Victrex: Why this UK star stock is worth owning

Shares are recovering from a 12-month sell-off and our companies analyst likes them a lot.

10th January 2020 15:16

by Richard Beddard from interactive investor

Shares are recovering from a 12-month sell-off and our companies analyst likes them a lot.

As Victrex (LSE:VCT) had warned, its performance in the year to September 2019 did not reflect the company’s growth company status. Revenue declined 10%, adjusted profit declined 18%, and free cash conversion was also weak at 64%. Though these statistics are, on the face of it, unimpressive, they need to be considered alongside Victrex’s unique position in its industry.

Plastic fantastic

- Read about how to: Open a Trading Account | How to start Trading Stocks | Top UK shares

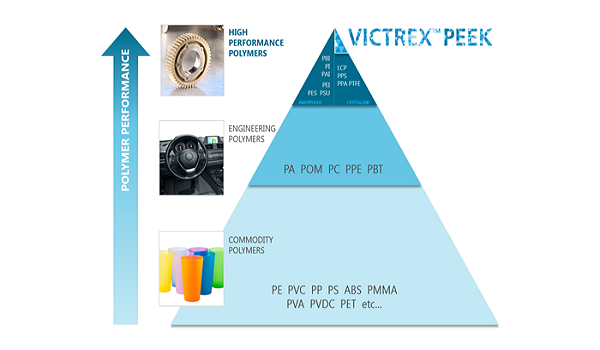

Victrex manufactures PEEK, a tough polymer that is tricky to make but lighter and easier to form into components than metal. Victrex says over 200 million car drivers rely on PEEK anti-locking brake and electronic stability control components, and the material is commonly found in aeroplanes, mobile devices, and implants in the human body. As the highest performing of high-performance polymers, Victrex says PEEK sits on top of the “polymer pyramid”:

Source: Victrex

The company is the only specialist manufacturer of PEEK and the longest established producer, having invented the material more than 40 years ago and developed proprietary grades of PEEK and composites of PEEK and carbon fibre since. As a result of its expertise, the company is highly profitable and there is a simple reason Victrex’s performance is so susceptible to swings in demand in sometimes capricious industrial markets - it is the bulk of the market. The company owns much of global PEEK manufacturing capacity, so if there is a slowdown in car or smartphone production, less PEEK may be required.

Short-term challenges

Victrex achieved lower revenue and profit in 2019 than the previous year because of reduced demand from the auto and electronics industries. It sold 36% less PEEK to electronics customers because of depressed smartphone and semiconductor sales, and because Victrex no longer supplies what it describes as the “large consumer electronics order”, standard grade PEEK blended with other polymer, reportedly used in iPhone components. The order belongs to rival Solvay, which until recently lacked the capacity to manufacture it all. In common with other businesses supplying the auto industry, Victrex says it experienced a lull in demand following the introduction of new fuel consumption and emissions testing regulations in 2018. Manufacturers shipped more cars before more stringent procedures came into force, and relaxed production afterwards.

Weaker than usual cash conversion was a result of higher levels of capital spending on production facilities and higher levels of stock as a contingency against Brexit.

Long-term challenges

Dominance means Victrex must find new applications for PEEK if it is to grow the business faster than the markets it already serves are growing. It is moving downstream (closer to the customer), by forming or part-forming PEEK into parts to prove that it is a superior material to the metals it seeks to displace.

- 10 star shares for the future

- 35 best growth stock ideas for 2020

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

The prototypical downstream project for Victex is its 20 year-old medical division, Invibio, which earned most of its £58 million in revenue from spinal implants in 2019 (20% of Victrex’s total revenue). In recent years the company has established six new “mega-programmes”: Juvora (dental implants like frames and bridges), Trauma (plates for fixing fractures), Knee (knee replacements), Gears, Aerospace Loaded Brackets (used in doors and fuel tanks for example), and Magma (subsea oil pipe). In 2019, it launched a seventh mega-programme in collaboration with Airbus to develop primary and secondary aerospace structures, plane parts that, in the event of failure, are neither critical nor inconsequential.

