Time to call it a day after these two huge companies disappoint?

These massive household names have tested the patience of overseas investing expert Rodney Hobson, and after a year of underperformance, our columnist has a difficult decision to make.

25th October 2023 09:27

by Rodney Hobson from interactive investor

One sector still under the long shadow of Covid-19 is naturally pharmaceuticals, where companies that sold vaccines must now find replacements for lost sales as fewer and fewer people seek pandemic protection.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The pharmaceutical and medical devices group Johnson & Johnson (NYSE:JNJ) seems to have come out of a big corporate shake-up in good form, despite a mixed picture in its third-quarter results. In August it completed the biggest reorganisation in its 137-year existence by letting shareholders exchange J&J shares for those of Kenvue, its former consumer health unit, banking $21 billion in the process.

J&J group sales rose 6.8% to $21.4 billion in the three months to the end of September, providing what chief executive Joaquin Duarto claimed was a solid foundation for future growth. He raised guidance for full-year sales, though only fractionally, and not by enough to offset the decline in sales of lucrative Covid-19 vaccines.

Shareholders will have to be patient, therefore, because comparisons are still being affected by the disappearance of those Covid vaccines. As a result, net earnings were flat at $4.3 billion in the third quarter.

This was a much more subdued report than the highly upbeat second-quarter figures that easily beat expectations and led to an upgrading of full-year expectations.

On the credit side, Johnson & Johnson has followed up with several highly encouraging outcomes for clinical trials on a variety of potential cancer treatments, particularly for lung and prostate. While there is always scope for later failure on any promising drug, there is reasonable hope that at least one will make it through and turn into a blockbuster.

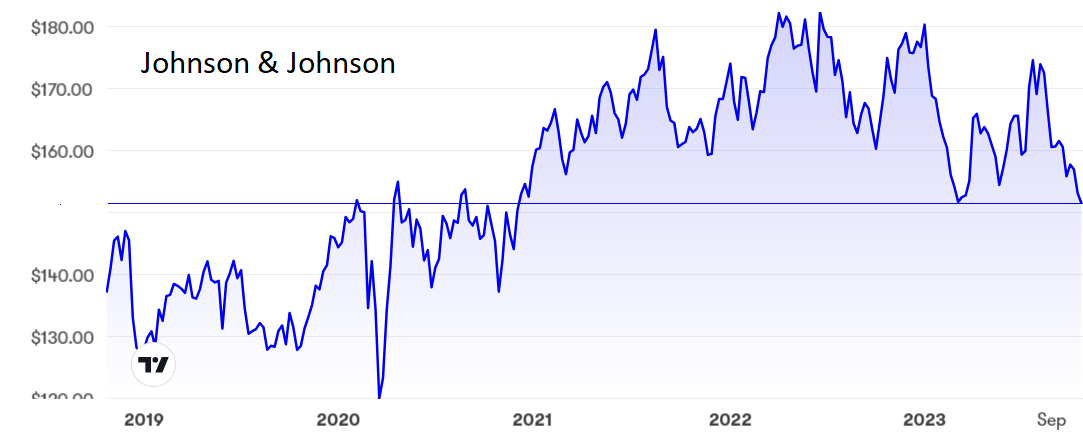

Johnson & Johnson shares have turned down after trying to push ahead of $180 several times over the past couple of years and have now slipped back to a critical level just above $150, the previous ceiling and a more recent support point. The price/earnings (PE) ratio is currently just above 30, which factors in a substantial bounce back in profits next year, while the yield offers some consolation at 3%.

Source: interactive investor. Past performance is not a guide to future performance.

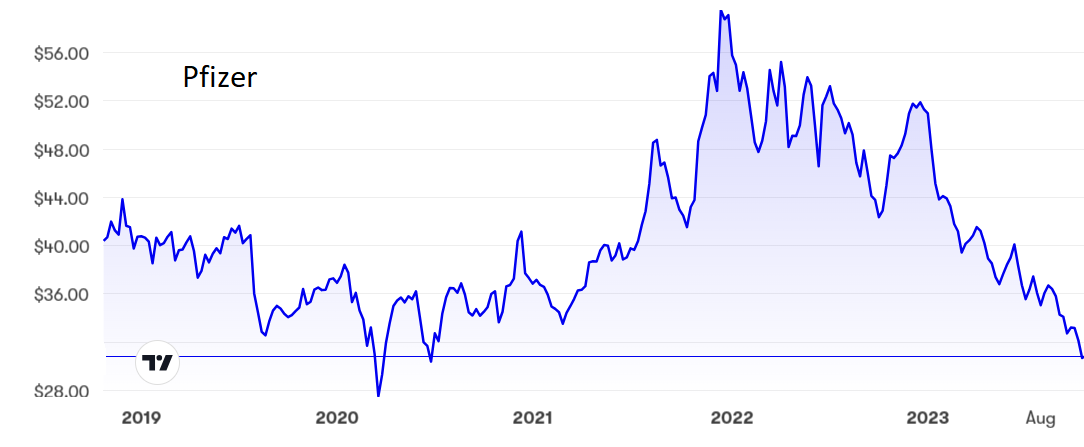

Pfizer Inc (NYSE:PFE) had a much tougher second quarter as sales of two drugs to treat Covid fell sharply. Investors were warned that revenue from oral anti-viral drug Paxlovid and vaccine Comirnaty would be only about $12.5 billion this year, a whopping 42% lower than last year. This decline will surely continue until sales of these two products disappear entirely.

Guidance on group full-year revenue was reduced from $67-70 billion to $58-61 billion at the beginning of August. Worse still, expectations for earnings per share were slashed from over $3 to around $1.50.

Pfizer’s share price has naturally reflected the tougher times. From just shy of $60 in December 2021 there has been a steady slide to around $31, where the PE is a lowly 8.2 and the yield has been pushed up to 5.3%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have recommended Johnson & Johnson shares several times, believing they would hold above $160, but am now starting to get cold feet. I still think that existing shareholders should stay in and at least enjoy the dividend, but new investors may prefer to let the shares settle before taking the plunge. If they drop below $145 than the buy rating is restored.

I had hoped in March that Pfizer would find a floor around $40 but the worsening news put an end to that, and it is hard to share the company’s continuing bullish stand. Do not commit yourself before third-quarter figures due in a week’s time. If they are unexpectedly good and you have missed a buying opportunity, then too bad. More likely is that total sales are still sliding, and the corner has not been turned yet. Better to sell and look for opportunities elsewhere.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.