different to that of the Morningstar US Target Market Exposure index, due to the different group of stocks each targets.

Fees

When evaluating an ETF, it is imperative to consider its yearly fee as these are directly taken out of returns.

Invesco Nasdaq-100 Equal Weight ETF, Xtrackers S&P 500 EW ETF, and SPDR S&P 400 US Mid Cap ETF charge between 0.20% and 0.30%, and are more expensive than plain vanilla ETFs, as market-cap weighted US large-cap blend equity ETFs charge as little as 0.03%.

In turn, diversifying away from standard large-cap blend market cap exposure comes with higher costs, which investors should bear in mind.

The bottom line

When deviating away from market capitalisation, investors should be mindful of what they are simultaneously betting for or against when aiming to reduce concentration risk, as well as the costs of the funds compared to plain market cap weighted US large-cap focused ETFs.

Madeleine Black is an analyst at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.