Victrex ultimately expects at least £50 million in annual revenue from each mega-programme at its peak, but progress is slow. Revenue from all new products launched since 2014, including the mega-programmes, was 4% in 2019, the same as in 2018 and 2017. In recent years, a step forward in one mega-programme has often been nullified by a step back in another. That may not be surprising, considering Victrex is trying to disrupt highly regulated and conservative markets.

Though the benefits may be clear: lighter, fuel efficient, and cheaper planes, for example, engineers that have used metal for decades must be persuaded to change. Then a supply chain must be put in place. Commercialising PEEK in new markets requires trials, regulatory approval, the creation of manufacturing capacity through joint ventures with part manufacturers or, as in the case of Gears, the acquisition of a manufacturer, and distribution.

- Six portfolio failures and four lessons for long-term investors

- Six speculative UK share ideas for 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Proponents of metal are innovating too, which has resulted in a resurgence in titanium implants, for example. Victrex contends PEEK remains the “material of choice” in spinal implants, though, and appears to be vindicated by double digit revenue growth for its newest spinal product in 2019. This growth, though, is at the expense of older PEEK products as well as metal.

While Victrex has some big advantages, it also faces considerable challenges. This is how I score it:

Does Victrex make good money?

Yes. In 2019, Victrex spent more on capital than is usual and earned less profit than it did in 2018, resulting in a sub-par but still very healthy 21% return on capital. Average cash conversion is respectable for a company that invests in capacity ahead of commercialising new programmes, at 78%.

Score: 2

What could prevent it from growing profitably?

Diversified chemical firms, principally in the USA and China, manufacture standard grades of PEEK and any increase in their capacity could increase competition in respect of standard PEEK grades.

Score: 1

How will it overcome these challenges?

Victrex’s response to the competitive risk is to differentiate the product, inventing new processes, grades, and forms of PEEK and manufacturing parts. It is very well placed as the only specialist producer, although commercialisation of new products can be a long and frustrating process.

One indicator of whether Victrex is successfully fending off competition is the average selling price it achieves, which was £78 per kg in 2019 (an average selling price of £78 multiplied by a sales volume of 3,751 tonnes give us Victrex’s revenue of £294 million). That £78 is the highest value it has achieved in recent years but, before we get out the bunting, other factors have helped: the weak pound has bolstered Victrex’s revenue as nearly all of its sales are earned abroad, and the loss of the modestly priced large electronics order has boosted the average selling price too.

Victrex’s established markets should still grow over the long-term and there is little reason to panic about competition. Rivals are less focused and have been slow to add capacity.

Score: 2

Will we all benefit?

Victrex is probably a good place to work. All staff receive a profit related bonus and 93% of employees are members of share option plans. The company reported only 5% voluntary staff turnover in 2019, which is typical. Staff reviews on recruitment site Glassdoor are limited in number but broadly positive.

Executive pay is extremely high. Chief executive Jakob Sigurdsson earned total remuneration of £763,000 despite not receiving a bonus in 2019 because of the firm’s weak performance (employees didn’t receive a bonus either). High executive pay partly reflects high pay throughout the company. Sigurdsson earned 15 times the median salary plus benefits of £48,000, which is perhaps defensible. But a new remuneration policy could blow that multiple apart in more profitable years. Victrex plans to increase his performance related bonus to a maximum of 150% of basic salary, and long-term incentives to 175%.

Score: 2

Are the shares cheap?

They are reasonably priced. A share price of £25 values the enterprise at about £2.1 billion, or 24 times adjusted profit. I believe profitability was sub-par in 2019 and a multiple based on what Victrex would have earned had it achieved its average return on capital over the last 12 years is a better valuation guide. It puts Victrex on a multiple of 19, and an earnings yield of 5%.

Score: 0.4

A score of 7.4 means Victrex is probably a good long-term investment.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.