Value funds bouncing back, but investors left nursing heavy losses

Experts warn that it is too early to claim the tide has turned in favour of value versus growth.

19th August 2020 10:13

by Hannah Smith from interactive investor

Experts warn that it is too early to claim the tide has turned in favour of value versus growth.

Value investing has long been out of favour as an investment style, but recent data shows a marked improvement in performance. What is behind this rebound, and does it mean that we are finally seeing a reversal of fortune for the value approach?

Value investing involves picking stocks that appear to be trading at prices lower than their true value, perhaps because the market has oversold them on some bad news, or a company is going through change.

Looking at a selection of value and recovery funds from across the retail funds universe, we can see that, since the start of the year, the majority have recorded falls of -15% to -25% or more.

However, if you look at performance from 24 March to 12 August, there has been a significant rebound, with funds up 20% to 30% as stock markets recovered from the low point of March’s sell-off.

M&G Recovery, for example, was the best performer since the end of March, up 31%, data from FE Analytics shows. However, it is still heavily in the red year-to-date, down -22%. Tom Dobell’s £1.4 billion portfolio features names such as BP (LSE:BP.), Rio Tinto (LSE:RIO), National Grid (LSE:NG.) and Oxford BioMedica (LSE:OXB) among its top 10 holdings.

Another strong performer since the end of March is Polar Capital UK Value Opportunities, up 28%. The fund, which holds Hikma Pharmaceuticals (LSE:HIK), Persimmon (LSE:PSN) and Brewin Dolphin (LSE:BRW), has fallen -22% year-to-date.

Value funds have struggled because we have been in a low interest rate environment for so long, explains Ben Yearsley, director at Shore Financial Planning. This has meant the banks and insurers that commonly feature in value portfolios have found it harder to make money.

- What is behind the supposed death of value investing?

- Ian Cowie: superheroes’ reserves are lifeline for income investors

- Income hunters can find great funds on ii’s Super 60 recommended list of investments

Bounce off the lows

Yearsley does not think the March to August performance is much more than “purely the bounce off ridiculously low levels”. For example, William Hill (LSE:WMH) is a stock that could be in value or recovery portfolios, and it has gone from 40p in March to £1.48 (at the close of trading on 18 August). “The year-to-date numbers are more telling because they show you there is still a long way to go for value to recover,” he says.

The catalyst for a sustained value resurgence could be something like further clarity over the impact of Brexit, or a resumption of dividends from companies that had stopped their payouts. He pointed to insurer Aviva (LSE:AV.), which recently began paying a dividend again, triggering a share price bounce. “It has got to be either dividends or mergers and acquisitions that will propel value”, he suggests.

- Aviva brings back dividend, though Covid hits profits

- Dividend drought: how severe will UK equity income payout cuts be?

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Shauna Bevan, director at RiverPeak Wealth, says many of her clients hold Man GLG Undervalued Assets, so she would love to see it outperforming again. The fund has dropped -26% year-to-date and gained 22% since March. But she thinks it is too early to say the tide has definitively turned in favour of value versus growth.

“Value has had a couple of stronger periods since the market lows at the end of March but, year-to-date, growth is still the clear winner. It is easy to see why – growth sectors such as technology and healthcare continue to benefit from an acceleration in the structural trends that are changing how people shop, work and access services,” she says.

“Meanwhile, traditional value sectors such as energy and banking have suffered from the dramatic slowdown in economic activity, a structural shift away from fossil fuels and non-existent inflation with low or negative interest rates.”

