What could a Jeremy Corbyn government mean for your finances?

Tom Bailey explores what impact a Corbyn led government would have on the markets.

14th May 2019 10:55

by Tom Bailey from interactive investor

Brexit has distracted investors from the prospect of a Corbyn administration coming to power. Tom Bailey explores what such an eventuality might mean for markets.

For the past three years Brexit has dominated investors' minds in the UK. However, lurking in the background has been a growing possibility that a Labour government led by Jeremy Corbyn, alongside John McDonnell as chancellor of the exchequer, could eventually be elected.

As both men are veteran anti-capitalist campaigners, their unpopularity with the financial community is a given. However, in stark contrast to the intense focus on Brexit, there has been comparatively little consideration given to the consequences for stock markets of a Corbyn-led government. What, in practical terms, might a Corbyn administration mean for investors?

The morning after

According to Ed Smith, head of asset allocation research at Rathbones, history offers some useful guidance on this. He says:

"Our case study of market reactions to [the Socialist Party candidate] Francois Mitterrand’s accession in France in 1981 raises interesting questions about how a Corbynled government would fare."

Mitterrand, at the time of his election, was considered far left even by the standards of French politics in the 1980s. He shared a platform with the French Communist Party and promised sweeping nationalisation of French industries. His election was greeted with a 20% plunge in the French stock market.

Smith expects a similar reaction if Corbyn comes to power. He says: "Markets are likely to run riot initially, with bond yields and the pound moving sharply higher and lower respectively almost overnight, and the stock market slumping."

However, it's worth noting that the extent of the volatility markets are likely to experience on the morning after a Corbyn election victory will depend greatly on how expected that victory is.

If in the run-up to a general election it appears almost certain that Corbyn will win, that result will already be reflected in the prices of equities, bonds and currency, so movements in these prices will be minimal.

However, if Corbyn were to win a surprise victory, the market reaction would be much more dramatic.

A scenario similar to the latter outcome unfolded following the Brexit vote in 2016. As the day of the referendum approached, markets appeared to take it as a given that the remain side would win, so Brexit was not priced into asset values. When it became clear that the leave camp had won, markets quickly adjusted and sold off, with asset prices across the board taking a dive.

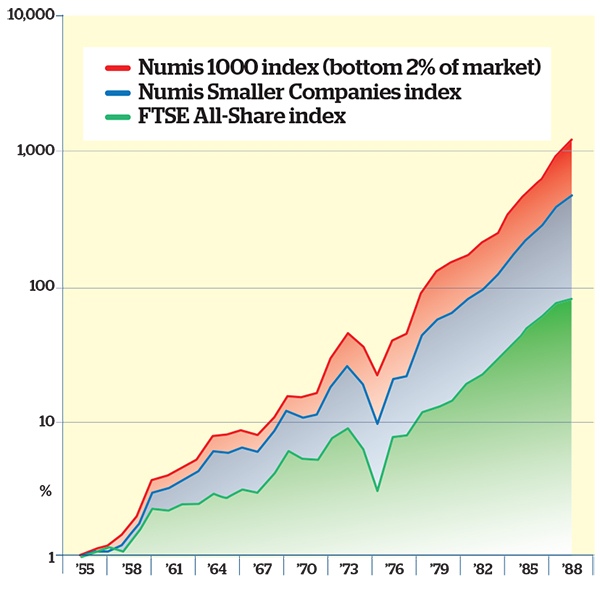

Small companies streaked ahead of the main market between 1955 and 1988

Source: Miton Asset Management

When the dust settles

However, while markets may see wild swings initially in the aftermath of an unexpected election outcome, eventually normality will return.

Businesses will still be trying to turn a profit and expand, and investors will continue to seek the best places to grow their money. So once the dust settles on a Labour victory, what are the long-term consequences for UK shares?

The UK's investment environment is unique in that seemingly bad news for the country's economy is often greeted positively by the UK's largest stock market index, the FTSE 100 index.

