Why I'm considering selling these tech funds

Equity markets have turned sharply lower, which has made the Saltydog analyst review his portfolio.

3rd June 2019 12:22

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Equity markets have turned sharply lower, which has made the Saltydog analyst review his portfolio.

Sell in May?

There's an old stock market adage "Sell in May and go away, don't come back till St Leger Day." It stems from the days when the well-heeled headed away from the City of London to the country for the hot Summer months. Trading volumes were low and historically shares tended to perform better between November and April than they did between May and October.

In today's high-paced 24/7 digital world the saying is probably no longer relevant, but if you had dipped out of the markets last month you’d be sitting pretty now.

The trade war between the US and China has escalated in the last few weeks. Just when most people thought that they were about to sign a trade deal, President Trump increased the tariffs on $200 billion of Chinese goods from 10% to 25%. China has retaliated, raising the tariffs on $60 billion on US goods and threatening to limit the export of rare earth minerals.

To remind the rest of the world that it's not immune to the 'America First' policies being adopted by President Trump, last week he proposed a 5% tariff on goods from Mexico, which then rises by 5% per month until it reaches 25% in October. The European car manufacturers fear they may be next.

In the UK, we've got the additional uncertainty over Brexit and the imminent leadership contest.

All things considered, it's not surprising that stock markets around the world struggled during May.

The table above shows a selection of indices covering stock markets from both the developed and emerging markets. They've nearly all gone down during May, and some quite dramatically. In Hong Kong, the Hang Seng went down 9.4%.

Elsewhere in Asia, the Chinese and Japanese markets also struggled, but the Indian Sensex bucked the trend and went up by 1.7%.

The Russian RTSI is the best-performing index in the table, gaining 3.1%. The UK indices have gone down, but they have done better than France, Germany and the US.

Last week, our sector analysis showed 13 sectors had made losses in the previous four weeks, and I'm expecting our next set of reports to show that the situation has got worse.

It's said that a rising tide lifts all boats, but unfortunately the opposite is also true. Over the last few weeks we've seen the value of the funds in our portfolios start to fall, reflecting the wider economic downturn. We've already sold a couple and so our cash levels are starting to rise again. This week we will consider increasing the cash further.

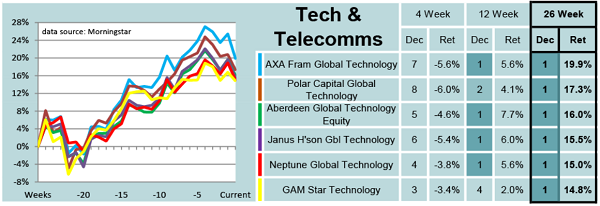

Often, the funds that go up the fastest are also the ones to suffer the most when the tide turns. The best-performing sector in the first quarter of this year was Technology and Telecommunications. The leading funds are still showing impressive gains over 12 and 26 weeks, but they've gone down more recently.

We hold a couple of funds from this sector in our portfolio – perhaps it's time to lock in some of the recent gains.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.