Two hot tips and what to do with them now

14th September 2022 08:32

by Rodney Hobson from interactive investor

After surging 160%, Rodney gives a fresh view of this top stock. He also backs this children’s favourite to recapture much higher ground.

Two companies in quite different sectors - but both looked hot tips at the depths of the pandemic-induced stock market crash in Spring 2020. Time to look at how they fared as we came through and out of the slump.

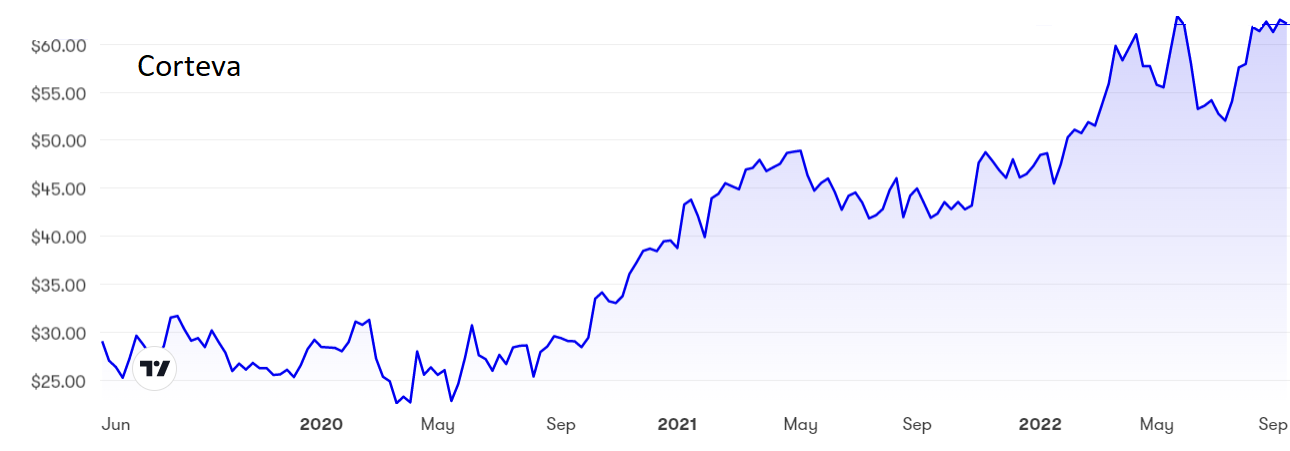

It has been a fascinating three years or so for Corteva Inc (NYSE:CTVA) since it was floated in May 2019. The seeds and agricultural chemicals company was born out of turmoil, with chemical companies Dow and Du Pont coming together to pool their various resources before splitting into three parts along business lines.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Corteva’s sales are split roughly 50:50 between North America and the rest of the world and also fairly evenly between seeds and crop chemicals, with the former segment marginally the larger.

The shares started life at around $29 and bobbed about mainly below that level before suddenly gathering momentum in the second half of 2020. They peaked at $63 in May this year and despite a frightening correction to $52 they are back above $60.

Source: interactive investor Past performance is not a guide to future performance

You need luck as well as judgement to catch the bottom of any market but my recommendation to buy at $24 on 1 April 2020 was about as near as you get – though my comment that $40, seen then by commentators as fair value, looked wildly optimistic reads like an April Fool joke in hindsight. The stock is worth more than six times my suggested buy level now.

Unfortunately, at this stage the shares look to be topping out, and understandably so. The price/earnings (PE) ratio is a demanding 25.7 while the yield is just under 1%. They are still worth holding on to, since Corteva is among the leaders in the fields where it operates, although it would not be wrong to bank some of those profits at this stage. You could sell half your stake and hang on to the rest effectively for free.

Targeting $100 again

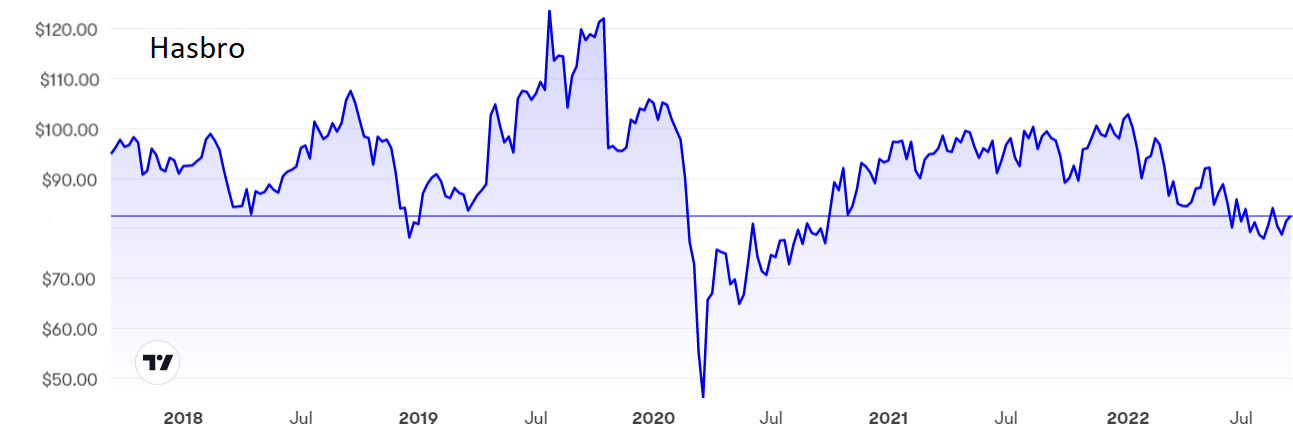

In contrast, the recovery at toys and entertainment franchise group Hasbro Inc (NASDAQ:HAS) has been slow and disappointing considering that its portfolio includes perhaps the greatest board game ever invented, Monopoly, plus popular toys Action Man and My Little Pony. It also makes money from television series and franchising deals.

Revenue from sales of toys in the United States have continued to grow strongly thanks to a combination of increased purchases and higher prices, while Asia-Pacific is emerging as a major growth region. Temporary store closures that occurred in many parts of the world during the pandemic are now consigned to history.

Supply chain issues have not been as big a burden to toymakers as in some industries but rising raw material costs are the one major hurdle for the sector.

- Is the US a land of opportunity for trust investors?

- Do emerging markets offer better value than the US, UK and Europe?

- The sustainable funds weathering the style storm

Despite having what should be overwhelming appeal, Hasbro shares were already falling well before the extent of the Covid-19 panic took hold, eventually losing more than half their value from a peak above $120 to a low below $50.

Now the recovery has run out of steam at $102 and the shares are back at around $80, where the PE is only slightly toppy at 21 and the yield is a very reasonable 3.3%.

Source: interactive investor Past performance is not a guide to future performance

I tipped the shares at $75 in April 2020 so anyone who followed that advice is still in profit and has collected dividends too. Christmas is obviously a key trading period, and it is certainly possible that belt tightening among consumers will have an impact, but most families will be keen to see that the children suffer least.

I said 30 months ago that the shares would top $100 again when the coronavirus scare started to become an unpleasant memory. It happened then and it will do so again. Hasbro is still a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.