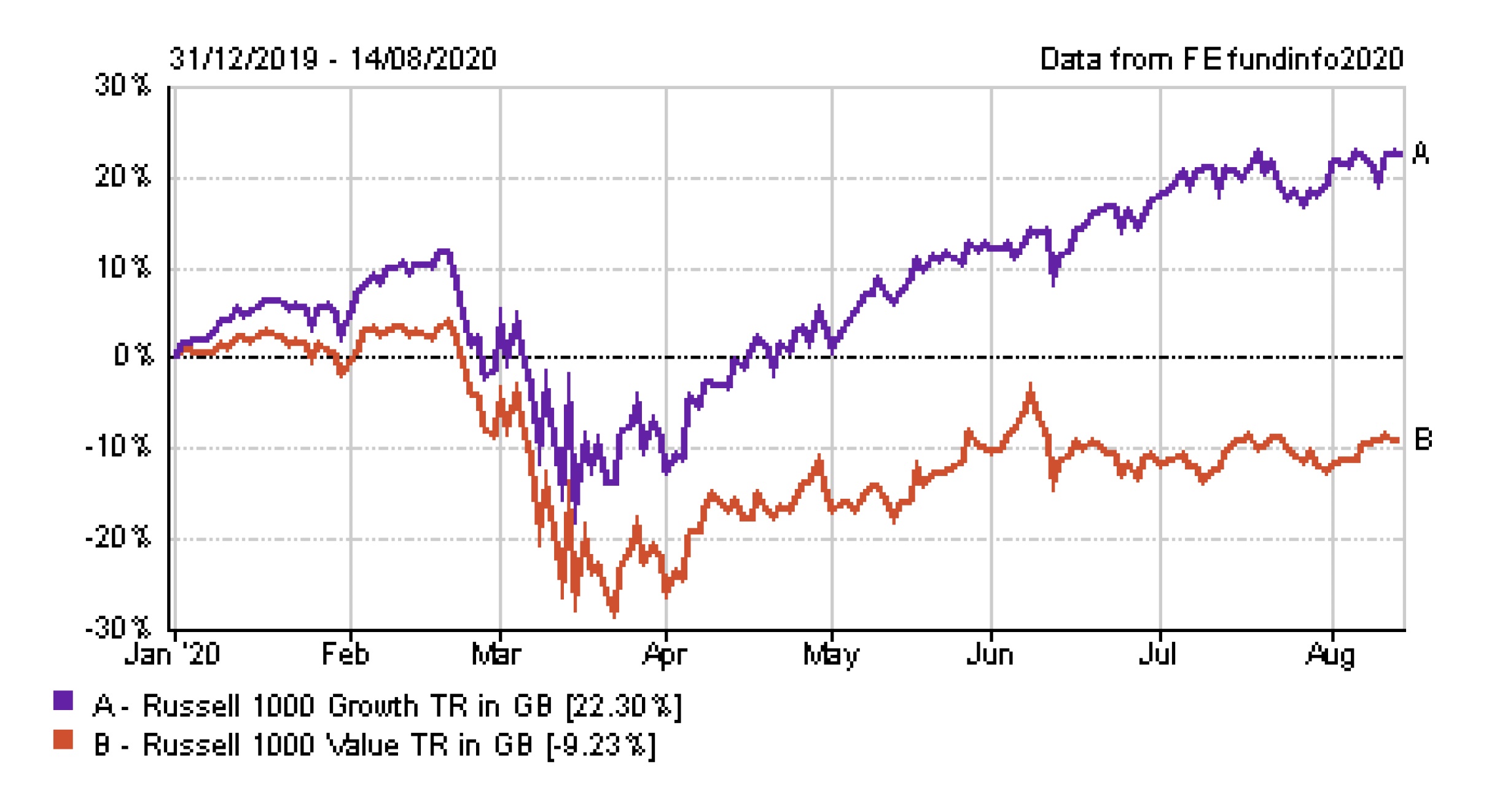

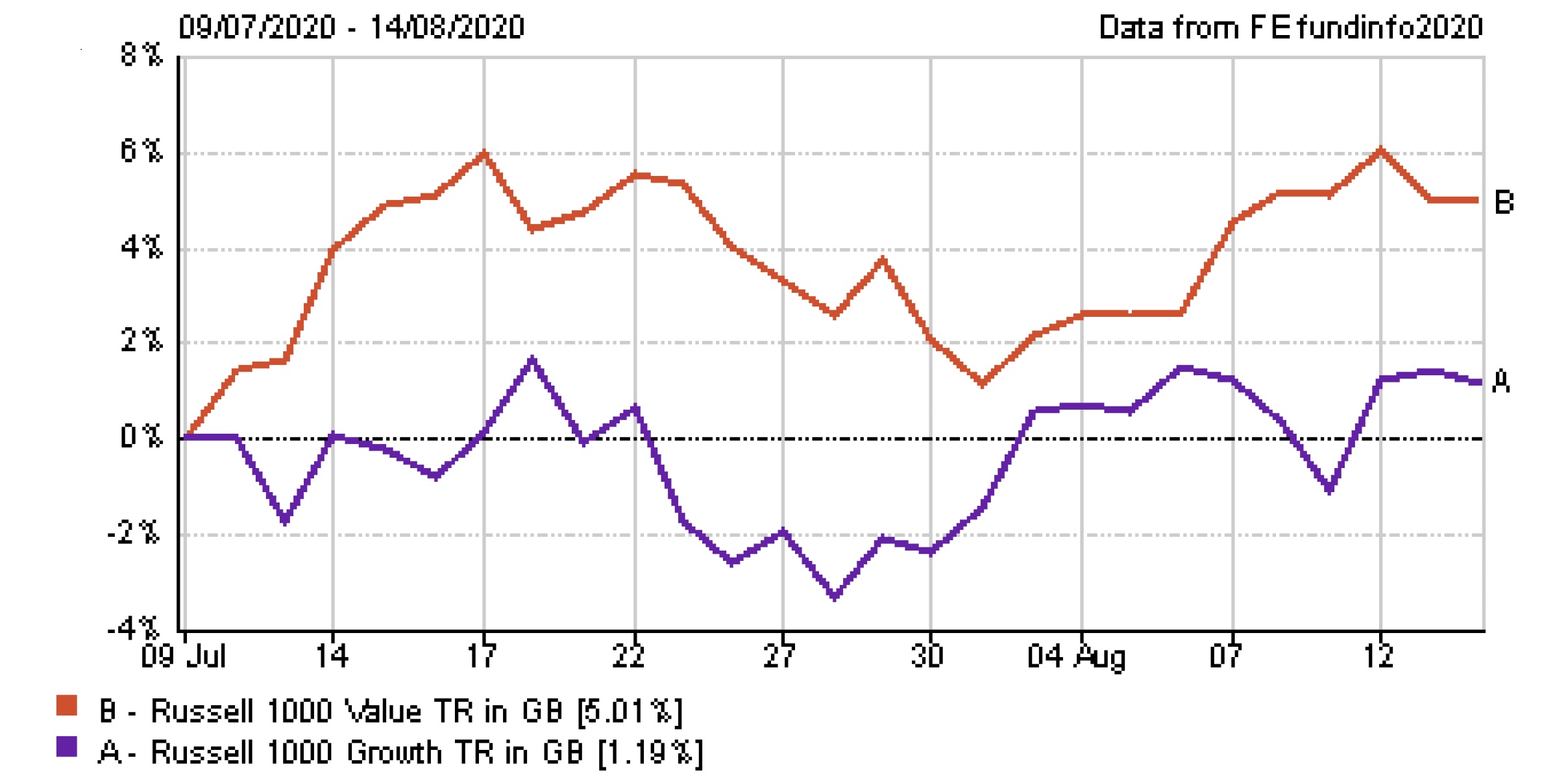

The below charts compare US value and growth indices (the US makes for better comparison because the UK is more of a value market owing to its lack of high-growth technology stocks). You can see from the charts the recent period in which value has outperformed growth.

Source: FE Analytics.

Bad news priced in

Despite the challenges in value investing, both Bevan and Yearsley are reluctant to turn their backs on these funds, which they say still have a place in portfolios.

“I am loath to abandon a value-oriented investment style altogether,” says Bevan. “Over the very long term, it has proven to be a good source of investment performance and so much bad news is already priced in that it feels hard to imagine a scenario where value managers can continue to underperform to the same degree.

“Should the worm turn, then I think the change could be quite rapid given how crowded the growth trade is right now. I think it remains prudent to invest in a diversified mix of investment styles and accept that not everything in the portfolio will perform in concert.”

Yearsley says he would still want to have value in his portfolios as well as growth investment styles, for balance and diversification. However, he adds:

“I would struggle to go overweight value, certainly UK at the moment, because of the interest-rate outlook. We’re not anywhere close to a rate rising cycle for the next five years at least, maybe 10, and so traditional value stocks like banks and insurers are going to struggle.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.