Two winning stocks in a $300 billion market

More of us will work from home, even once the pandemic is history. This pair will profit from the trend.

20th January 2021 09:22

by Rodney Hobson from interactive investor

More of us will work from home, even once the pandemic is history. This pair will profit from the trend.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

As Covid-19 vaccinations proceed apace in countries such as the UK and India, and with President-elect Joe Biden set to speed up jabs in the United States, it could be that employees can look forward to seeing their colleagues some time soon.

On the other hand, it seems likely that many companies of various shapes and sizes have discovered that working from home is a better alternative to long commutes and high office rents. At the very least, quite a few companies will have developed a hybrid workforce with some employees operating part of the time from home and others in the office.

- Invest with ii: Most-traded US Stocks | Buy International Shares | Interactive investor Offers

The pandemic has forced a wide range of companies to accelerate their transition to cloud computing as a way of keeping home workers fully connected to each other. Spending on cloud services could easily top $300 billion as it absorbs an increasing proportion of overall IT spending over the next three or four years.

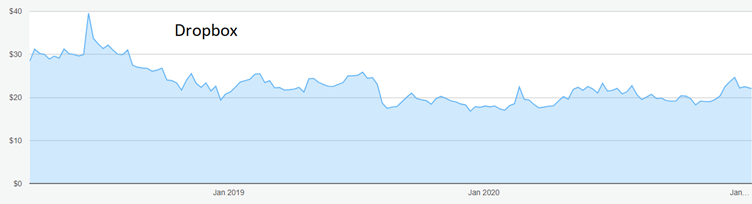

One company that would benefit considerably from this scenario is Dropbox (NASDAQ:DBX), which calls itself “the world’s first smart workspace” offering cloud storage and content management. Although it is up against the might of Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOGL), it is no tiddler, with a recognised brand and a global base of more than 600 million users across 180 countries.

- Your 50 most-popular US stocks

- Investing in the US stock market: a beginner’s guide

- Want to buy and sell international shares? It’s easy to do. Here’s how

Even so, it would be rash to assume that Dropbox will continue last year’s stellar growth, which saw third-quarter results beating analysts’ expectations, with revenue up 13.8% year-on-year. Growth is already slowing, from 16.4% in the second quarter, and the company’s guidance for the final quarter is 12%. The figures will be released in early February but could well reflect the impact of increased competition, causing revenue growth to slow to high single digits by the end of 2021.

Source: interactive investor. Past performance is not a guide to future performance

What is encouraging is that, like many high-tech companies, Dropbox has built a solid user base before working on converting freeloaders into paying customers, then into users of higher paying services, then into return customers. Of those 600 million users, only about 16 million actually cough up.

Third-quarter revenue was boosted by a 9% increase in paying users and from a greater use of higher-priced subscription plans. Annual recurring revenue improved by 12% and adjusted earnings per share doubled as operating margins improved.

Another positive sign, though it initially knocked the share price, is that Dropbox itself has found that allowing employees to work from home has its benefits. Its decision to make 315 employees, 11% of the workforce, redundant was not a sign of retreat but an acknowledgement that it needed fewer support staff if there were fewer workers in the office.

This will release cash to be ploughed into parts of the business that return the most profit or are growing fastest. Management is targeting free cash flow of $1 billion in 2124.

- Tesla: is Elon Musk’s vast fortune safe?

- Most-bought US stocks in 2020

- Why you must spread your investing wings in 2021

Chief operating officer Olivia Nottebohm leaves at the beginning of February, but chief executive Drew Houston, a co-founder of the company, and chief financial officer Tim Regan provide more than adequate continuity.

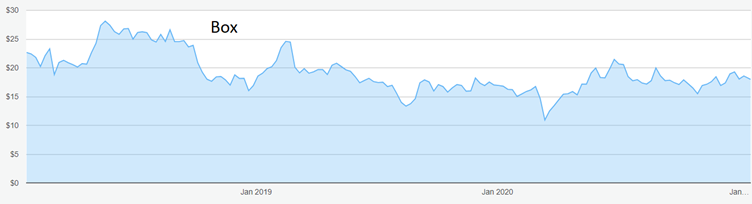

Discover what’s inside the Box

An investment alternative, with a shorter name and a smaller presence, is Box (NYSE:BOX), a leader in the sophisticated world of content management services, which is in an early stage of shifting onto cloud computing.

It has been held back over the past 12 months by the impact of Covid-19 on smaller businesses that form a large part of its customer base. Even so, revenue grew 10.6% in the third quarter to 31 October, beating analysts’ forecasts.

Source: interactive investor. Past performance is not a guide to future performance

As at Dropbox, growth has slowed slightly, though not alarmingly, from 11.4% in the second quarter, while the number of paying customers is growing. Although a loss was recorded, the underlying figures moved into a small profit. Box is concentrating on growing those profits by cutting costs, improving margins and requiring all future spending to demonstrate a strong return on investment.

- What is earnings season?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Dropbox shares started trading at $28 nearly three years ago but have fallen back from an early overoptimistic peak just below $40. A solid floor has been established at $17. Box has moved erratically between $11 and $29 but has settled in a tighter range just below $20.

Hobson’s choice: Buy Dropbox up to $23. Some analysts think it will reach $30 this year but there could be resistance around $25. Box is worth considering below $20. The target here is at least $23.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.