UK shares shine in a mixed April for markets

3rd May 2023 10:40

by Douglas Chadwick from ii contributor

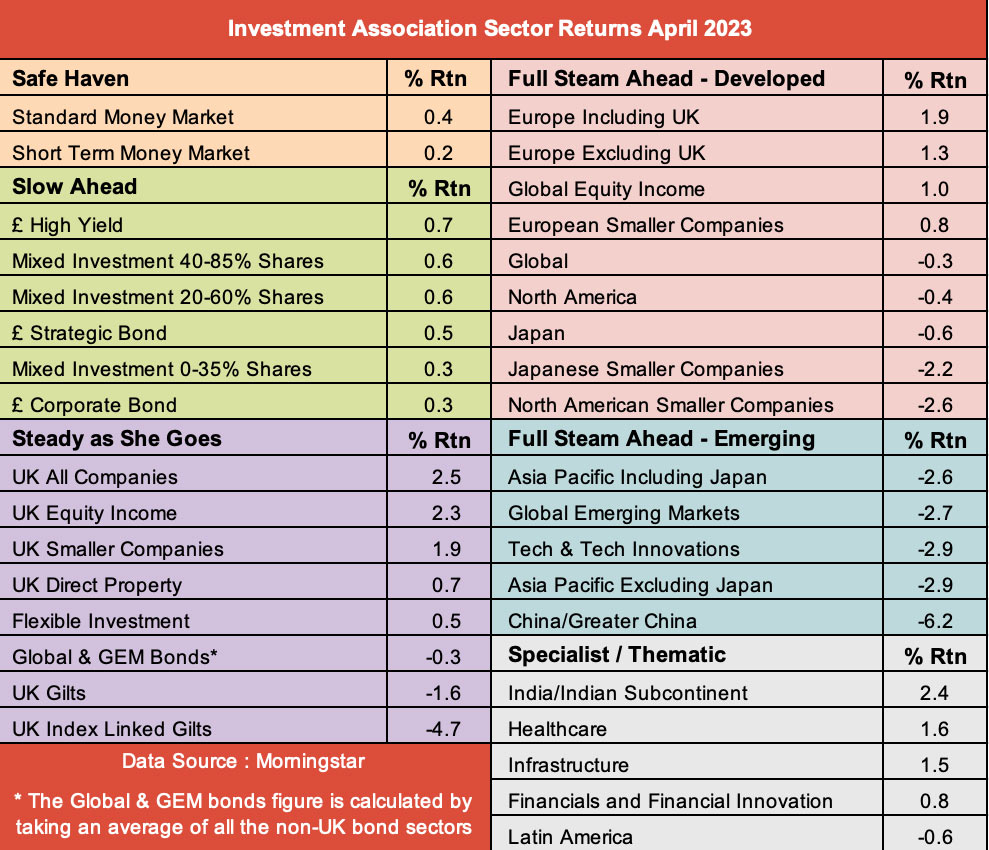

All three UK fund sectors were stronger performers last month, but US and global funds disappointed.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

There are three Investment Association (IA) sectors for funds that primarily invest in UK equities. Two are for funds principally targeting growth, namely UK All Companies and UK Smaller Companies, and one is for funds mainly targeting income, UK Equity Income.

- Invest with ii: ii Super 60 Investments | Transfer an Investment Account | Free Regular Investing

The best-performing sector last month was UK All Companies with a one-month return of 2.5%.

Past performance is not a guide to future performance.

Next was the India/Indian Subcontinent sector, which rose 2.4%, but the other two UK equity sectors were not far behind. UK Equity Income was in third place, up 2.3%, and then it was UK Smaller Companies, up 1.9%.

The European sectors, which are among the best-performing sectors so far this year, also made further gains.

Unfortunately, the sectors representing the countries with the largest economies in the world did not do so well. The two North American sectors, China/Greater China, and the two Japanese sectors all fell in value.

The best-performing sector so far this year is still Technology & Technology Innovations, but it dropped 2.9% last month.

Our top 10 funds, based on their returns in April, come from an unusually wide range of sectors. There are six in total: Property, UK All Companies, UK Equity Income, India/Indian Subcontinent, Global and Specialist.

Saltydog’s top 10 funds in April 2023

| Fund name | Investment Association sector | Monthly return |

| abrdn UK Real Estate Share | Property | 7.3 |

| abrdn UK Value Equity | UK All Companies | 5.9 |

| Premier Miton Pan European Property Share | Property | 5.4 |

| Jupiter India | India/Indian Subcontinent | 4.9 |

| Invesco Income & Growth UK | UK All Companies | 4.5 |

| Pictet-Biotech | Specialist | 4.4 |

| IFSL Marlborough Multi-Cap Growth | UK All Companies | 4.3 |

| CT UK Equity Income | UK Equity Income | 4.1 |

| Trojan Global Equity | Global | 4.1 |

| CT UK Equity Alpha | UK Equity Income | 4.1 |

Data source: Morningstar. Past performance is not a guide to future performance.

Overall, last month was better than both February and March, but not as good as January. Nearly 70% of the funds that we track went up, nearly twice as many as we saw in March, and the average return for all the funds that we analyse was a gain of 0.3%, compared with a loss of 1.1% the previous month. However, most of the gains were made a few weeks ago and the last fortnight has not been so encouraging. Last week, 75% of the funds fell in value.

In our demonstration portfolios we remain cautious with most of our investment in either cash or money market funds. The remainder is in funds from the UK All Companies, Europe including UK, Europe excluding UK, and Specialist sectors.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.