Behind this apparent paradox is the makeup of the index. Around 70% of index earnings come from abroad, so the index is well-placed to benefit from a fall in the pound relative to other currencies, as often happens following the release of bad news.

That's why many commentators expect to see some upside for the FTSE 100 if Corbyn comes to power, just as they did following the Brexit referendum.

According to Thomas Becket, chief investment officer of Psigma: "The pound could easily fall by around 10%. This would boost profits for FTSE 100 firms that generate most of their earnings overseas."

He adds: "[As a result] we would expect a major outperformance of the FTSE 100 compared with the FTSE 250 index, and small-cap UK shares to be hit immediately. This could well be a long-term buying opportunity, but nobody will care over the short term."

Indeed, small- and mid-cap companies (constituents of the FTSE 250 or smaller still in terms of market capitalisation) are expected to perform particularly poorly. These companies often rely on importing elements of the end products they sell to consumers, so a weaker pound means higher costs.

At the same time, they are more reliant than large firms on UK consumers. This puts them at risk from a weakening economy and a resulting fall in consumer demand. Should a Corbyn government preside over a slowing economy, companies reliant on consumers' disposable incomes are most at risk.

Richard Champion, deputy chief investment officer at Canaccord Genuity, notes that hotels and pubs are particularly vulnerable.

Other domestic-facing companies with large UK workforces may also take a hit, as Corbyn has pledged to boost workers' pay.

Smith says: "Labour has promised to increase the National Living Wage to £10 an hour by 2020, a significantly higher rate than the £8.75 an hour promised by the Conservative government."

He adds: "The Labour plan would benefit seven million workers and raise employment costs by 15% on average to £14 billion a year, or 1.5% of total payroll costs in 2020." Of course, the increase in the minimum wage has to be paid for by someone. Using the Office for Budget Responsibility's projection on UK firms' gross profits for 2020, Smith estimates that Labour's wage increase would knock about half a percentage point off an average FTSE 250 company's profit margin, which has averaged 14% since 2010 – though he notes that "firms are unlikely to wear all of that loss in profit".

Not so simple

Gervais Williams, manager of the Diverse Income Trust (LSE:DIVI), says he is not particularly concerned about increases in the minimum wage. As far as he is concerned, were Labour to hike wages, this would simply be a continuation of a process started by the Conservative Party. He says: "The government has already done a lot. It is not a change in that trend."

At the same time, Williams, himself a small-cap fund manager, disputes the idea that the FTSE 100 will outperform small-cap companies.

He says: "We've had left-wing governments before and, depending on their policies, it can be difficult: they can cause flight of capital and weak interest rate rises. That can be negative. But in the 1970s we saw small caps outperforming." He adds: "If you look across the 1960s and 1970s, sterling fell. However, overall, despite these decades being a period of low-growth and a bad time generally, small caps outperformed. Tiny companies worth less than £50 million outperformed even more."

Despite the poor economic conditions at the time, he says, small caps in listed markets were able to perform strongly because of "their ability to borrow capital and their agility with capital". By agility, Williams means the capacity of small companies to adapt to uncertain and shifting economic conditions. Should we see similar economic problems under a Corbyn-led government, he is confident (perhaps predictably, given his interest in the area) that small caps will do better than large caps, despite the currency benefits many FTSE 100 companies derive from a weaker pound.

The aerospace and defence sectors are likely to be hit by the election of a Labour government. Corbyn's opposition to UK military spending is well-documented. Moreover, a Corbyn government may ban UK arms companies from selling to countries such as Saudi Arabia, a large customer for UK arms manufacturers. JPMorgan Claverhouse (LSE:JCH) recently sold its stake in BAE Systems (LSE:BA.) partially on the back of the risk of Corbyn coming to power – while stressing that this was one consideration among others.

At the same time, sectors such as banking, infrastructure and utilities could all come under fire from a Corbyn administration. In particular, rail companies, utilities and Post Office face the threat of nationalisation. Whichever policies are implemented, the share prices of such companies can be expected to take a hit, at least over the short term.

