The two UK funds Saltydog has just bought

UK funds have seen performance pick up of late, says our Saltydog analyst.

23rd November 2020 13:25

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

UK funds have seen performance pick up of late, says our Saltydog analyst.

From 1 January 2020 to the end of October, the FTSE 100 fell by 26%. It is not the only stock-market index that has struggled this year, but it has done worse than most.

The big fall came during the first quarter of the year as it became clear that the Covid-19 outbreak that began in China was spreading around the world.

In the first three months of the year, the FTSE 100 lost 25% of its value. In the US, the S&P 500 fell by 20% over the same period, and the Nasdaq was down 14%. In Japan, the Nikkei 225 dropped 20% and in Germany the DAX shrank by 25%. It was a similar story for other stock markets.

Over the next seven months, most stock markets rebounded. The S&P 500 went up by 27%, the Nasdaq gained an amazing 42%, the Nikkei 225 grew by 21% and the DAX made 16%. However, after making a brief recovery, the FTSE 100 dropped back again and between the beginning of April and the end of October lost a further 2%.

- The most consistent fund over the past three years

- Investing during the second wave: time to buy emerging markets?

- ii Super 60 investments: quality options for your portfolio, rigorously selected by our impartial experts

In November, there was another upturn in markets and this time the UK has not been left out. In the last three weeks, the FTSE 100 has gone up by 13.9%.

