Two stocks to own as oil price races toward $100 a barrel

4th February 2022 08:37

by Rodney Hobson from interactive investor

Despite the pressure on government to reduce the use of fossil fuels, life is looking brighter for oil companies than at any time in the past two years, says our overseas investing expert. Here are the two stocks he'd buy.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Crude oil prices are back up to levels last seen in 2014 as the world has bounced back more quickly than expected from the pandemic lockdowns, with March contracts for the key West Texas Intermediate and Brent crudes push up towards £90 a barrel. Many experts think the next stop is $100.

Despite the pressure on government to reduce the use of fossil fuels, life is looking brighter for oil companies than at any time in the past two years.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

Two factors could affect the equation. Opec, the oil producers’ cartel, plus non-members led by Russia, have agreed to increase supply by 400,000 barrels by March and Iran is seeking to return to the oil market as soon as possible.

However, Opec members have managed only an extra 210,000 barrels so far and there is considerable scepticism over whether it can, or indeed wants to, raise production much further in the next couple of months.

Several members, notably Nigeria and Angola which have failed to invest sufficiently in production, have been unable to fulfil their higher quotas. Meanwhile, Iran still faces sanctions in the West and supplies from Russia will be disrupted if fighting breaks out in Ukraine.

- No trading fees on US shares until 11 February. Click here for details

- Watch our share, fund and trust tips, plus outlook videos for 2022

- US stock market outlook 2022: more record highs for Wall Street?

- Top 10 things you need to know about investing in the US

The US and other consuming countries have tried to offset the impact of production shortfalls by releasing oil from strategic reserves, but this can only be a short-term palliative move, not a cure.

Crude production was reduced heavily in 2020 in the depths of the Covid-19 pandemic when it became impossible to give oil away free, let alone sell it. Having bitten that somewhat unpleasant bullet, producer nations are realising they can make more money from higher prices rather than higher production.

At best, crude prices will be restrained rather than sent plummeting. Every dollar on a barrel of oil is a significant boost to the profits of oil companies.

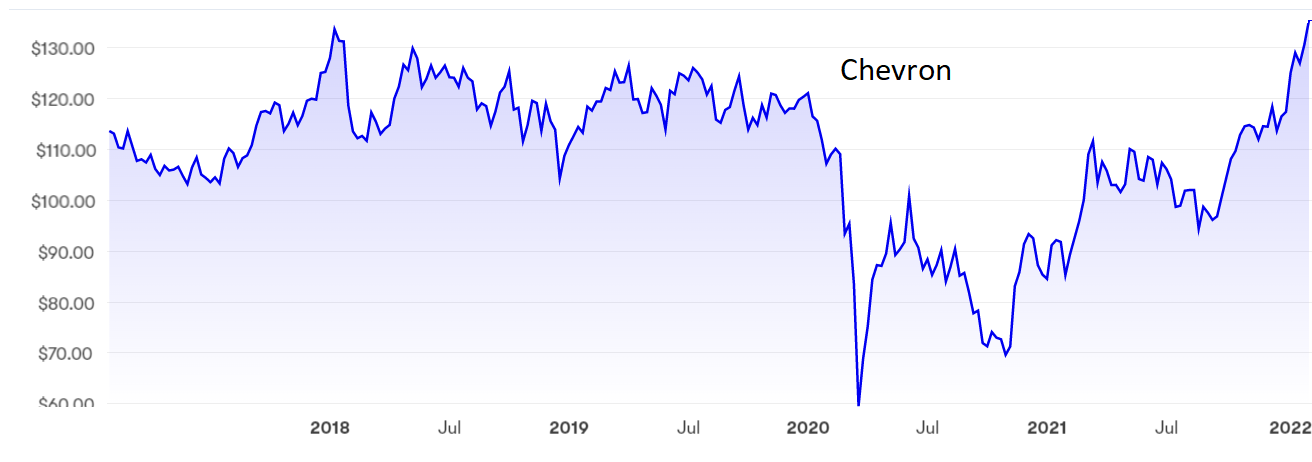

The rosier picture was reflected in fourth-quarter figures from Chevron Corp (NYSE:CVX) and Exxon Mobil Corp (NYSE:XOM). Chevron reported net income of $5.08 billion, easily wiping out the $665 million loss suffered in the same period of 2020 when the oil industry was in crisis.

