US outperformance: all good things must come to an end?

A Kepler analyst and believer in mean reversion asks whether this is what’s down the road for the mighty US market.

1st August 2025 14:09

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

In researching how to introduce an article on mean reversion, I stumbled across a lecture given by John C. Bogle, founder of the index fund provider Vanguard, to the Massachusetts Institute of Technology’s Lincoln Laboratory in January 1998.

It struck me that there were many parallels with today’s investment environment (don’t forget, the US was deep into a long bull market that would, in time, accelerate and turn into the dotcom bubble).

The premise of the article was that while some opposing components of the stock market (value and growth, for instance) tend to out- or under- perform each other on occasion, over the long run, they converge and generally exhibit similar returns. In short, they revert to the mean.

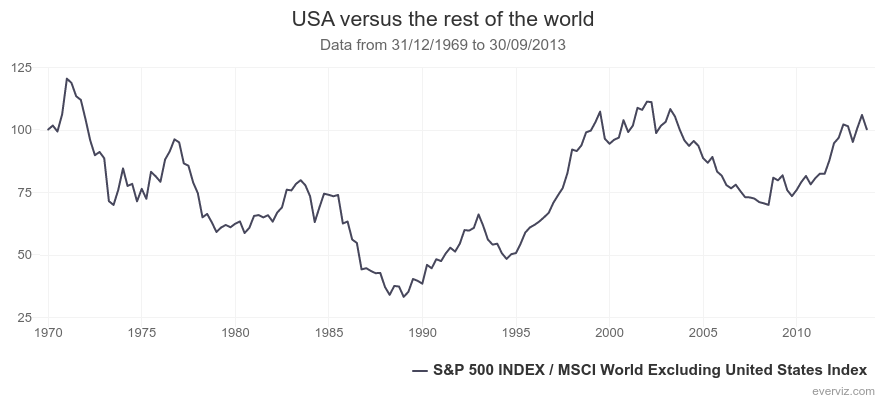

One example given by Bogle was US versus international stocks. Bogle looked at data for the 38 years to 1998 using the S&P 500 Index for US stocks and the MSCI Europe, Australia and Far East (EAFE) Index for international stocks.

He found that during the first 24 years of this period, the EAFE index returned slightly more than the S&P 500 (9.7% per year versus 8.4%), before EAFE went on to rout the S&P 500 between 1984 and 1988. In the nine following years, though, the S&P 500 bounced back to form to recover all of its underperformance.

By the end of Bogle’s 38-year period, both the S&P 500 and MSCI EAFE had each returned compound annualized gains of 11.5%. “The relative value of each initial $1 invested by the investor who stayed in the US was worth precisely the same for the internationalist,” Bogle said. “Over the long run, then, reversion to the mean has clearly manifested itself in global equity markets.”

You can see a version of that in the chart below, which plots the return of the S&P 500 relative to the MSCI World ex-US Index between December 1969 and September 2013, where if the line is above 100, the US is outperforming and if the line is below 100, the rest of the world is outperforming.

We start at 100 at the end of 1969 and the rest of the world outperforms the US for almost three decades, until the US starts to pick up and reverses all its underperformance. The chart starts and finishes at 100, meaning both indices returned the exact same amount.

Going on a round trip

Source: Bloomberg. Past performance is not a reliable indicator of future results

A record to be broken

As a young(ish) person with a relatively low weighting to US markets (around 33% across my SIPP and ISA portfolios), this finding resonated. I still have what I believe is a decent amount invested in the US, but it’s a c. 50% underweight versus, say, the MSCI All-World Country Index.

This is broadly because I believe that it will be almost impossible over the next couple of decades for the massive outperformance US markets have produced versus every other asset class, let alone equity region, to continue.

