Two standout shares I’d buy in this popular sector

26th April 2023 08:46

by Rodney Hobson from interactive investor

Corporate America is pumping out first-quarter results at speed, but the numbers reflect varying degrees of success. Overseas investing expert Rodney Hobson names shares he likes and one to sell.

Optimism sparked by a decent set of banking results to start the US quarterly reporting season was soon deflated by a disappointing follow-up set of figures. There are always winners and losers whatever the economic circumstances.

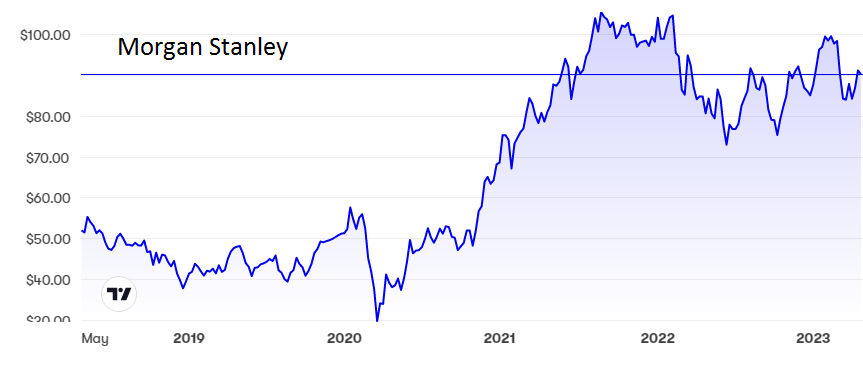

While rising interest rates helped JPMorgan Chase & Co (NYSE:JPM), Citigroup Inc (NYSE:C) and Wells Fargo & Co (NYSE:WFC) in the first quarter of 2023, it was the lack of deal-making that hit top investment bank Morgan Stanley (NYSE:MS), which also took a knock from setting aside $234 million (£188 million) to cover bad loans.

- Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Revenue was down at $14.5 billion, though only by 1.9%, so this was far from catastrophic. Even though net income slid 18% to just over $3 billion, analysts had feared worse. And while mergers and acquisitions were in short supply, causing revenue in the core investment banking arm to fall by 24%, at least wealth management offered shareholders a fair degree of solace with revenue up 11%. This division brought in $109.6 billion in net new assets, some from smaller banks suffering from a crisis of confidence after the failure of Silicon Valley Bank.

Life will continue to be tough in the second quarter, but Morgan Stanley should have little difficulty in coming through without too much pain until business starts to pick up in the second half. American companies are reported to be lining up bids for undervalued British stocks, which should certainly help.

Also banks tend to be sensibly overcautious at this stage of the economic cycle and put aside too much to cover debt defaults, so some of the first quarter provisions could well be written back in by year end.

The shares have made several attempts to break above $100 since recovering from the pandemic crash, but have sunk back to $88 where the price/earnings (PE) ratio is not too challenging at 15.5 and the yield is a decent 3.35%.

Source: interactive investor. Past performance is not a guide to future performance.

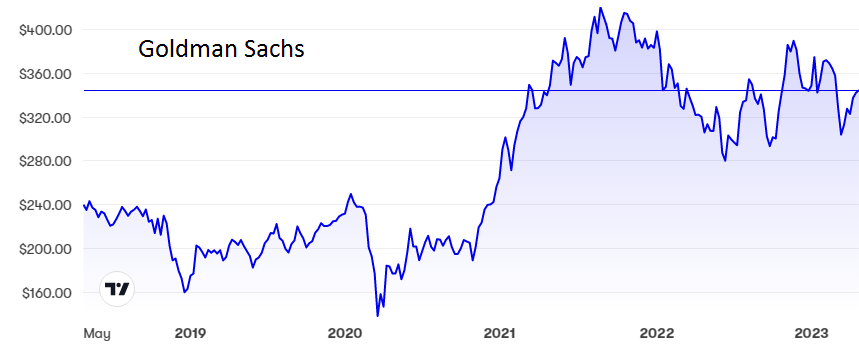

It is much harder to feel optimism about The Goldman Sachs Group Inc (NYSE:GS), which has suffered the same problems as rivals without managing to find any silver linings. In contrast to its rivals, Goldman saw sales in its fixed income division tumble 17%.

Group revenue declined 5% to $12.2 billion in the quarter while net earnings slumped 19% to $3.1 billion. This has persuaded Goldman to reverse its previous policy of an aggressive move into mainstream banking. It has now sold off a chunk of its consumer loan book and the rest is up for sale. The GreenSky financial technology business bought for $2.24 billion just over a year ago is also to be disposed of, probably at a loss.

- Can tech giants deliver in bumper earnings week?

- Two bank stocks to buy and one to hang on to

- ii view: McDonald’s sales stay robust during cost-of-living crisis

The shares are well down from a 12-month peak at $389 but may not find support at the current level around $340,where the PE ratio could be too demanding even at a below average 12.2, and the yield of 2.8% is insufficient compensation for the looming problems.

Source: interactive investor. Past performance is not a guide to future performance.

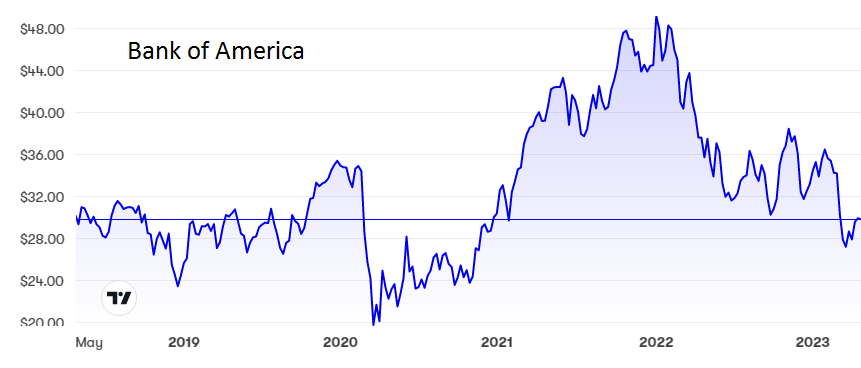

At least Bank of America Corp (NYSE:BAC) put some colour back into investors’ cheeks despite announcing that it is to reduce its workforce by 2% by shedding 4,000 jobs rapidly.

Revenue rose 13% to $26.26 billion as its bond traders enjoyed their best quarter for a decade. A 16% rise in net income to $7.66 billion was the best performance among the major banks and BoA seems to have benefited more than most from the flight away from smaller rivals.

Source: interactive investor. Past performance is not a guide to future performance.

The shares have tumbled from $49 at the start of last year to only $29 now. That does not reflect the improved prospects.

Hobson’s choice: Buy Morgan Stanley below $99. The downside looks limited to $84. Sell Goldman Sachs. There is clearly better value in the sector and even $300 may not hold. Buy Bank of America up to $36.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.