Why FTSE 100's Ferguson just plunged 11%

This marks a swift reversal of fortunes for a company whose US exposure was behind last year's rally.

26th March 2019 14:49

by Graeme Evans from interactive investor

This marks a swift reversal of fortunes for a company whose US exposure was behind last year's rally.

After a miserable winter for shares in FTSE 100 stalwart Ferguson (LSE:FERG), the US plumbing and heating supplier further rattled investors today as it warned profits were no longer piping hot.

The stock, which had been trading as high as 6,556p in the autumn, tumbled another 10% to 4,634p - the lowest point for the blue-chip company since September 2017.

The decline marks a swift reversal of fortunes for a company whose exposure to a roaring US economy had fired up investors for much of 2018. Around 90% of its trading profits come from the region, with part of the remainder from the Wolseley brand in the UK.

While today's half-year results show a strong performance, with headline earnings per share up 19.7% to 241.9 US cents a share, the fears of investors that Ferguson will be caught out by a slowing US economy seem to be coming true.

The company now expects revenues growth of between 3% and 5% for the second half of this financial year, whereas it delivered an improvement of 6.5% in the first half. As a result, trading profits will be towards the bottom of the consensus range at closer to £1.58 billion.

Analysts at UBS think the new guidance means that US sales growth will slow to below 5% in the current half-year, down from a robust 9.7% in the six months to January 31.

UBS added:

"We think this is not that surprising given the weaker trends in housing over the last few quarters, but we believe the sharpness of the moderation in growth will surprise some."

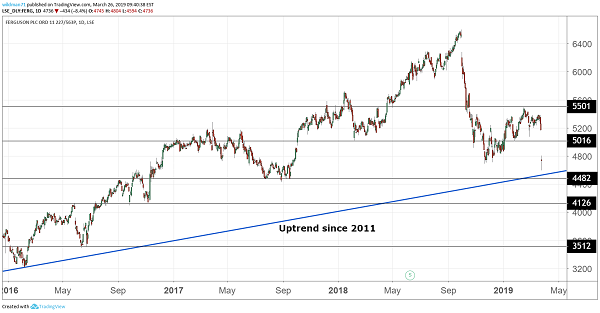

Source: TradingView (*) Past performance is not a guide to future performance

The shares now trade on a price/earnings multiple of around 13.5x for 2019, although this compares with an average of 17x for the previous five years. With a price target of 5,430p, analysts at Peel Hunt still think the shares are worth adding despite a 2.5% cut to their estimates today.

They added:

"While the US economy may not grow as fast, we still expect the business to deliver robust mid-single digit growth in the next few years."

Ferguson's strong balance sheet and cash generative nature has contributed to another sharp hike in its dividend, which grew 10% at the half-year stage to 63.1 US cents a share.

Having just completed a share buyback programme, Ferguson said its priorities were on investing in organic growth, growing the dividend in line with earnings and on bolt-on acquisitions. It added:

"Any surplus cash after meeting these investment needs will be returned to shareholders promptly."

In the first half, Ferguson said its US businesses continued to take market share. In Canada, residential markets weakened and in the UK plumbing and heating markets were flat. Trading profits in the UK were down 17%, compared with growth of 8.2% to $700 million in the US.

*Horizontal lines on charts represent levels of previous technical support and resistance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.