What I’d do now with this top share tip

A lot has happened since shares in this global business peaked three months ago, and those who followed analyst Rodney Hobson’s tip would have done very well. Can it break records again?

14th May 2025 07:53

by Rodney Hobson from interactive investor

At first sight, international hotel chains look reasonably insulated from US President Donald Trump’s tariff wars. After all, the services provided do not cross international boundaries and most supplies such as food, furnishings and linen are sourced domestically. However, no business is completely isolated from the real world.

Business and personal travel took a hefty knock during the pandemic and the hotel trade has struggled to recover slowly. The last thing that any hospitality business needs right now is further disruption.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

On that basis, things are not going at all badly at Marriott International Inc Class A (NASDAQ:MAR). Net income increased 16% to $665 million in the first three months of this year on total revenue 4.8% higher at nearly $6.3 billion. The hotel chain said that "continued travel demand" supported "strong" earnings. Diluted earnings per share jumped 24% to $2.39.

In an impressive expansion to its estate of 9,500 hotels, Marriott added 12,200 rooms in the latest quarter, just over half being in international markets where revenue per available room is growing more strongly – up 5.9% compared with 3.3% in the home territory of the United States and Canada for the Maryland-based operator.

Alas, Marriott may not find it so easy to fill those extra rooms over the rest of this year. It now reports "somewhat softer expectations" in North America. This will reduce expected growth in revenue per available room from 2-4% to 1.5-3.5%.

That may seem a fairly modest reduction in what is a fairly broad range, but this is a key measurement of how well any hotel chain is faring and the impact on total revenue and profits will be greater. Projections for gross fee revenue for the whole of 2025 have been slashed by $5 billion to less than $5.5 billion.

Chief executive Anthony Capuano remains bullish about sustainable, long-term growth despite the global economic uncertainty. He points to “our industry-leading global portfolio” that includes the Ritz-Carlton and Westin brands.

Marriott is indeed reasonably insulated from any reaction to Trump’s cavalier attitude towards foreign countries. It has not been associated with the Trump administration and its name does not automatically throw up feelings of anti-American aversion.

- ii view: InterContinental Hotels makes robust start to 2025

- Political risk is part of a stock’s value now – and, no, you can’t afford to tune it out

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

However, the tailing off of the North American operations is worrying. It is in Canada that the strongest emotions have naturally been stirred, and the recent meeting between Trump and Canadian Prime Minister Mark Carney has done nothing to alleviate those tensions. If anything, feelings are running higher now than before.

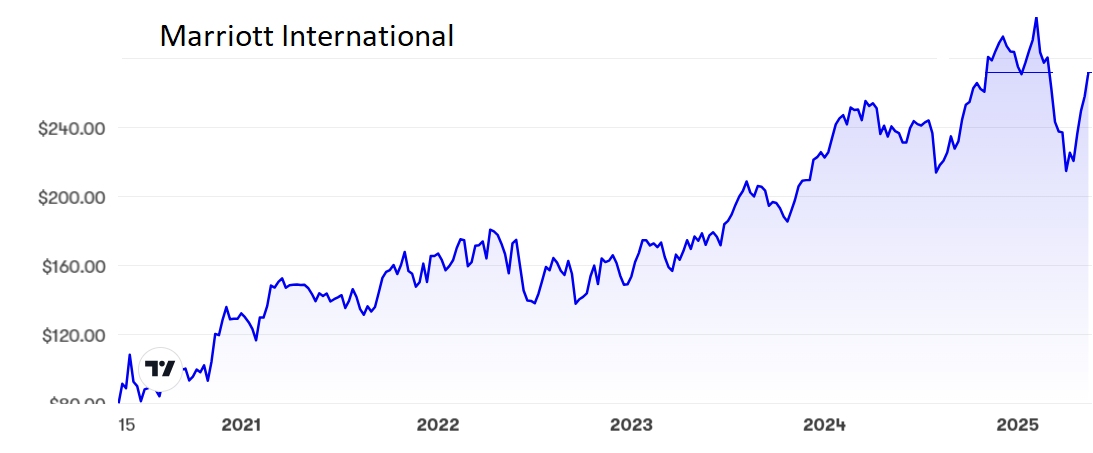

Marriott shares peaked at $304 in early February but were among the first to start falling as the tariff wars loomed and they dropped as low as $211 over the next two months, a fall of around 30% and something of an overreaction.

Source: interactive investor. Past performance is not a guide to future performance.

The first-quarter figures offered some reassurance, although as with all American companies, those three months before trade barriers kicked in are far from indicative of the rest of 2025. The stock is now back up to $274, where the price/earnings (PE) ratio is still a bit daunting at 29 and the yield is quite meagre at just under 1%.

- Have investors been selling, buying, or sticking with the US?

- Is US stock market exceptionalism over?

Hobson’s choice: Well done to anyone who bought at or near the recent bottom, but it really is time to consider banking what could be quite substantial profits.Those profits will be even greater if you bought two years ago when I tipped Marriott at $170.

The best chance to buy has obviously gone and there could be some resistance at the current price. Even if the shares move higher, it will be difficult for them to break above $280, at which level the case for selling becomes even more compelling. I really cannot see the previous peak just over $300 being reached again this year.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.