Restricted by reality

Despite all that, most investors are cautious about drawing firm conclusions. Expanding on his comparison with Mitterrand, Smith flags up the possibility of a Corbyn government that gradually moderates, potentially winning acceptance from markets.

Mitterrand, after several years implementing socialist economic policies, increasingly moderated his politics and courted private business. In the late 1980s his re-election was greeted with a slight rally in markets. Smith says: "If, even after a period of folly, a Corbyn government jettisons its most left-wing reforms and courts private enterprises just a little, as Mitterrand did with his 'tournant de la rigueur' change of direction, markets could recover very quickly."

Smith has doubts about Corbyn following such a path, though. He says: "This requires Corbyn to allow centrist colleagues to join the debate, but he currently refuses to permit anything of the sort: his army of activists has demonised the terms 'centrist' and 'Blairite', while threatening MPs and councillors found lacking hard-left credentials with deselection."

Champion makes a similar point. He argues that markets are likely to have a moderating effect on a Corbyn government. He says: "Ultimately, markets are likely to constrain 'prime minister' Corbyn's freedom of action. There are several historical examples of left-wing governments being forced to change direction in the face of crumbling currencies and rising bond yields."

Indeed, Champion also cites Mitterrand's volte-face as an example of this. He adds:

"After 18 months, he had to change tack, cut spending and embrace a more market-oriented set of policies, helping kick-start a 15-year bull market."

Williams argues that any fear around Corbyn has to be put in the context of political developments across the rest of Europe and beyond. He says:

"It depends on what happens around the world. What other kind of governments will come to power in France or Germany? In Germany and Sweden, there has been a lurch to the right. It's the same outcome. It's against consensus."

So while Corbyn may seem less business-friendly against the backdrop of UK political norms, Williams argues, he may not be viewed that way when compared with other political winners in Europe. He adds that a bigger concern is the global economy. Industrial numbers around the world have been weak, and "irrespective of Brexit or Corbyn, we are cautious about world growth".

Tax-free savings in Labour's sights

When it comes to tax incentives for investing, Darius McDermott, managing director at Chelsea Financial Services, believes there is likely to be some "tinkering" should Corbyn come to power.

He says:

"If there was a Corbyn government, we would be worried about tax incentive products such as Isas, pensions, VCTs and EISs."

He notes that while there is little specific policy from Labour on these, the party's rhetoric on the distribution of wealth is strong. A Labour government would almost certainly look at these products.

McDermott believes pension tax relief would be an early target for a Corbyn-led government. He says: "Pension tax relief would be the first target, particularly for higher-rate taxpayers."

There has been speculation that Labour would introduce a 30% flat rate relief for everyone, which would hit higher earners.

McDermott thinks changes to ISAs are likely. "I would be surprised if [a Labour government allowed] them to continue under the current regime.

There might be a lowering of annual limits or a cap on the overall size of ISA pots."

What can you do to Corbyn-proof your portfolio?

FTSE 250 companies are likely to be punished by markets in the wake of a Corbyn-led government coming to power. As Thomas Becket notes, it could be a long-term buying opportunity, but investors will have to be brave. He says:

"No one will care in the short term. It will be a case of get out, get the fire brigade out and stay out."

For those looking for capital preservation first and foremost, the key to protecting your portfolio in the event of a Corbyn-led government is diversification.

Becket says:

"I urge all investors to ensure their portfolios are balanced and diversified, and that they maintain a high proportion of assets in overseas markets."

Funds that should help to protect capital include Personal Assets Trusts (LSE:PNL) and Ruffer Investment Company (LSE:RICA), while those offering great global diversification with little UK exposure include Rathbone Global Opportunities and Artemis Global Income.

More generally, he points to investments in commodities and gold miners.

"They are plays on the lunacy of global politicians that would become more attractive with the advent of a Corbyn-led government in the UK."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.