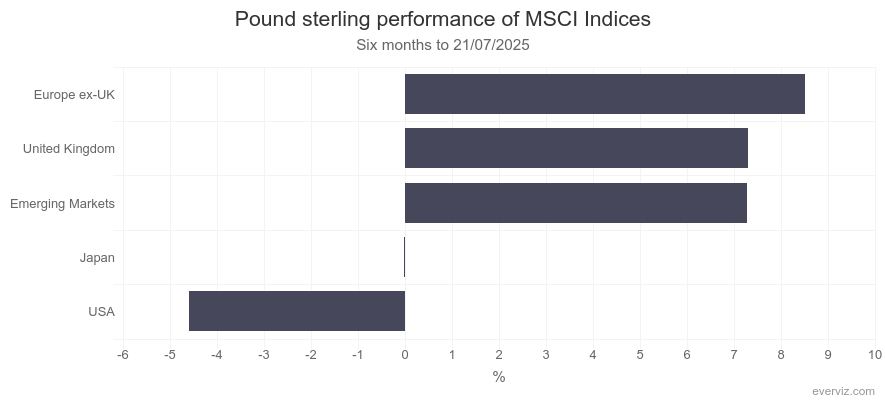

Happily, a cursory glance at my best-performing investments shows that this thesis is coming true, for the time being. Top of my ISA performers are UK funds such as Temple Bar Ord (LSE:TMPL), Fidelity Special Values Ord (LSE:FSV)and Odyssean Investment Trust Ord (LSE:OIT), as well as Montanaro European Smaller Ord (LSE:MTE). When it comes to my SIPP, Fidelity China Special Ord (LSE:FCSS) leads the way, ahead of MTE, Aberforth Smaller Companies Ord (LSE:ASL)and Fidelity Emerging Markets Ord (LSE:FEML).

That’s certainly a broad spread of different regions and countries outperforming their US counterparts in recent months. Indeed, while the S&P 500 Index returned circa 4.6% in the six months to 21 July 2025 in US dollar terms, the pound sterling denominated Vanguard S&P 500 exchange-traded fund (ETF) has shed c. 4.2% in value. By contrast, the Vanguard FTSE 100 and Vanguard FTSE 250 ETFs are up c. 7.3% and 8.3% respectively over the same time frame.

Six-month stock market performance

Source: FE fundinfo Past performance is not a reliable indicator of future results

Some now argue that the US is so exceptional it will reinstate its world domination in due course, as soon as President Trump finishes chickening out of every threat he’s made since becoming the leader of the free world.

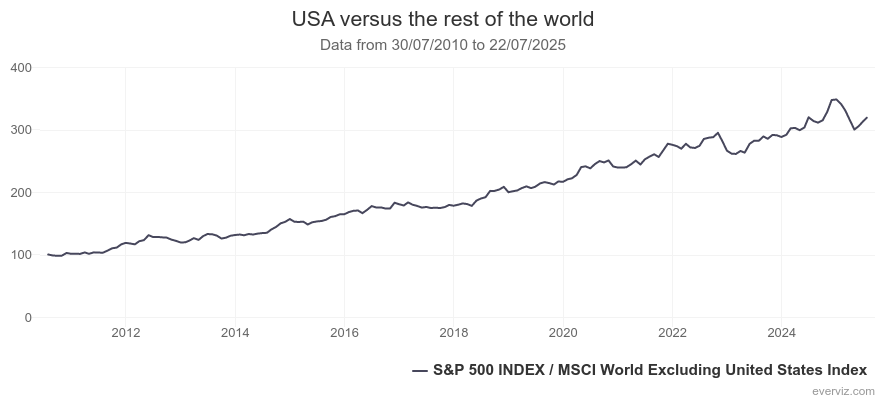

Yet, if one believes in mean reversion, as Bogle did, it seems to me that the scene is set for the US to underperform. Consider the chart below, which shows the return of the S&P 500 relative to the MSCI World ex-US Index for the past 15 years. There’s barely been any let up in US exceptionalism. The current short period of outperformance from the rest of the world is bigger than what we’ve seen previously, but still resembles a tiny blip.

Unbroken US leadership

Source: Bloomberg. Past performance is not a reliable indicator of future results

A return to the mean would need a very long period of US underperformance and many will be sceptical that this is even possible. Both corporate earnings growth and GDP growth in the rest of the world, bar a few emerging economies, lag the US by a long shot and America’s technological innovation, not to mention the deepness of its capital markets, may very well continue to surprise us all.

Still, Bogle pooh-poohed suggestions that earnings growth (then having averaged 12.6% after inflation for the past 15 years, versus a historical average of 4%) had “moved to a new, distinctly higher, plateau”, something many believe is true today.

Then, $1 of earnings from US equities were selling for $21, which was well above their long-term average of $14, leading Bogle to “suppose it’s fair to say that our future expectations ought to be held in check”. Today, $1 of earnings from US equities are selling for c. $22. That could go higher (as it did in the two years after Bogle’s speech), but the likelihood is over a longer timeframe it will revert to the mean.

Bogle advocated for a total stock market approach for those in the audience – not only focusing on the S&P 500, but also mid-cap and small-cap stocks – through an index fund wrapper. Interestingly, he said that he saw “no compelling reason to include international equities” in portfolios, though I suspect that’s because non-US index funds were harder to come by back then.

Of course, I’m overwhelmingly invested in actively managed funds with only two index funds in my portfolios (and even then they’re what you’d probably call ‘actively passive’). Still, I remain a believer in mean reversion, just as Bogle was. In his words, “I’m willing to stake my own retirement investment strategy on the fact that it will continue to exist”.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.