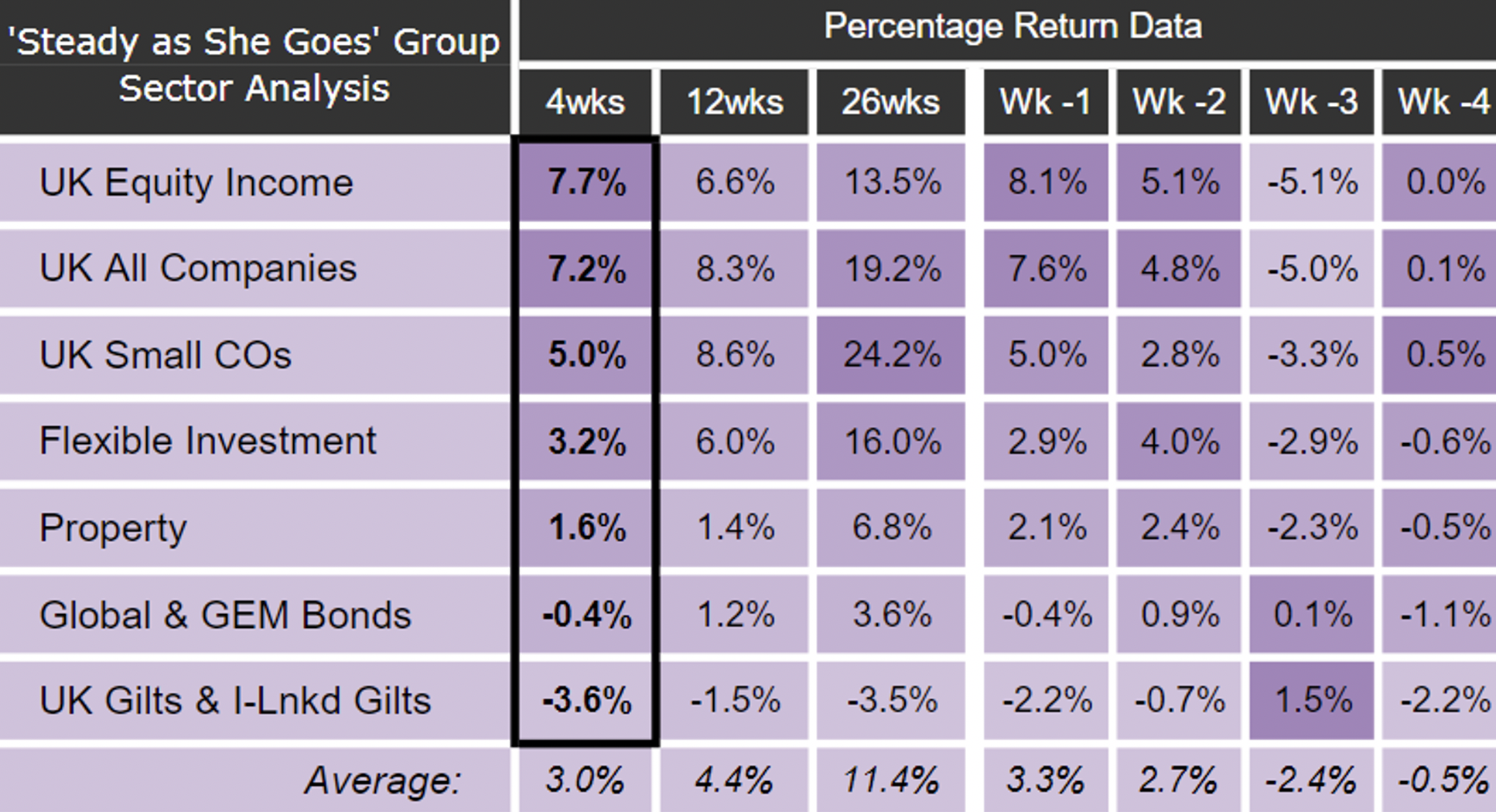

Each week, we analyse the performance of a wide range of funds. We sort them, based on their Investment Association sector, and put them into our Saltydog Groups, based on their historic volatility. The Saltydog Groups are: Safe Haven, Slow Ahead, Steady as She Goes, and Full Steam Ahead (which we split into developed and emerging markets).

When we reviewed the numbers last week, the best performer over the previous four weeks, was Steady as She Goes. The leading sectors, from any group, were UK Equity Income and UK All Companies.

Data source: Morningstar

We have only had a relatively small amount of exposure to the funds from the UK Equity sectors in our demonstration portfolios.

