10 star shares for the future

From his 30-stock portfolio, our companies analyst names his favourites and shares that face the chop.

13th December 2019 15:38

by Richard Beddard from interactive investor

From his 30-stock portfolio, our companies analyst names his favourites and shares that face the chop.

Since the last Decision Engine update five weeks ago, dotDigital (LSE:DOTD), a developer of digital marketing software, and Softcat (LSE:SCT), a hardware and software reseller, have joined the Decision Engine. They take the total number of shares ranked to 30.

Think of a football club. A portfolio is the first team. The first team is picked from the squad, which is all the companies currently available for investment whether they are in the first team or in the reserves. The Decision Engine is my squad, the shares I have scored and know well enough to invest in. It is ranked to make it easier to choose which shares to pick for the first team. The top, say, 20 shares, in my opinion, make a good portfolio.

Thirty is a large number of shares for one person to keep tabs on, while also scouting for new opportunities. It may not be the maximum squad size, but it feels close. To keep the squad manageable, and improve its quality over time, I must swap weaker squad members for stronger new recruits as I discover them.

Companies “at risk”

You might think that the lowest scoring companies would be at highest risk of expulsion from the Decision Engine. That bottom ranked James Halstead (LSE:JHD), a manufacturer of vinyl flooring, will be the first up against the wall when a new share gets a high score. But James Halstead and most of the other low-ranking shares are not at risk, at least not imminently. Before I explain why, let me remind you of the criteria I use to score the shares.

There are five, each of which is scored out of two to give a total out of 10. They are:

1. Profitability: Does the company make good money?

2. Risks: What could prevent it from growing profitably?

3. Strategy: How will it overcome these challenges?

4. Fairness: Will we all benefit?

5. Value: Are the shares cheap?

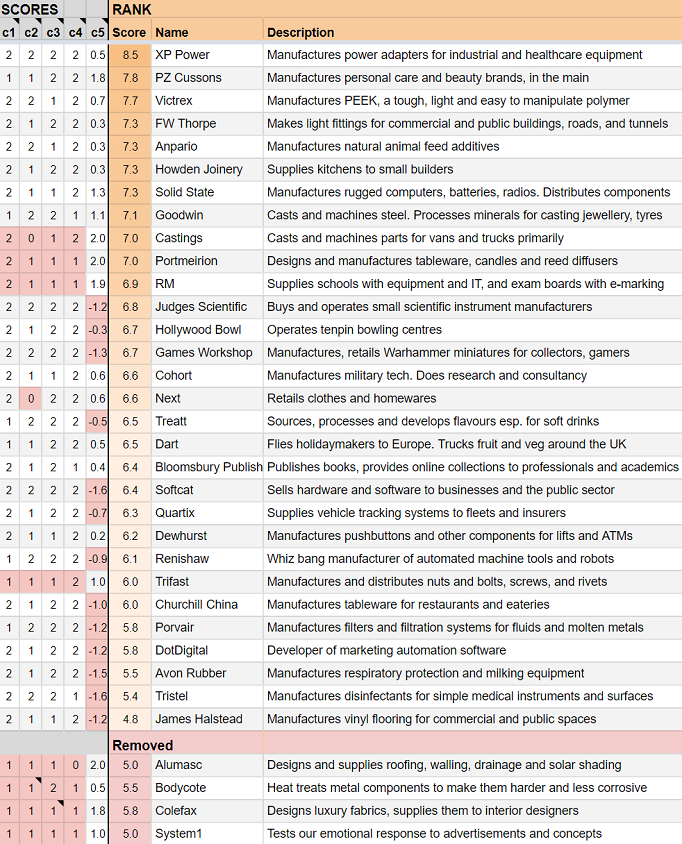

The table below shows how each company scores in the first five columns on the left, as well as the total score (the column c1 is profitability, c2 is risks, c3 is strategy, c4 is fairness, and c5 is value):

As I said, all of the criteria score a maximum of two. The first four criteria, which all refer to the quality of a business, score a minimum of zero. The fifth, value, is scored between -2 and 2. In other words companies on high valuations (an enterprise multiple of more than 25) get a negative score.

The bottom eight shares in the list are penalised in this way. They are good businesses, in other words, but the shares are expensive. All it would take to move one of these shares up the ranking is a significant fall in its share price.

We can even quantify how good these businesses are: James Halsted scores six out of eight for the four business quality criteria. The other seven shares, Treatt (LSE:TET), Renishaw (LSE:RSW), Churchill China (LSE:CHH), Porvair (LSE:PRV), dotDigital (LSE:DOTD), Avon Rubber (LSE:AVON) and Tristel (LSE:TSTL) score seven. James Halstead languishes on a score of 4.8 because 6 minus 1.2 (the value score) is 4.8.

To my mind, these companies are expensive for a reason. Traders can see they are good businesses and they are performing well enough, so the share price is high relative to profit. Having established that they are good businesses I do not want to forget about them, even though they look pricey because stock market traders are not known for the consistency of their opinions over time. Should these shares fall out of favour, they will shoot up the Decision Engine rankings as their valuations get cheaper, and I may want to include them in my portfolios.

The businesses most at risk are those I am less confident about, either because they generally score less well in terms of business quality or because they score zero for one particular business criterion. Four shares (marked in pink in the table) scored less than six out of eight the last time I profiled them (they all scored five). They are: Castings (LSE:CGS), Portmeirion (LSE:PMP), RM (LSE:RM.) and Trifast (LSE:TRI). Two companies scored zero for a single criterion. They are Next (LSE:NXT) (for risks) and Castings (LSE:CGS) (also for risks).

These five companies will be the first up against the wall. To see why, you can read the articles in which I scored them. Normally, we include the link in the table, but with the addition of extra columns this time, there was no space. There is a way though to find these articles quickly. For any of the shares in the Decision Engine just copy and paste this link into your browser:

And change the XXX to the company’s stock market ticker code. For example, XP Power (LSE:XPP) is:

There is one exception, Treatt, which I am profiling next week. You can read my profile from December 2018 here: http://bit.ly/swTET2018.

Richard owns shares in most of the shares ranked by the Decision Engine, including Avon Rubber, Castings, Churchill China, Portmeirion, Next, Renishaw, RM, Treatt, Trifast, and Tristel, which are mentioned in the text.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.