Two UK income funds we’ve just bought

5th December 2022 11:02

by Douglas Chadwick from ii contributor

Saltydog Investor’s optimism continues, with UK income funds the latest to be added to portfolios.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

A few weeks ago we invested in two funds from the UK All Companies sector and two funds from the UK Smaller Companies sector. It is early days, but they have started well and are already showing modest gains.

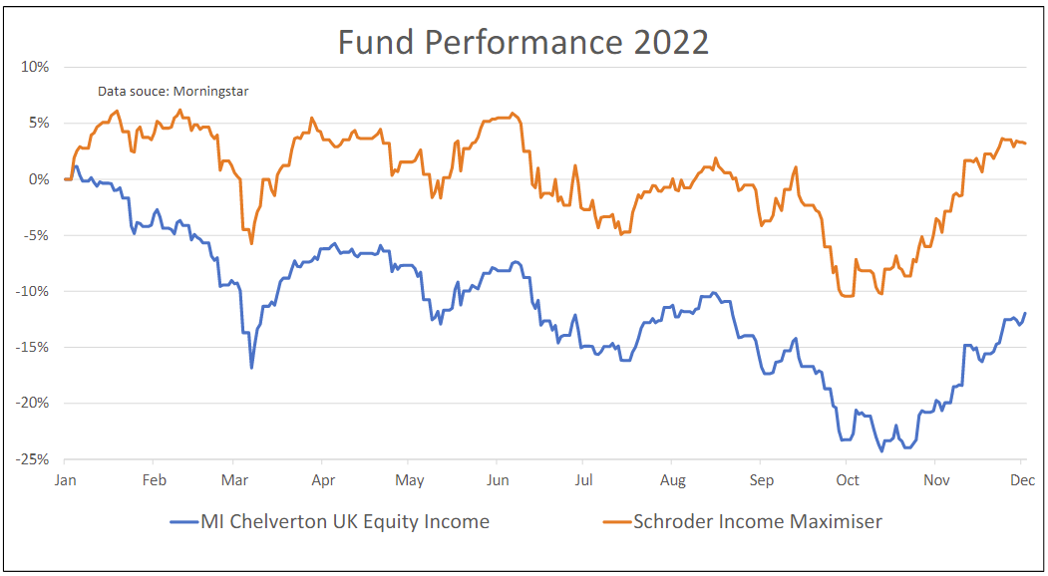

Last week we also invested in two funds from the UK Equity Income sector: MI Chelverton UK Equity Income and Schroder Income Maximiser.

Although their performance was quite different at the beginning of the year, since March they have followed a similar pattern and they have both had an impressive November, rallying from the October lows.

Past performance is not a guide to future performance.

It has been a difficult year for stock markets all around the world, but the UK’s FTSE 100 has done better than most. Last month it rose 6.7%, and it is one of the few indices that we track that is ahead of where it was at the beginning of the year. The other two are the Indian Sensex and the Brazilian Ibovespa.

The FTSE 250 did well in November, gaining 7.1%, but is still down 18.4% so far this year.

Although most of the stock market indices that we track fell in the first three quarters of the year and are showing year-to-date losses, the last two months have been much more encouraging.

Stock market indices 2022

| Index | Jan, Feb, March | April, May, June | July, Aug, Sept | Oct | Nov | Year-to-date |

| FTSE 100 | 1.8% | -4.6% | -3.8% | 2.9% | 6.7% | 2.6% |

| FTSE 250 | -9.9% | -11.8% | -8.0% | 4.2% | 7.1% | -18.4% |

| Dow Jones Ind Ave | -4.6% | -11.3% | -6.7% | 14.0% | 5.7% | -4.8% |

| S&P 500 | -4.9% | -16.4% | -5.3% | 8.0% | 5.4% | -14.4% |

| NASDAQ | -9.1% | -22.4% | -4.1% | 3.9% | 4.4% | -26.7% |

| DAX | -9.3% | -11.3% | -5.2% | 9.4% | 8.6% | -9.4% |

| CAC40 | -6.9% | -11.1% | -2.7% | 8.8% | 7.5% | -5.8% |

| Nikkei 225 | -3.4% | -5.1% | -1.7% | 6.4% | 1.4% | -2.9% |

| Hang Seng | -6.0% | -0.6% | -21.2% | -14.7% | 26.6% | -20.5% |

| Shanghai Composite | -10.6% | 4.5% | -11.0% | -4.3% | 8.9% | -13.4% |

| Sensex | 0.5% | -9.5% | 8.3% | 5.8% | 3.9% | 8.3% |

| Ibovespa | 14.5% | -17.9% | 11.7% | 5.5% | -3.1% | 7.3% |

Source: Morningstar. Past performance is not a guide to future performance.

The general improvement in October and November is also reflected in our latest Investment Association (IA) sector analysis. Last month, nearly all sectors made gains, but there were some exceptions.

The US sectors struggled with North America only just breaking even and North American Smaller Companies making a loss of 1.9%. The USD Government Bond, USD High Yield Bond, and USD Mixed Bond sectors (which we group together with the other global bonds) also fell. However, during the month the pound strengthened by over 5% against the dollar, which would not have helped the performance of these funds when converted into sterling.

- Ten growth funds the pros have been sticking by despite style rotation

- The big risk fund managers are braced for in 2023

Only four other sectors lost value: UK Direct Property, Healthcare, Financials & Financial Innovation, and Latin America.

In our “Steady as She Goes” group, the three UK Equity sectors, UK All Companies, UK Equity Income and UK Smaller Companies, were towards the bottom of the group in August and September. In October, they moved up to second, third and fourth place, and last month they were first, second and third. UK All Companies and UK Equity Income were at the top with a one-month return of 7.5%.

Past performance is not a guide to future performance.

For most of this year our demonstration portfolios have been mainly in cash, or the money market funds, and that is still the case. However, over the past couple of months we have started venturing back into the markets.

After the Liz Truss debacle and the disastrous mini-budget, the UK now seems to be on a more even keel. Our economy still faces many challenges ahead, but that is true all around the world. It appears that, at least for the time being, there is more confidence that we are heading in the right direction and that there are brighter times ahead.

We are pleased with the performance of the UK funds that we bought in November, and hope that the upward trend continues, which should also benefit our latest investments.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.