So much went well as Chevron achieved record cash flow: earnings from the upstream business leapt from $501 million to $5.16 billion while exploration costs fell; the downstream unit swung from a loss of $338 million to profits of $760 million.

Source: interactive investor. Past performance is not a guide to future performance.

There were some favourable distortions such as better weather in the Gulf of Mexico, but even so it is hard to ignore the remarkably better overall picture. The average sales price per barrel of crude oil almost doubled from $33 to $63 just as production jumped from 21,000 barrels a day to 1.22 million.

That meant full year profits hit $15.6 billion compared with a loss of $5.5 billion in 2020. Production reached a record 3.1 million barrels a day while 1.3 billion barrels were added to proved reserves.

- Worst January for Nasdaq since 2008 crisis

- Four US stocks to own for pricing power

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

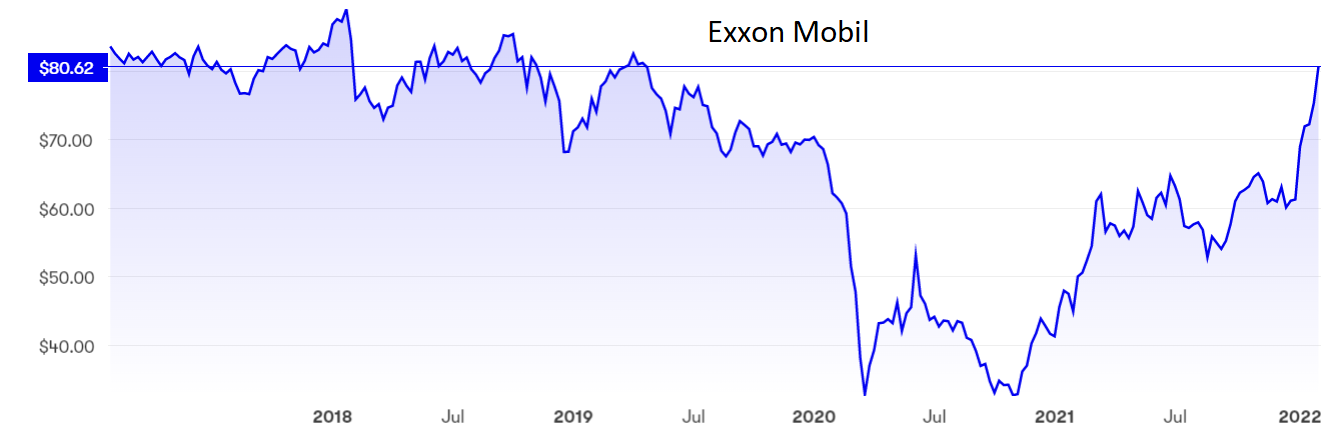

Exxon also swung from loss to profit, producing earnings of $8.87 billion for the final quarter and $23.04 billion for the full year. Its downstream arm refined more oil than in any quarter since 2013 and full-year earnings from chemicals hit a record. Exxon is making up for lost opportunities in 2020.

Source: interactive investor. Past performance is not a guide to future performance.

Exxon shares have more than doubled over the past 15 months from $34 to just under $80, where the yield is an attractive 4.33%, but they are still below peaks reached in 2019 and 2020. Chevron shares have also doubled, from $60 in March 2020 to $134 now. The yield is 3.92%.

Hobson’s choice: Exxon and Chevron are well ahead since I advised shareholders to hold on in November. At that stage I was worried about clouds still hanging over the sector. Those clouds have blown away and it is not too late for newcomers to buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.