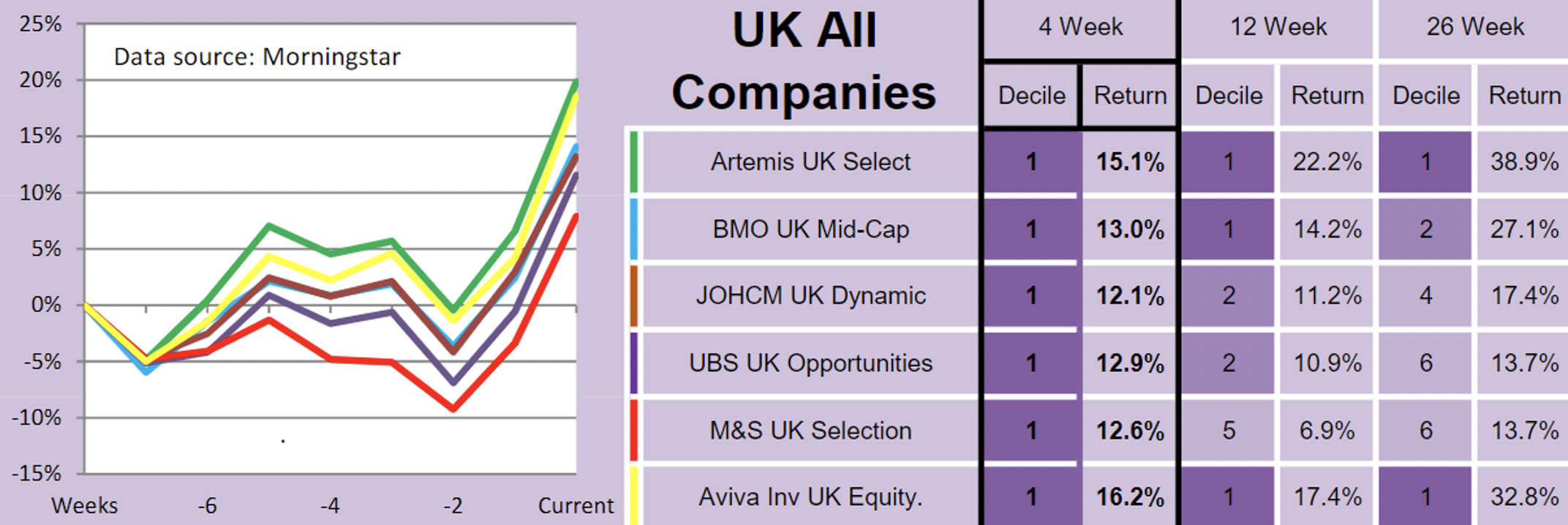

We invested in the Kames UK Opportunities fund, from the UK All Companies sector, towards the end of April and held on to it after it changed its name to Aegon UK Opportunities. In just under seven months, it had gone up by nearly 20%, a great result, but it looks like other funds in the same sector are now leading the way. Last week, we sold it.

We have replaced it with a fund that features in our latest analysis: the Artemis UK Select fund.

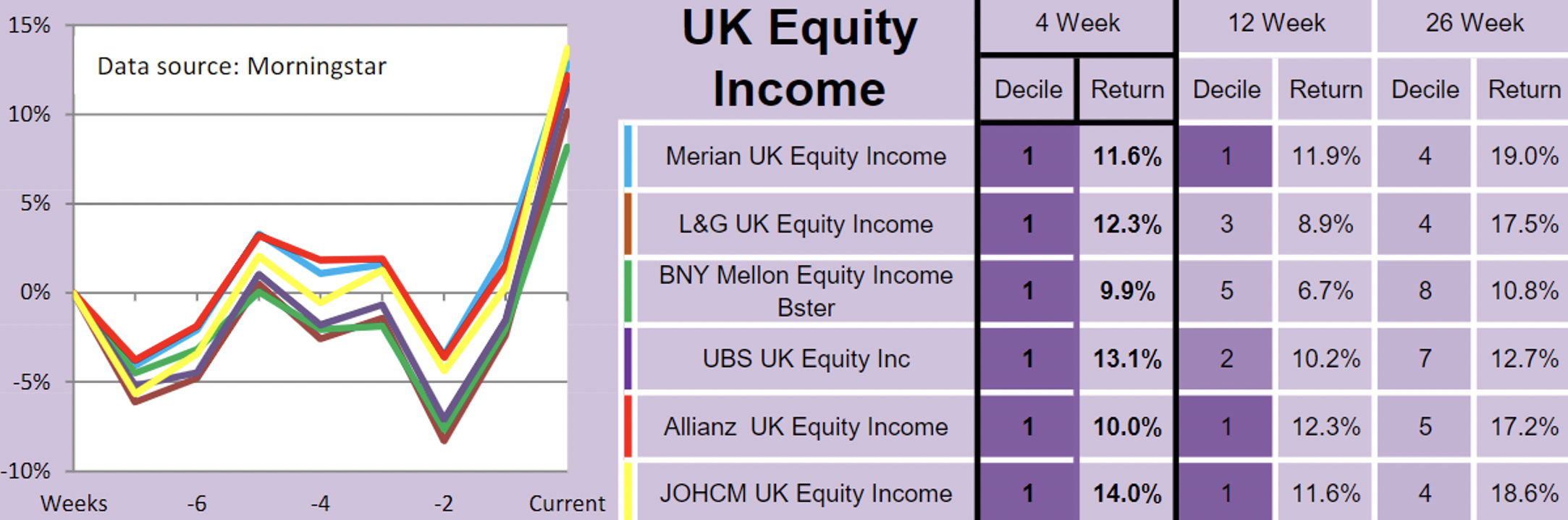

We have also invested in the Merian UK Equity Income fund from the UK Equity Income sector.

Hopefully, we will now see the UK market start to catch up with other stock markets around the world.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.