Time to buy this pharma giant after near-60% plunge

This industry giant has fallen on hard times, but overseas investing expert Rodney Hobson thinks the recovery potential is attractive. A 6% dividend yield rewards investors for waiting.

7th February 2024 09:26

by Rodney Hobson from interactive investor

After the Lord Mayor’s Show comes the corporation dustcart, goes an old saying. Drugs company Pfizer Inc (NYSE:PFE) was parading in glory during the pandemic but, since sales of its Covid vaccine slumped, the performance has been a bit rubbish.

Pfizer won plaudits for creating its vaccine speedily, but its product had to be stored at very low temperatures so rivals were soon able to muscle in with equally effective alternatives that had the advantage of a longer shelf life.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Last year the drugs giant found itself with lower sales being compared with the halcyon days that it enjoyed during the previous 12 months. Revenue in the fourth quarter fell sharply, down 41% to $14.2 billion, taking the total for the year towards the bottom end of the company’s own guidance range. The decline was not only because of rapidly disappearing demand for the Covid vaccine but because of lower sales of Pfizer’s Paxlovid antiviral treatment.

What is striking is that revenue actually topped $100 billion for the first time in 2022, so the annual rate is now little more than half that elevated level. It is, however, some comfort that apart from coronavirus products, revenue was actually up 7%, giving hope for this year as comparatives become much easier.

Nothing, though, can take away the pain of a particularly difficult six months that led to the board reducing its forward guidance for 2024 to $58.5-$61.5 billion compared with analysts’ forecasts of at least $63 billion.

After recording its first quarterly loss for four years in July-September, Pfizer suffered another deficit of $3.37 billion in October-December compared with a $5 billion profit a year earlier. Part, but not all, of the latest loss was caused by $2.57 billion charges from restructuring and acquisitions. One hopes that the resulting cost-cutting will pay off as soon as possible.

The challenging quarter meant full-year revenue was down 42% to $58.5 billion while net income slumped 93% to $2.12 billion.

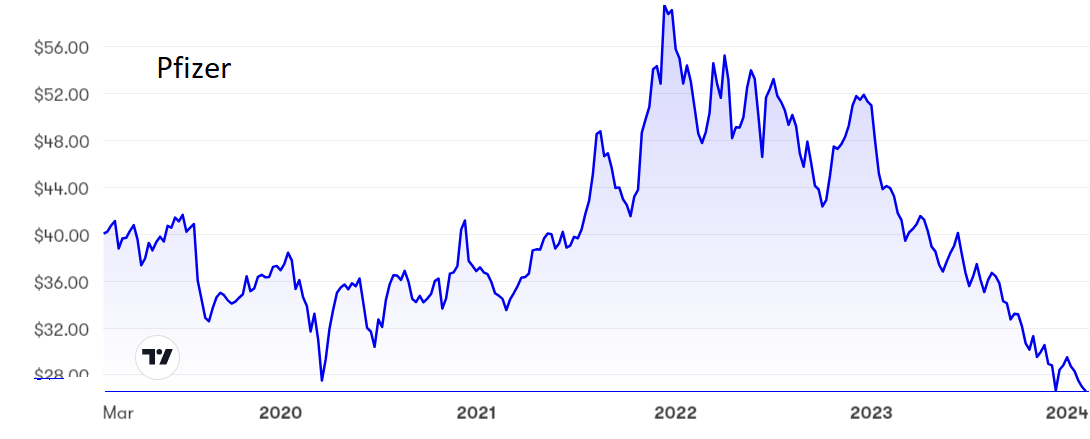

Naturally, the difficult circumstances have had a corresponding effect on the share price, which has fallen by more than a third over the past 12 months and by more than half since the peak just shy of $60 at the end of 2021.

Source: interactive investor. Past performance is not a guide to future performance.

At the current $28, the price/earnings (PE) ratio is a massive 72 while the yield is rather high at 6.1%. It should be noted that the PE has been distorted by the one-off losses and it should be at a more realistic level during 2024.

- Stockwatch: time to sell Meta and Amazon or hold on?

- ii view: Meta profits rocket as Zuckerberg pays first dividend

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Such a high yield normally raises concerns that the dividend could be cut, but the Pfizer board will be reluctant to suffer that ignominy unless the current year continues the disappointment of the past six months, which is unlikely.

Hobson’s choice: After a 30% fall in the share price early last year I suggested that Pfizer could bottom out around $40, but then in October rated the shares a ‘sell’. In a demonstration of the dangers of trying to catch falling knives, the stock has continued its downward slide, and the shares fell another 16%. This could, though, at last be the time to buy in and hope to enjoy a gradual recovery.

Update: Exercise equipment supplier Peloton Interactive Inc (NASDAQ:PTON) has downgraded already battered expectations after yet another quarter of falling sales, casting further doubts on the strategy of switching more to a subscription service. Revenue for the current year is likely to fall short of the previously expected $2.7-$2.8 billion range. The shares are bumping along around $4, a far cry from the peak of $160 set a little over three years ago. I repeat my advice to stay well clear. If you have clung on against my past advice to sell you are probably not prepared to listen, but it is not too late to get out whatever you can.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.