The top 20 fastest-growing investment funds

Our Saltydog investor identifies which funds have grown the most over the last three months.

14th September 2020 12:51

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Our Saltydog investor Douglas Chadwick identifies which funds have grown the most over the last three months.

When stock markets fell during February and March, a significant amount of money was either switched between funds, or withdrawn completely. As conditions have improved, money has started to flow in again. In this piece, we look at which funds have grown the most over the last three months.

- Invest with ii: Sustainable Funds List | Top Investment Funds | Transfer an Investment Account

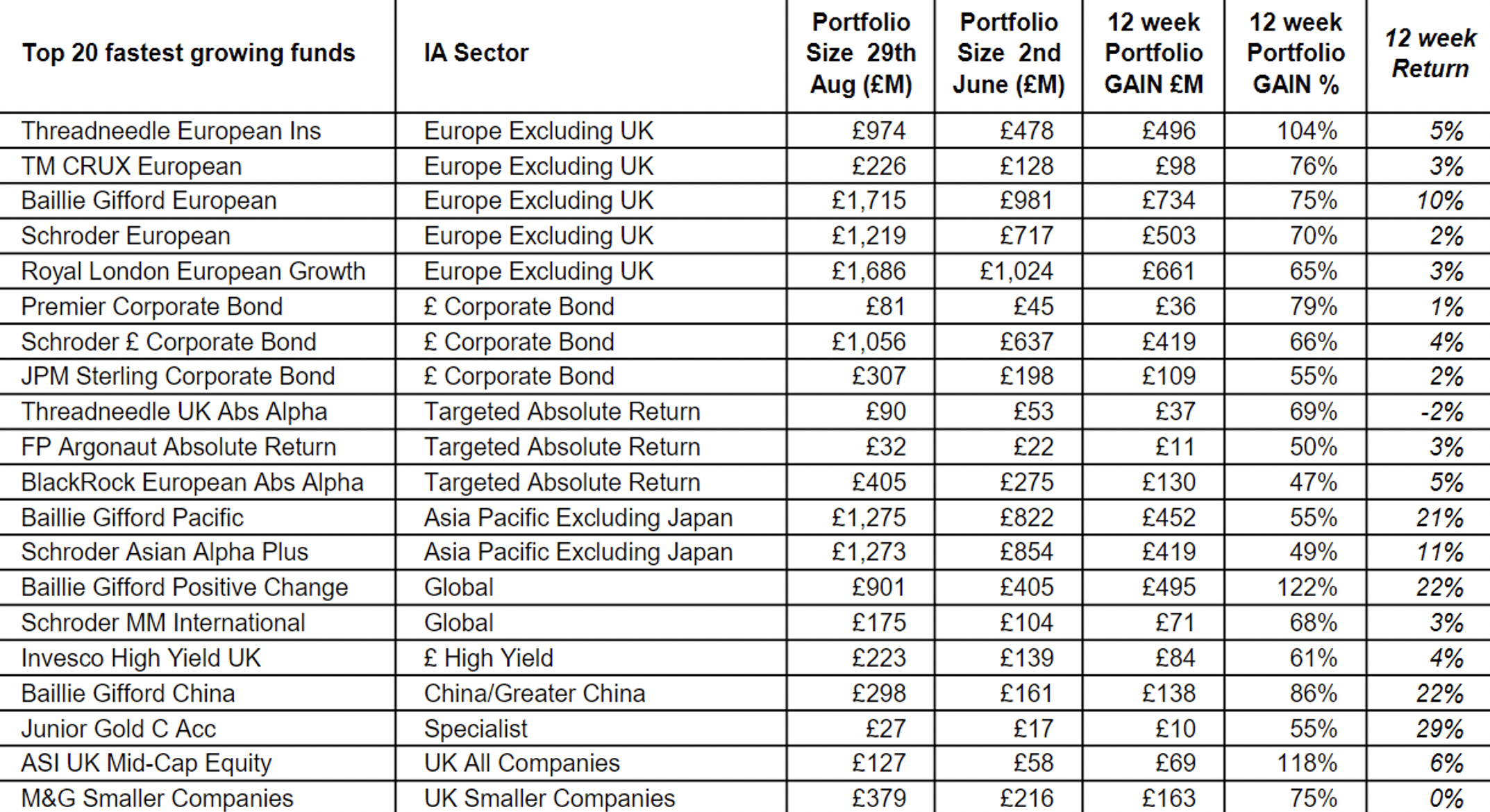

To get started, we have used a very basic calculation. When we prepare our weekly reports, we download the portfolio value of each of the funds in our analysis and store it. All we have done is taken the value from as near to the end of August as possible and compared it with one from 12 weeks earlier.

We have calculated the overall change in value and expressed this as a percentage of the initial value, and have ranked the funds by their overall percentage gain.

The change will have been driven by two factors. The performance of the underlying assets and the amount of money added or withdrawn from the fund.

To give an indication of the split, we have also shown the 12-week percentage return.

So, for example, the Baillie Gifford Positive Change fund had a portfolio value of £901 million on the 29 August. Twelve weeks earlier, it was only £405 million. That means that it has grown by £495 million, which is 122%.

During the last 12 weeks, it has produced a return of 22%, which means that of the 122% increase in portfolio size, only 22% can be attributed to the growth of the money that was initially invested. The remaining 100% will be related to the inflow of funds.

- The top 10 fund-sector winners since the sell-off

- Record investor exodus from UK funds

- Looking to diversify your portfolio? ii’s Super 60 recommended funds is full of great ideas

We intend to see if we can fine-tune this report to get a better understanding of the flow of money into and out of the funds.

What is clear from the table above is that most of the increase in these funds has been generated by new money.

We thought that there might be a strong bias towards one particular sector, but that hasn’t been the case.

Five of the funds are in the Europe Excluding UK sector, three are from Sterling Corporate Bonds, three are from Targeted Absolute Returns, two are from Asia Pacific Excluding Japan and two are from Global. There is also one from each of the following sectors: Sterling High Yield, China and Greater China, Specialist, UK All Companies and UK Smaller Companies.

It is interesting to see that there aren’t any funds from the Technology and Telecommunications or North American sectors.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.