Two shares that tick the boxes as good long-term investments

This is where our Share Sleuth evaluates the companies in his portfolio. Here's his latest analysis.

14th August 2019 09:13

by Richard Beddard from interactive investor

This is where our Share Sleuth evaluates the companies in his portfolio. Here's his latest analysis.

Share Sleuth remains a blow-by-blow account of running a portfolio. It documents the trades, discusses performance (rarely, any more would be a distraction), and explains the portfolio's methodology and its objective, which is to buy shares in good companies at reasonable valuations and hold them for the long term.

Share Watch is where I evaluate the shares in the portfolio, plus a similar number of shares that might make better investments: the companies on my watchlist.

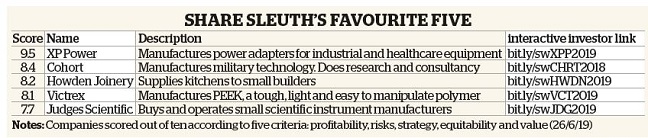

We are dispensing with 'add', 'watch', and 'eject' recommendations and replacing them with a list of my favourite five shares, updated every month.

This is potentially more useful than the top 10 holdings disclosed by fund managers, which are a fund's biggest shareholdings but not necessarily the shares the fund manager would buy now.

The favourite five (see table below) are the highest-ranked shares according to my research process, which scores each share according to five criteria: profitability, risks, strategy, equitability and value. These are the shares I am most confident in.

Confidence from within

Please bear in mind my confidence in shares will sometimes be misplaced: it is an occupational hazard when dealing with the future, so holding shares for the long term requires you, the potential owner, to familiarise yourself with the shares before buying them.

Holding shares through thick and thin is much less nerve-jangling if your confidence in them comes from within.

You can find out in more detail what I thought of the favourite five in previous editions of Share Watch by following the links to our sister website, interactive investor.

Recently I have been taking a closer look at Churchill China (LSE:CHH) and Next (LSE:NXT), two admirable companies.

Churchill China (CHH)

More than a decade ago Churchill China (LSE:CHH) changed course in response to the threat posed by cheap imported Chinese tableware. Since then profit has grown every single year.

The company gradually withdrew from selling us tableware, concentrating instead on the hospitality industry. Restaurants, pubs and caterers are demanding customers in terms of price and specification, but they are also repeat customers if the product is good.

Traditionally, most of the tableware they buy is plain, white and strong enough to take a bashing in commercial kitchens, but Churchill China has found a way to apply textures, patterns and colours cheaply, making more distinctive plates that "frame the food".

Over the past five years it has profited handsomely by selling highly durable and attractive plates into a European market dominated by large German manufacturers.

As market leader in the UK, where restaurants have been closing, it does not have exciting growth prospects at home; and Brexit is a risk to growth in Europe, where it is a much smaller fish.

But this family-owned business should continue cranking out growth as it presses home an advantage built on recent design innovations and the enduring qualities of hardwearing British ceramics.

Next (NXT)

One of the attractions of Churchill China is its experienced board, which has adapted the business to changing circumstances. At the helm of Next (LSE:NXT) we have Lord Wolfson, who over more than two decades oversaw the hugely profitable rollout of Next's high street stores and the growth of its catalogue, Next Directory.

The catalogue has migrated online, where today Next earns about half of revenue and the bulk of profit. Partly due to its credit arm, Next Pay, it is still the most profitable retailer of its peers, including internet-only retailers like ASOS (LSE:ASC) and Boohoo (LSE:BOO); but revenue and profit growth have stalled over the last three years. Next is repositioning the stores to be a more effective part of its distribution network, including its own warehouses and those of other clothing brands.

The company has already taken the revolutionary step to sell rival brands through its own website and is repositioning itself as a marketplace that will be their cheapest sales channel, promising to give back any profit over the 16% margin it requires. For some years now, sales of other brands have been the fastest-growing bit of Next, so the strategy is built on a good foundation.

Neither Next nor Churchill China scores highly enough to make it into my favourite five, but they both score well and may be good long-term investments.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.