Where can value investors find the best fund and trust bargains?

With the mantra ‘buy low, sell high’ firmly in mind, we make an argument for a shift to buying value.

16th January 2020 10:40

by Jennifer Hill from interactive investor

With the mantra ‘buy low, sell high’ firmly in mind, Jennifer Hill makes a solid argument for a shift to buying value.

Value investing is set for a comeback in 2020, after a decade in the doldrums. While recession risk appears to have subsided, sentiment remains fragile and there is a solid argument for a shift to buying value.

“Value is already pricing in a downturn – and growth stocks trade close to all-time highs,” says Lee Wild, head of equity strategy at interactive investor.

Precisely timing the shift is impossible, though, and Wild concedes growth stocks may have further to climb if macro events such as trade talks and interest rate policies go their way.

Whatever materialises, there is a lot to be gained in the long term from going against the grain. Some of the world’s most successful investors – Sir John Templeton, George Soros and Warren Buffett being among them – were or are contrarians.

With that in mind, we have asked a range of independent investment experts to pinpoint the most unloved and best-value regions and sectors worldwide.

UK

For beaten-up value stocks and a region out of favour, look to the UK. Companies with a domestic focus have suffered most from Brexit – which means smaller companies.

Brokers Willis Owen and Charles Stanley both like the smaller companies team at Aberforth Partners, which makes investment decisions in a collegial manner and names seven managers on its Aberforth UK Small Companies fund.

“The team is very well resourced, being one of the largest purely focused on UK smaller companies, and it looks for undervalued companies,” says Adrian Lowcock, head of personal investing at Willis Owen. He believes UK smaller companies “look very attractive in the long term”.

Jon Cunliffe, chief investment officer at Charles Stanley, prefers its sister investment trust Aberforth Smaller Companies (LSE:ASL). The portfolios mirror each other but shares in the investment trust have typically outperformed, as the discount to net asset value at which they trade has narrowed from a 12-month high of 13.8% to 3.8%.

At a stock level, Wild rates the value opportunity in housebuilders such as Barratt (LSE:BDEV) and Redrow (LSE:RDW) – “solid, profitable businesses that pay out robust dividends”. David Liddell, a director of IpsoFacto Investor, likes banks as well as housebuilders, flagging Barclays (LSE:BARC) as trading at less than two-thirds of tangible asset value and yielding more than 4%.

Europe

While Brexit has impacted UK stocks, the European stock market has also felt the brunt, compounded by its mini trade war with the US, diesel car scandal and negative interest rates making a huge hole in the profitability of its banks.

Haig Bathgate, 7IM’s head of portfolio management, points to value in the European value sector, rating the LF Lightman European fund as “a good fund to gain exposure on this front”. It was only launched in March 2019, but manager Rob Burnett forged a strong track record at the helm of Neptune European Opportunities for 13 years. His new fund invests in companies valued at low price-to-book (PB) and price-to-earnings (PE) ratios with high free cashflow yields.

Dzmitry Lipski, investment analyst at interactive investor, tips TR European (LSE:TRG). Manager Ollie Beckett’s value style and bias to smaller companies has held back performance in recent years, but the 12.1% discount on which the shares trade stands to narrow in the event of a meaningful style rotation away from growth.

Asia

Asian equities have lagged since the onset of the US-China trade war. “For those who favour a contrarian, value tilt to their portfolio, China and Hong Kong look cheap on both a forward PE and a PB basis,” says Cunliffe, while the US is “becoming increasingly expensive on both metrics”.

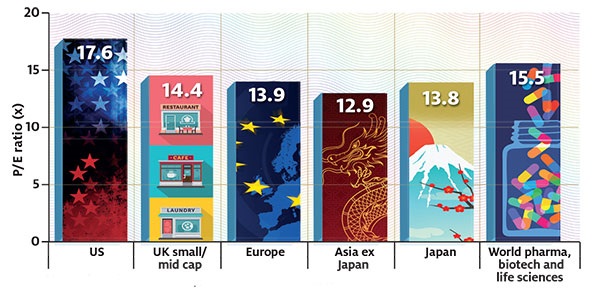

Brooks Macdonald considers the forward PE ratio, based on earnings expectations for the year ahead, to be one of the most useful measures of value. Edward Park, its deputy chief investment officer, points to the US market trading around 17.6 times earnings, while Asia ex-Japan trades at a mere 12.9 times earnings despite strong economic growth and China undertaking both fiscal and monetary easing in recent months.

While Park doesn’t expect the trade war to be resolved in the near term, the potential rollback of some tariffs already imposed could see global asset allocators reassess their underweight position on the region.

Lowcock at Willis Owen likes First State Asia Focus, which has almost two-thirds in India, China, Hong Kong and Taiwan.

Managers Martin Lau and Richard Jones look for quality businesses trading at attractive valuations. He also tips the “exceptionally cheap” Japanese stock market, which has “again started to shine” as fears of a global recession dissipate and trade relations improve, and the Man GLG Japan CoreAlpha. Its four managers use valuation measures like PE, PB and dividend yield to identify companies that are cheap and undervalued. Broker Peel Hunt likes the CC Japan Income & Growth (LSE:CCJI), which taps into the cheapness of the Japanese stock market and also into its growing equity income story.

Specialist sectors

The biotechnology sector benefits from structural growth trends – the ageing population and increasing US drug approvals – but has recently underperformed the healthcare sector and broader equity market amid US election uncertainty. International Biotechnology (LSE:IBT) is Numis Securities’ preference in the sector. “The manager, Carl Harald Janson, avoids binary event risk by selling a position in a company before it announces the result of clinical drug trials,” says analyst Sam Murphy.

“Historical evidence suggests this strategy produces superior returns by taking advantage of overly-optimistic investors mispricing risk and driving the share price of drug companies higher prior to such announcements.”

The portfolio is tilted towards oncology and rare diseases businesses, and has a small allocation to unquoted venture capital life science companies.

QuotedData highlights private equity as an unloved sector – discounts have widened despite reasonably respectable underlying performance.

Research director James Carthew highlights Oakley Capital Investments (LSE:OCI) as an example; its net asset value is up 23% in a year but its shares are trading at a 25% discount.

Bargain basements not so hard to find

Note: Chart shows forward PE ratios based on next 12 months’ earnings. Source: MSCI as at 31 October 2019

Passive plays: How to buy unloved markets

Some sectors are better suited to passive exposure than others. Smaller companies isn't one of them.

1) “We don’t have any smaller companies trackers on our platform, rated or otherwise,” says Adrian Lowcock, head of personal investing at Willis Owen. “It’d be too expensive to track the whole market and tracking a subsection might lead to different returns.”

2) Books Macdonald typically uses active managers for exposure to Asia to avoid the Chinese state-owned enterprises that are a major component of the index, but for rapid exposure it uses the UBS MSCI AC Asia Ex Japan ETF.

3) Willis Owen likes HSBC Japan Index for broad exposure to large Japanese companies, while Canaccord Genuity Wealth Management tips the Lyxor JPX Nikkei 400 ETF, which screens companies for positive corporate governance and a focus on shareholder value.

4) Jordan Sriharan, Canaccord’s head of passives, likes healthcare as a long-term theme but points to it being used as a political football amid recent UK and forthcoming US elections. The SPDR® MSCI World Health Care ETF (LSE:WHEA) “may provide a good longer-term entry point for more nimble investors, should valuations fall as the tweets roll in,” he says.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.